Earthlink 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Earthlink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

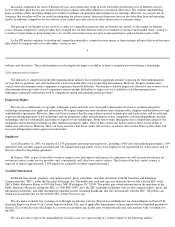

The following table summarizes narrowband subscriber activity for the years ended December 31, 2002 and 2003:

The subscriber amounts above and in subsequent tables do not include the Membership Customers that purchased a Membership Package

from PeoplePC prior to the date of our acquisition of PeoplePC that continue to receive service for their prepaid terms. As of December 31,

2002 and 2003, there were 487,000 and 160,000 such Membership Customers, respectively, receiving services, down from 518,000 at the date

of the acquisition. Both amounts include 99,000 international Membership Customers that EarthLink does not intend to target in our efforts to

convert these Membership Customers to paying subscribers. We have excluded these Membership Customers because they prepaid for service

for periods of up to four years prior to the date of our acquisition of PeoplePC. We will include the acquired Membership Customers in our

reported subscriber amounts if and when they elect to convert to paying subscribers at the end of their prepaid terms. At the acquisition date,

we established a liability for the estimated direct cost to deliver services to these Membership Customers pursuant to their contract terms, and

we reduce the liability and record non-

cash revenue as we deliver services to these Membership Customers. Such reduction is intended to offset

the cost of delivering the services. EarthLink recorded revenues during the years ended December 31, 2002 and 2003 of $9.1 million and

$14.0 million, respectively, associated with the delivery of services to Membership Customers acquired. EarthLink expects to record

approximately $1.8 million of revenues during the year ended December 31, 2004 associated with the acquired Membership Customers.

Our results of operations are significantly affected by subscriber cancellations, or "churn." Our average monthly churn rates for

narrowband subscribers were 4.5%, 4.1%, 4.1% and 4.0% for the four quarters in the year ended December 31, 2002 and 4.5%, 4.5%, 4.6%

and 4.8% for the four quarters in the year ended December 31, 2003. The increase in churn from the rates experienced in 2002 is due to early-

life churn related to the higher level of gross subscriber additions during 2003, an increased number of subscribers who migrated to broadband

services and discontinuing service to certain wireless subscribers in the third and fourth quarters of 2003. If churn rates continue to be at or

above the rates experienced in late 2003, our narrowband subscriber base may continue to decrease. We continue to implement plans to address

churn, including adding new features such as spamBlocker, acceleration-related applications and Pop-Up Blocker

SM

to enhance our service

offerings. However, we can provide no assurance that our plans will be successful in mitigating the adverse impact increased churn may have

on our subscriber base and operating results. In addition, competitive factors outside our control may also adversely affect future rates of

customer churn.

The number of narrowband subscribers we are able to add, which is our primary means of offsetting the adverse impact churn has on our

narrowband subscriber base, may decline and/or the cost of acquiring

22

new subscribers through our own sales and marketing efforts may increase as the market continues to mature or if competition becomes more

intense.

Broadband access revenues

Broadband access revenues consist of fees charged for high-speed, high-capacity access services including DSL, cable, satellite and

dedicated circuit services; installation fees; termination fees; and fees for equipment. Broadband revenues increased $110.5 million, or 44%,

from $250.6 million during the year ended December 31, 2002 to $361.1 million during the year ended December 31, 2003. The increase was

due to a higher average number of broadband subscribers, from 610,000 during the year ended December 31, 2002 to 931,000 during the year

ended December 31, 2003. The increase in average subscribers was due to continued growth in the market for broadband access via DSL and

cable and our efforts to promote broadband services.

The effect of the increase in average subscribers was partially offset by a decrease in average monthly revenue per broadband subscriber

during the same period, which declined 6% from $34.23 during the year ended December 31, 2002 to $32.31 during the year ended

December 31, 2003. The decrease in average monthly revenue per broadband subscriber was due to a shift in the mix of our broadband

subscriber base from frame relay, dedicated circuit and business sDSL subscribers (who generally pay a higher monthly fee) to retail cable

subscribers. The decrease also resulted from introductory pricing offered to new retail broadband customers to stimulate increased sales and

Year Ended December 31,

2002

2003

(in thousands)

Subscribers at beginning of year

4,203

4,035

Gross organic subscriber additions

1,607

2,087

Acquired subscribers

308

76

Narrowband subscribers converted to our broadband services

(98

)

(54

)

Churn

(1,985

)

(2,160

)

Subscribers at end of year

4,035

3,984