Dominion Power 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

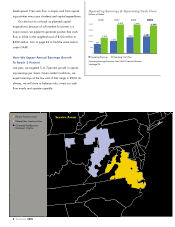

5.00

2.50

0

2.58

Dividend is more than

covered by regulated/

tariff-based earnings

Hedged unregulated earnings

provide additional coverage 61% from

regulated/

tariff-based

Unhedged

Unregulated

Hedged

Unregulated

Regulated

Tariff-based

*Net income plus depreciation, depletion and amortization of operating

segments excluding the Corporate segment

Based on Non-GAAP Financial Measures

See page 24.

VEPCO-Reg

42%

CNG-Reg

19%

CNG/DEI-E&P

33%

DEI-Non Reg

6%

Stable, Well-Covered Dividend

Dollars Per Share

Dividend Operating Cash Flow Sources*2003

Operating

Earnings

6.Dominion 2003

25

20

15

10

5

0

20.8

15.9 16.9

Market Capitalization

Billions of Dollars

As of December 31

20032001

16.5

2000 2002

Our GAAP earnings include a $750 million charge

recorded in 2003 as a result of a disappointing write-

down at our telecommunications unit. They also include a

$180 million gain created by an accounting change in

the treatment of asset retirement obligations, a gain we

also excluded from operating earnings. With these and

certain items detailed on page 24, we reported GAAP

earnings of $1.00, down about 79 percent from GAAP

earnings of $4.82 a year earlier.

A 21.4-Percent Total Return

In 2003, we delivered a total return of 21.4 percent,

exceeding past-year targets of 15 percent. This includes

a 16.2-percent increase in our share price, which closed

the year at $63.83, up from $54.90 a year earlier. And

it also includes your annual dividend of $2.58 per share,

a 4-percent yield at year-end.

Our dividend payout — illustrated on a GAAP basis

on page 24, but about 57 percent of operating earnings

at current levels — totaled more than $800 million last

year. We’ve paid out more than 300 consecutive divi-

dends over the last 70 years.

Through recent market turmoil, I’ve made a special

point to assure you that our existing dividend rate is

secure. It remains secure. Only our board of directors

can determine whether or when to increase it. Many fac-

tors influence the board’s decision and management’s

recommendations. Ultimately, any decision hinges entirely

on whether we can invest this cash for the long term at

returns higher than our cost of capital. We compare these

opportunities with the alternatives of repurchasing shares

or raising the dividend.

Promoting Management Focus on

Sustained Long-Term Results

How company executives are rewarded is an important

corporate governance issue today.

At Dominion, we pay officers and middle manage-

ment to strike a reasonable balance between making

their annual earnings and productivity goals and sound