Einstein Bros 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

http://www.sec.gov/Archives/edgar/data/949373/000104746903027186/a2116520z10-ka.htm[9/11/2014 10:14:22 AM]

Our Common Stock is currently trading in the "pink sheets" under the symbol "NWCI.PK." On May 22, 2002, our Common Stock was

removed from the eligible list on the OTC Bulletin Board for a failure to comply with NASD Rule 6530, which resulted from our failure to timely

file our Form 10-K for the year ended January 1, 2002. Prior to May 22, 2002, our Common Stock was quoted on the OTC Bulletin Board under

the symbol "NWCI.OB." Prior to November 27, 2001, our Common Stock was quoted on the Nasdaq National Market under the symbol "NWCI."

Effective November 27, 2001, our Common Stock was delisted from the Nasdaq National Market. We received a Nasdaq Staff Determination

on September 7, 2001 asserting violations of two rules relating to stockholder approval for equity issuances and that our Common Stock was

subject to delisting. We appealed the Staff Determination at a hearing before the Nasdaq Listings Qualifications Panel on October 18, 2001. The

Panel issued a ruling on October 30, 2001 that cited conditions for maintaining our listing and provided us with an extension of time until

November 19, 2001 to attempt to satisfy them. We timely appealed the October 30, 2001 ruling, while simultaneously endeavoring to satisfy the

conditions imposed by the Panel. We were not able to satisfy all of the conditions prior to the November 19, 2001 deadline and sought additional

time to attempt to satisfy them, a request that the Panel denied. The Panel subsequently informed us by letter that, effective November 27, 2001,

our stock would be delisted. The Panel cited both corporate governance violations and public interest concerns as separate and independent bases

for its ultimate determination.

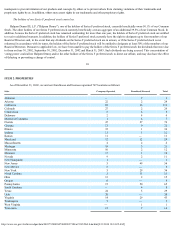

The following table sets forth the range of high and low closing sale prices (as quoted on the Nasdaq National Market, the OTC Bulletin Board

or the "pink sheets," as applicable) for our Common Stock for each fiscal quarter during the periods indicated.

Fiscal 2002

High

Low

First Quarter (From January 1, 2002 to April 2, 2002) $ 0.79 $ 0.32

Second Quarter (From April 3, 2002 to July 2, 2002) $ 0.43 $ 0.25

Third Quarter (From July 3, 2002 to October 1, 2002) $ 0.28 $ 0.13

Fourth Quarter (From October 2, 2002 to December 31, 2002) $ 0.15 $ 0.05

Fiscal 2001

High

Low

First Quarter (From January 1, 2001 to April 1, 2001) $ 2.31 $ 1.00

Second Quarter (From April 2, 2001 to July 3, 2001) $ 1.60 $ 0.88

Third Quarter (From July 4, 2001 to October 2, 2001) $ 1.22 $ 0.50

Fourth Quarter (From October 3, 2001 to January 1, 2002) $ 0.51 $ 0.20

As of April 30, 2003, there were approximately 326 holders of record of our Common Stock. This number does not include individual

stockholders who own Common Stock registered in the name of a nominee under nominee security listings.

15

We have not declared or paid any cash dividends on our Common Stock since our inception. We do not intend to pay any cash dividends in

the foreseeable future, and we are precluded from paying cash dividends on our Common Stock under our financing agreements.

ITEM 6. SELECTED FINANCIAL DATA

The following table sets forth selected historical financial and operating data on a consolidated basis at December 27, 1998, December 26,

1999, December 31, 2000, January 1, 2002 and December 31, 2002 and for the fiscal years then ended. The income statement data and the balance

sheet data as of and for the fiscal years ended December 27, 1998 and December 26, 1999 are derived from our unaudited consolidated financial

statements, which are not included in this Form 10-K. As discussed in Note 3, as a result of a review of our historical financial information, certain

adjustments have been made to the previously reported financial information for the 1998 and 1999 fiscal years. The information contained in this

table should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our

historical consolidated financial statements, including the notes thereto, included elsewhere in this Form 10-K.

Fiscal Year Ended

December 27,

1998

December 26,

1999

December 31,

2002

As Restated

January 1,

2002

As Restated

December 31,

2000

(Dollars in thousands)