Dominion Power 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12.Dominion 2003

Managing Our Businesses

As a Btu Balance Sheet

Deregulation opens unique opportunities because we own

electric generation and natural gas assets. Both forms can

be measured in British Thermal Units, or Btus. Think of

our businesses as a Btu balance sheet — assets on the

left; “liabilities,” or obligations to customers, on the right.

Our “assets” are megawatts and natural gas

reserves that make up the supply side of our portfolio.

Our Btu obligations include customer-supply obligations,

forward sales contracts with credit-worthy institutions and

financial hedges, which are agreements to sell energy at

a certain price on a future date.

By the end of 2003, we had matched 90 percent of

our electric generation with our retail and wholesale cus-

tomers. We also hedged or locked in the prices we expect

to get for more than 80 percent of our 2004 natural gas

and oil production, reducing our exposure to price volatil-

ity in wholesale natural gas and power markets.

If gas prices spike up or down, we have less to

make or less to lose. In a boom-or-bust scenario, we’ll

make a margin.

Creating Profits, Cash Through Commodity

Volatility, Growing “Internal Hedge”

I have a name for the 10 percent of generation that we

have not matched and the 20 percent of natural gas that

we have not hedged — “Btu equity.”

Btu equity gives us flexibility. We can create more

cash and profits by taking advantage of interconnections

between natural gas and competitive power markets.

Think of a child’s seesaw: When natural gas prices rise,

it costs us more to generate power in our merchant

gas-fired units. Therefore, the profit margins earned on

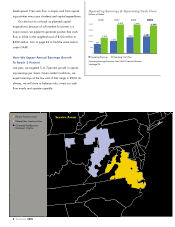

Baseload 50%

Intermediate 28%

Peaking 22%

Generation:

Unit Mix

As of Year End

Gas/Other 28%

Coal 26%

Nuclear 21%

Purchases 15%

Oil 10%

Generation:

Fuel Mix

As of Year End

25,000

12,500

0

24,408

21,867

23,830

Electric Generation Capacity Growth

Megawatts

As of Year End

20032001

19,265

2000 2002