Earthlink 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Earthlink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

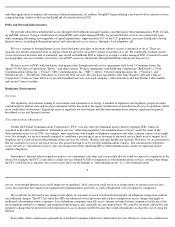

(1)

1999

2000

2001

2002

2003

(in thousands)

Balance sheet data:

Cash and cash equivalents $

685,753

$

674,746

$

424,029

$

382,065

$

349,740

Investments in marketable securities (3)

—

—

169,995

133,372

138,125

Cash and marketable securities

685,753

674,746

594,024

515,437

487,865

Total assets

1,109,147

1,486,137

1,182,781

1,023,553

827,020

Long-term debt, including long-term portion of capital leases

188,367

13,472

2,423

937

342

Total liabilities

350,694

303,886

331,727

331,253

283,357

Accumulated deficit

(328,378

)

(698,030

)

(1,068,971

)

(1,236,991

)

(1,303,771

)

Stockholders' equity

758,453

1,182,251

851,054

692,300

543,663

Reflects the accretion of liquidation dividends on Series A and Series B convertible preferred stock at a 3% annual rate, compounded quarterly, and the accretion of a dividend

related to the beneficial conversion feature in accordance with Emerging Issues Task Force ("EITF") Issue No. 98-5. During 2003, the holder converted all remaining shares of

Series A and Series B convertible preferred stock into common stock. Consequently, there are currently no shares of Series A or Series B convertible preferred stock outstanding

and no associated dividend obligations.

(2)

In February 2000, each outstanding share of then existing EarthLink Network, Inc. common stock was exchanged for 1.615 shares of common stock of EarthLink and each

outstanding share of then existing MindSpring Enterprises, Inc. common stock was exchanged for one share of common stock of EarthLink.

(3)

Investments in marketable securities consist of debt securities classified as available-for-sale and have maturities greater than 90 days from the date of acquisition. EarthLink has

invested primarily in U.S. corporate notes and asset-backed securities, all of which have a minimum investment rating of A, and government agency notes.

13

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion of our financial condition and results of operations should be read in conjunction with the consolidated financial

statements and notes thereto included elsewhere in this Report.

Safe Harbor Statement

The Management's Discussion and Analysis and other portions of this report include "forward-looking" statements (rather than historical

facts) that are subject to risks and uncertainties that could cause actual results to differ materially from those described. Although we believe

that the expectations expressed in these forward-looking statements are reasonable, we cannot promise that our expectations will turn out to be

correct. Our actual results could be materially different from and worse than our expectations. With respect to such forward-

looking statements,

we seek the protections afforded by the Private Securities Litigation Reform Act of 1995. These risks include, without limitation, (1) that we

may not be able to successfully implement our broadband strategy which would materially and adversely affect our subscriber growth rates and

future overall revenues; (2) that we may not successfully enhance existing or develop new products and services in a cost-effective manner to

meet customer demand in the rapidly evolving market for Internet services; (3) that our service offerings may fail to be competitive with

existing and new competitors; (4) that competitive product, price or marketing pressures could cause us to lose existing customers to

competitors, or may cause us to reduce prices for our services; (5) that our commercial and alliance arrangements, including a marketing

arrangement with Sprint, may be terminated or may not be as beneficial to us as management anticipates; (6) that declining levels of economic

activity, increasing maturity of the market for Internet access, or fluctuations in the use of the Internet could negatively impact our subscriber

growth rates and incremental revenue levels; (7) that we may experience other difficulties that limit our growth potential or lower future overall

revenues; (8) that service interruptions could harm our business; (9) that we have historically not been profitable and we may not be able to

sustain profitability; (10) that our third-party network providers may be unwilling or unable to provide Internet access; (11) that we may be

unable to maintain or increase our customer levels if we do not have uninterrupted and reasonably priced access to local and long-distance

telecommunications systems for delivering dial-up and/or broadband access, including, specifically, that integrated local exchange carriers and

cable companies may not provide last mile broadband access to us on a wholesale basis or on terms or at prices that allow the company to grow

and be profitable in the broadband market; (12) that we may not be able to protect our proprietary technologies or successfully defend

infringement claims and may be required to enter licensing arrangements on unfavorable terms; (13) that government regulations could force us

to change our business practices; (14) that we may not experience the level of benefits we expect in connection with restructuring our contact

centers and may not otherwise be able to contain our costs; and (15) that some other unforeseen difficulties may occur. This list is intended to

identify some of the principal factors that could cause actual results to differ materially from those described in the forward-looking statements

included herein. These factors are not intended to represent a complete list of all risks and uncertainties inherent in our business, and should be

read in conjunction with the more detailed cautionary statements included in our other filings with the Securities and Exchange Commission.

Overview

EarthLink, Inc. ("EarthLink," "we," "us" or "our") is a leading Internet service provider ("ISP"), providing nationwide Internet access and

related value-added services to its individual and business customers. Our primary service offerings are narrowband, broadband or high-speed,

and wireless Internet access services; web hosting services; and advertising and related marketing services. We provide our broad range of

services to more than five million paying customers through a nationwide network of dial-up points of presence ("POPs"), a nationwide

broadband footprint and wireless technologies. We derive