EMC 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 EMC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

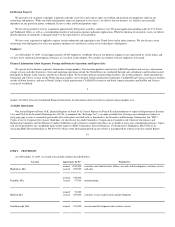

Reduction in

Cost of Sales

Inventory

Scrapped and

Charged Against

the Reserve

2003

Category

Beginning

Balance

Inventory

Sold

Favorable

Vendor

Settlements

Ending

Balance

Excess and obsolete EMC owned inventory $ 6.3 $ (5.4) $ – $ – $ 0.9

Reduction in

Cost of Sales

Inventory

Scrapped and

Charged Against

the Reserve

2002

Category

Beginning

Balance

Inventory

Sold

Favorable

Vendor

Settlements

Ending

Balance

Excess and obsolete EMC owned inventory $ 226.2 $ (182.9) $ (37.0) $ – $ 6.3

Excess and obsolete purchase obligations 29.3 (4.8) (20.9) (3.6) –

Total $ 255.5 $ (187.7) $ (57.9) $ (3.6) $ 6.3

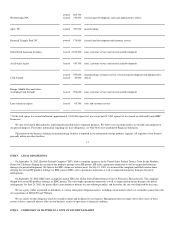

Impact of the 2002 and 2001 Restructuring Programs. The 2002 and 2001 restructuring programs have been completed, although our ability to sell and

sublet facilities is subject to appropriate market conditions. The expected cash impact of the charges is $402.1, of which $101.9 was paid in 2003 and an

aggregate of $190.3 was paid in 2002 and 2001. The remaining accrual balances primarily relate to the consolidation of facilities that will be paid over the

respective lease terms through 2012.

Other Restructuring Programs

During 1999, we recorded a charge of $223.6 relating to restructuring, merger and other special charges primarily associated with our acquisition of Data

General. In 1998, we recorded a charge of $135.0 related to a Data General restructuring program and certain asset write-downs resulting from the program.

During 2003, the Data General restructuring accrual was reduced by $16.1. The reduction resulted from management's decision to utilize a facility for

Documentum, LEGATO and certain of our other operations that we had previously vacated. Additionally, we favorably resolved a previously recognized

contractual obligation. As of December 31, 2003, the remaining accrued obligations associated with the 1999 and 1998 charges are $12.3. The amount relates

to remaining lease obligations for vacated facilities that will be paid through 2015 and executive severance obligations attributable to the acquisition of Data

General.

Cost Savings from the Restructuring Programs

The 2003, 2002 and 2001 restructuring programs have reduced costs in all areas of our operations, favorably impacting cost of sales, SG&A expenses

and R&D expenses. As of December 31, 2003, the annualized costs savings, compared to the cost structure in place as of the end of the second quarter of

2001, is in excess of $1,275.0.

Investment Income

Investment income was $187.8 and $256.2 in 2003 and 2002, respectively. Investment income was earned primarily from investments in cash

equivalents, short and long-term investments and sales-type leases. Investment income decreased in 2003 compared to 2002 because of lower yields on

outstanding investment balances and reduced realized gains from the sale of investments. The weighted average return on investments, excluding realized

gains, was 2.7% and 3.5% in 2003 and 2002, respectively. Realized gains were $30.5 and $63.0 in 2003 and 2002, respectively. As a result of declining

interest rates, we expect our investment income to be lower in 2004 compared to 2003.

Other Expense, Net

Other expenses, net were $14.9 and $47.4 in 2003 and 2002, respectively. Other expenses, net decreased due to a reduction in losses on disposal of

assets.

25

Provision for Income Taxes

In 2003, we reported pre-tax income of $571.0 resulting in a provision for income taxes of $74.9. In 2002, we reported a pre-tax loss of $296.5 resulting

in income tax benefits of $177.8. In 2003, the effective income tax rate was 13.1%. The rate of benefit was 60.0% in 2002. The effective income tax rate is

based upon the income (loss) for the year, the composition of the income (loss) in different countries, and adjustments, if any, for the potential tax

consequences, benefits or resolutions of tax audits. For 2003, the effective tax rate varied from the statutory tax rate primarily as a result of the favorable

resolution of a series of tax matters which aggregated $80.9 and the mix of income attributable to foreign versus domestic jurisdictions. Our aggregate income

tax rate in foreign jurisdictions is lower than our income tax rate in the United States. Partially offsetting this benefit were non-deductible IPR&D charges of

$29.1 incurred in connection with the acquisitions of LEGATO and Documentum. We did not derive a tax benefit from these charges. For 2002, the effective

income tax rate varied from the statutory rate primarily as a result of the overall favorable resolution of international tax matters, which aggregated $67.7.

Additionally, a reduction in the valuation allowance resulting from the realization of capital loss carryforwards contributed to the favorable rate.

We expect our income tax rate to be approximately 30.0% in 2004; however, the rate may vary depending upon the income for the year, the composition

of the income (loss) in different countries, and adjustments, if any, for the potential tax consequences, benefits or resolutions of audits.

•

•

•

•

•