Dominion Power 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In further seeking to maximize the value

of our gas assets, we announced plans to

form a master limited partnership (MLP).

A commonly used financing vehicle in the

natural gas industry, the MLP would include

certain gas assets and allow the company

to maintain operating control while raising

capital by selling a portion of the limited

partnership interests to public investors.

We will have more to say about the process

and which businesses we will contribute

in 2014.

AGREEMENTS BENEFIT SHAREHOLDERS

Additional shareholder value will also

be derived from leasing approximately

100,000 acres of Marcellus Shale development

rights underneath several of our natural gas

storagefieldsinWestVirginiatotwogas

producers — CONSOL Energy and Triana

Energy LLC. Geological studies have proved

the storage fields’ structural stability to

withstand drilling far below them.

These farmout agreements are expected

to result in payments to Dominion of about

$200 million over the next nine years,

with an additional overriding royalty interest

in any gas produced there.

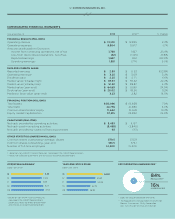

FINANCIAL OUTLOOK FOR 2014

The groundwork laid over the past few years

has fostered Dominion’s enviable position

among American gas and electric utilities.

We achieved operating earnings growth of

5–6 percent in 2013.* Our total shareholder

return ranked Dominion second of 20 utilities in

our peer group. And we returned 69 percent of

our operating earnings in dividends to you.**

We expect this growth to continue based

on our plan to invest nearly $14 billion between

2014 and 2018 in energy infrastructure projects

that make up our portfolio of diverse and

growing business lines.

Our guidance for 2014 contemplates

operating earnings in the range of $3.35 per

share to $3.65 per share.*** And, contingent

on quarterly declaration by the board,

your company plans to raise the dividend

rate from $2.25 per share in 2013 to $2.40 per

share in 2014—a 6.7 percent increase that is

expected to fall within our targeted dividend

payout ratio of 65 percent to 70 percent of

operating earnings per share.

NEW INFRASTRUCTURE COMES ONLINE

While reducing commodity risk through asset

sales in 2013, we also invested about $2.5 billion

in growth capital for energy infrastructure

projects that we expect to begin serving our

customers over the next decade. These outlays

will also bolster our eorts to provide higher

earnings per share in future years.

Every day, Dominion strives to meet our

customers’ demands. In Virginia, North Carolina,

West Virginia and Ohio, that means reliable

utility service in all weather conditions, at all

times. For our Dominion Transmission (DTI)

customers — whether gas producers,

shippers or end-user utilities — we must

provide a steady flow of gas from point

A to point B, and have sucient capacity

to handle their needs.

So we are investing in new electric

wires, substations, power stations, pipelines

and related natural gas developments and

upgrading existing energy infrastructure to

help ensure service reliability and customer

satisfaction today and decades henceforth.

Fundamentally, any expenditures we

consider must satisfy a market need and

benefit our customers, shareholders and

company alike. For instance, the New Market

Project, expected to come online in 2016

and cost about $160 million, will provide

Marcellus gas supply to customers of two

local distribution companies in New York state

while producing solid returns for Dominion.

We will continue to develop long-term

growth plans that serve the interests of each

of our stakeholders, while creating jobs in

our communities.

POWER STATIONS AND POWER LINES

In order to reliably serve our Dominion Virginia

Power customers, we must continue building

new power stations and power lines, while

upgrading existing facilities. Over the next five

years, we anticipate spending more than

$8 billion for electric utility growth projects.

The regulatory environment in Virginia is

important in light of this massive buildout.

The regulations provide balanced benefits

for our company, our ratepayers and the

Commonwealth of Virginia.

I am not sure you can point to another

regulatory framework in the country allowing

for fair returns on investment for the billions

13 DOMINION RESOURCES, INC.

* Based on non-GAAP Financial

Measures. See page 22 for GAAP

Reconciliations.

** See page 22 for GAAP Reconciliation

of Operating Dividend Payout Ratio

(non-GAAP) to Reported Payout Ratio

(GAAP).

*** See page 22 for GAAP Reconciliation

of 2014 Operating Earnings Guidance.

“

WE WILL CONTINUE TO

DEVELOP LONG-TERM

GROWTH PLANS THAT SERVE

THE INTERESTS OF EACH OF

OUR STAKEHOLDERS, WHILE

CREATING JOBS IN OUR

COMMUNITIES.

”