Dominion Power 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

09 DOMINION RESOURCES, INC.

In 2007, your company embarked on a

long-term regulated growth plan to meet

the heightened demand of our customers

while remaining flexible to take advantage of

new possibilities as they arise. Dominion has

executed and will continue to execute that

plan on time and on budget.

All told, we have spent billions of dollars

to expand our electric and gas infrastructure

throughout the mid-Atlantic. And, over the

next five years, we plan to spend nearly

$14 billion more for growth in assets with

long-term contracts and in businesses whose

returns are subject to federal and/or state

oversight. Last year, and into the future,

80 percent to 90 percent of our operating

earnings have and will come from these

stable businesses.

APPALACHIAN OPPORTUNITY

Dominion has had good fortune to be in

the right place.

Our company traces its ancestry to the

Colonial era in Virginia, and we found our

calling in the electric utility business in

1909. A merger with Consolidated Natural

Gas (CNG) in 2000 brought to Dominion a

century of valuable experience in the gas-

production and gas-transportation areas of

the Appalachian Basin.

While we will spend growth capital at our

electric and gas utilities to provide service to

new customers and businesses and enhance

the reliability of those systems, new business

opportunities lie in the Marcellus and Utica

Shale regions of the Appalachian Basin. It is

anareawherewehavedonebusinesssince

1891 and where natural gas production is

expected to more than double over the

next 10 years.

Our century of excellent service in the

area and our rock-solid reputation as a gas

infrastructure company have earned us trust

among producers and have put us in a good

position to maximize our opportunities there.

We have been in the right place and have

done the job well for more than 100 years.

Combine new and exciting gas business

development with the stable yet always

growing Dominion Virginia Power utility,

and you can expect (a) solid returns on your

investment, (b) strong earnings per share

growth and (c) commensurate increases

in the dividend.*

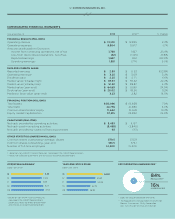

FINANCIAL REVIEW OF 2013

Dominion is dierent not only because we

have electric and gas businesses, but also

because both sides of your company

are growing.

Dominion Virginia Power is expanding

to serve new customers and heavy data

center load. And there is a dire need for

more infrastructure where our natural gas

businesses reside.

In 2013, Dominion earned $3.25 per

share in operating earnings, up from $3.09

per share in 2012, and within our guidance

range of $3.20 per share to $3.50 per

share.** Earnings under Generally Accepted

Accounting Principles (GAAP) in 2013 were

$2.93 per share, up from 53 cents per share

in 2012.

Operating earnings per share increased

in part because of a regulated infrastructure

growth plan we began in earnest in 2007.

Also contributing to higher earnings

per share in 2013 were cost-control and

cost-cutting measures.

DEAR INVESTORS

Every day Dominion delivers on our promises to provide reliable

electric and gas service at reasonable rates and leverage business

opportunities to add shareholder value.

* All dividend declarations are subject to Board of Directors

approval.

** Based on non-GAAP Financial Measures. See page 22 for

GAAP Reconciliations.