Earthlink 2015 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2015 Earthlink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Sales and Distribution

Business Markets

We market our products and services to a variety of buyers, ranging from small, medium and large businesses, public sector organizations, global carriers and

Fortune 100 companies. Our go-to-market strategy is focused on effectively serving the connectivity needs and challenges of each of these markets, aligning to the

highest growth segments, and doing so in the most cost-effective manner. We tie together all of our go-to-market efforts through consistent brand messaging.

In 2015, we launched new products and services aimed at our highest growth market, which is medium-to-large size businesses with needs to connect stores,

branches and remote users/locations. Our sales and marketing efforts are focused on engaging with our target decision makers, both online and in-person, with

insights on the issues they face. Recognizing the longer sales cycles and the need for relationship building through local presence, we go to market through a mix of

inside and regional direct sales channels, a national sales channel and independent and third-party partners and agents. We also invest in demand generation

through a mix of proprietary and industry conferences and trade shows, search engine marketing and optimization, and account based marketing and

communication. Sales enablement investments are aimed at onboarding and training our channel partners and at simplifying and automating core sales processes.

Our marketing efforts for small business customers are focused on retaining customers approaching contract expiration with attractive renewal offers. Our sales and

marketing growth efforts are centered on customers most likely to benefit from our voice, data and value-added products and services as they grow. To develop the

right bundle of services for our small business customers, we partner with third-party resellers and solution providers.

Our marketing efforts for carrier/transport customers are focused on building relationships with network industry planners and buyers through conferences and

events.

Consumer Markets

We engage in limited sales and marketing for our consumer services. Our marketing efforts are focused on retaining customers and adding customers through

alliances and partnerships. We offer our products and services primarily through direct customer contact through our call centers, search engine marketing, affinity

marketing partners, resellers and marketing alliances.

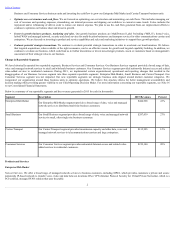

Competition

Business Markets

The market for our business customers is highly competitive, and we expect this competition to continue to intensify. Our business markets are rapidly changing

due to industry consolidation, an evolving regulatory environment and the emergence of new technologies.

We believe the primary competitive factors in our business markets include price, availability, reliability of service, network security, variety of service offerings,

quality of service and reputation of the service provider. While we believe our business services compete favorably based on some of these factors, we are at a

competitive disadvantage with respect to certain of our competitors. Many of our current and potential competitors have greater market presence, technical and

marketing capabilities and financial, personnel and other resources substantially greater than ours; own larger and more diverse networks; are subject to less

regulation; or have substantially stronger brand names. In addition, industry consolidation has resulted in larger competitors that have greater economies of scale.

Consequently, these competitors may be better equipped to adapt more swiftly to new or emerging technologies and changes in customer requirements, to provide

more attractive product offerings, to develop and expand their communications and network infrastructures more quickly, to charge lower prices for their products

and services, and to devote greater resources to the marketing and sale of their products and services.

Enterprise/Mid-Market . Our Enterprise/Mid-Market segment provides managed network, security and cloud services to distributed multi-site business customers

as well as traditional voice and data services. The market for managed network, security and cloud services is expanding rapidly and the number of companies

providing these services has increased in recent years. Our primary competitors are ILECs, such as AT&T, CenturyLink, Inc. and Verizon Communications Inc.;

CLECs, such as Global Capacity, Level 3 Communications Inc., Windstream Holdings, Inc. and XO Communications; cable service providers, such as Charter

Communications, Inc., Comcast Corporation, Cox Communications, Inc. and Time Warner Cable, which have recently begun to compete and penetrate the market

for larger business customers; wireless service providers; and asset-light network companies.

4