Einstein Bros 2002 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2002 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

http://www.sec.gov/Archives/edgar/data/949373/000104746903027186/a2116520z10-ka.htm[9/11/2014 10:14:22 AM]

The net (loss) earnings per share data are presented as basic earnings per share. Basic earnings per share and diluted earnings per share are

the same for all periods presented except the 1999 Fiscal Year. For the 1999 Fiscal Year, basic earnings per share was $0.26 and diluted

earnings per share was $0.25.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

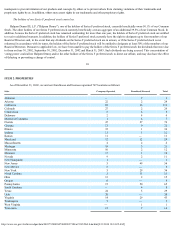

We are a leader in the quick casual segment of the restaurant industry. With 747 locations in 32 states as of December 31, 2002, we operate

and license locations primarily under the Einstein Bros. and Noah's brand names and franchise locations primarily under the Manhattan and

Chesapeake brand names. Our locations specialize in high-quality foods for breakfast and lunch, including fresh baked goods, made-to-order

sandwiches on a variety of breads and bagels, soups, salads, desserts, premium coffees and other café beverages, and offer a café experience with a

neighborhood emphasis. As of December 31, 2002, our retail system consisted of 460 company-operated, 261 franchised and 26 licensed

locations. We also operate dough production and coffee roasting facilities.

On June 19, 2001, we purchased substantially all of the assets of Einstein (the "Einstein Acquisition"). Einstein was the largest bagel bakery

chain in the United States, with 458 stores, nearly all of which were company-operated. The Einstein Acquisition was made pursuant to an asset

purchase agreement entered into by us as the successful bidder at an auction conducted by the United States Bankruptcy Court, District of Arizona,

on June 1, 2001, in the Einstein bankruptcy case. The purchase price was $160.0 million in cash plus the assumption of certain liabilities, subject to

adjustment in the event that assumed current liabilities (as defined under the asset purchase agreement) exceeded $30.0 million. The acquisition

was accounted for using the purchase method of accounting.

In January and March 2001, we issued Series F preferred stock and warrants to purchase our Common Stock and equity in a newly formed

affiliate, Greenlight New World, L.L.C. ("GNW"). The aggregate net proceeds of those financings of approximately $23.7 million were used to

purchase Einstein bonds and pay related costs. In January 2001, we issued additional Series F preferred stock and warrants to purchase our

Common Stock in exchange for Series D preferred stock and warrants that we had issued in August 2000. In June 2001, we issued additional

Series F preferred stock and warrants to purchase our Common Stock for aggregate net proceeds of $22.7 million, which were used to fund a

portion of the purchase price of the Einstein Acquisition. In June 2001, we issued the Notes and warrants to purchase our Common Stock. The net

proceeds of approximately $122.4 million were

17

used to fund a portion of the purchase price of the Einstein Acquisition, to repay our then-outstanding bank debt and for general working capital

purposes. Also in June 2001, we obtained a $35.0 million asset-backed loan to a non-restricted subsidiary, New World EnbcDeb Corp. ("EnbcDeb

Corp."), for net proceeds of $32.2 million, which were used to fund a portion of the purchase price of the Einstein Acquisition.

As a result of the Einstein Acquisition and the related financing transactions, management believes that period-to-period comparisons of our

operating results are not necessarily indicative of, and should not be relied upon as an indication of, future performance.

Restatements included in our Form 10-K filed on May 14, 2002

As previously disclosed in our Form 10-K for the year ended January 1, 2002, unauthorized bonus payments in the aggregate amount of

$3.5 million were made to certain former executive officers and former employees. A portion of those payments (approximately $1.0 million) was

made in the third quarter of our fiscal year ended January l, 2002 and the balance (approximately $2.5 million) in the quarter ended April 2, 2002.

All of these payments were originally recorded in our financial statements in the second and third quarters of fiscal 2001 as part of the acquisition

costs associated with the Einstein Acquisition and as a restructuring charge. An additional aggregate amount of $3.4 million, primarily relating to

operating and financing related expenses, was originally recorded in our financial statements in the second and third quarters of fiscal 2001 as a

part of the acquisition costs associated with the Einstein Acquisition and as restructuring charges. We revised the results of the second and third

quarters of fiscal 2001 in order to account for such expenses appropriately as general and administrative expenses as noted in our amended 10-Q

filings for fiscal 2001 and in our fiscal 2001 Form 10-K filed on May 31, 2002.

Restatements of Fiscal 2000 and 2001 Financial Statements pursuant to Reaudits

On July 29, 2002, we dismissed Arthur Andersen LLP and retained Grant Thornton LLP as our new independent auditors. In reviewing our

accounting for prior periods, Grant Thornton and we determined that certain of our accounting practices in previous years did not reflect the proper

application of accounting principles generally accepted in the United States or GAAP. Accordingly, Grant Thornton has reaudited and we have

restated our financial statements for fiscal 2001, fiscal 2000 and the opening balances of certain accounts in 2000.