Dow Chemical 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 Dow Chemical annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 The Dow Chemical Company

Buig Vue Thrgh

In an unpredictable global business environment, we are driving higher operating performance across

our enterprise. Our strengthened balance sheet and ongoing execution of business-specific actions

to improve return on capital demonstrate how Dow continues to leverage operational productivity to

accelerate value. This in turn enables us to focus our resources more deeply in high-growth businesses,

enhance financial flexibility and increasingly reward our shareholders.

Op d l Ec

Strengthening Our Balance Sheet

to Reward Shareholders

In2013,wecontinuedtoidentifynewwaystorelease

morecashandvaluefromourbalancesheet,while

reducingdebtandinterestexpense.

• In2013,wegenerated$7.8billionincashowfrom

operations–representinganewrecord,evenexcluding

theafter-taximpactofthecashpaymentfrom

PetrochemicalIndustriesCompany(PIC)ofKuwait.

• Additionally,themajorityofthisapproximately

$2.2billioncashawardreceivedin2013wasallocated

towardpayingdowndebt,helpingtobringourdebt

toequityratioswellbelowhistoriclevelsandreducing

ourinterestexpense$170millionyearoveryear.

• Overthepastthreeyears,Dowhasmorethandoubled

shareholderreturnsintheformofdeclareddividends

andsharerepurchases.Asourcashowandearnings

continuetogrow,weremainfocusedonrewarding

shareholdersandfundingorganicgrowth.

Improving Return on Capital

Ourongoingexecutionofourrestructuringactions

coupledwiththeprioritizationofourgrowthinvestments

reinforceourcommitmenttoenhancingreturnoncapital

andimprovingoveralloperatingperformance.

• Weacceleratedourcostsavingsandportfolio

managementactionsthroughouttheyear,

exceedingourgoaltodeliver$500millionin

costreductionsin2013.

• Weadvancedkeygrowthinitiativeswiththemajority

ofourforwardcapitalallocationputtowardthese

high-returnprojects.Thishasenabledastrongbridge

tonewearningsstreamsthatwillcontinuetoramp

upin2015wheninvestmentsinSadaraandournew

PDHunitontheU.S.GulfCoastcomeonline.

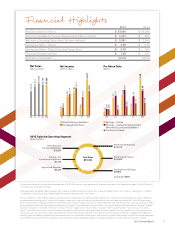

Clear Cash Priorities

(dollars in billions)

Cash Flow from Operations

Net Debt to EBITDA1

Net Debt to EBITDA

Cash Flow from Operations ($B)

$8.0

$7.0

$6.0

$5.0

$4.0

$3.0

$2.0

$1.0

$0.0

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

20102009 2011 2012 2013

Accelerate Share Repurchases

Expanded programs to $4.5B

Increase Dividend

15% increase in 1Q14 dividend

High-Return Organic Growth

CapEx of $3.3B$3.5B in 2014

Record cash flow from operations

$7.8B in 2013

Stronger balance sheet

1.4 net debt to EBITDA

Non-strategic business and

asset divestitures

$3B$4B in 201315

After-tax Impact

of KDow Award

q Increasing cash flow and a stronger balance sheet enable increased

remuneration and funding for high-return growth projects.

1 Net debt to EBITDA is defined as net debt divided by “Adjusted EBITDA.” Net debt equals total debt (“Notes Payable”

plus “Long-term debt due within one year” plus “Long-term debt”) minus “Cash and cash equivalents.”