Dish Network 1999 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 1999 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–20

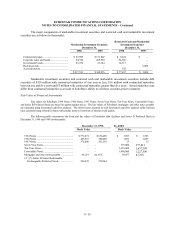

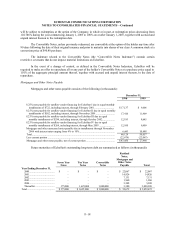

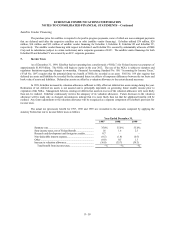

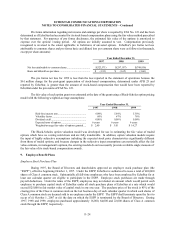

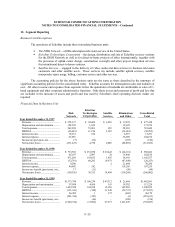

The temporary differences, which give rise to deferred tax assets and liabilities as of December 31, 1998 and 1999, are as

follows (in thousands):

December 31,

1998 1999

Current deferred tax assets:

Accrued royalties................................................................................... $ 15,971 $ 30,018

Inventory reserves and cost methods....................................................... 1,759 1,380

Accrued expenses.................................................................................. 9,976 29,846

Allowance for doubtful accounts ............................................................ 1,945 5,636

Reserve for warranty costs ..................................................................... 101 78

Total current deferred tax assets................................................................. 29,752 66,958

Current deferred tax liabilities:

Subscriber acquisition costs and other..................................................... –68

Total current deferred tax liabilities............................................................ –68

Gross current deferred tax assets................................................................ 29,752 66,890

Valuation allowance.................................................................................. (22,429) (55,162)

Net current deferred tax assets ................................................................... 7,323 11,728

Noncurrent deferred tax assets:

General business and foreign tax credits.................................................. 2,072 2,504

Net operating loss carryforwards ............................................................ 147,097 551,561

Amortization of original issue discount on 1994 Notes and 1996 Notes..... 105,095 –

Other.................................................................................................... 13,000 9,553

Total noncurrent deferred tax assets ........................................................... 267,264 563,618

Noncurrent deferred tax liabilities:

Depreciation.......................................................................................... (24,013) (43,459)

Other.................................................................................................... (322) (425)

Total noncurrent deferred tax liabilities....................................................... (24,335) (43,884)

Gross deferred tax assets ........................................................................... 242,929 519,734

Valuation allowance.................................................................................. (183,117) (464,327)

Net noncurrent deferred tax assets.............................................................. 59,812 55,407

Net deferred tax assets............................................................................... $ 67,135 $ 67,135

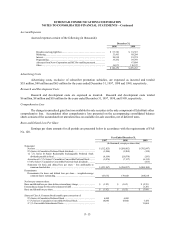

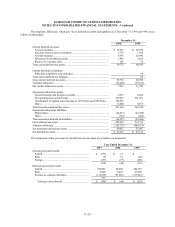

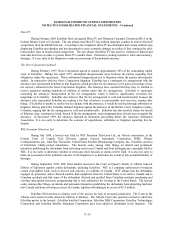

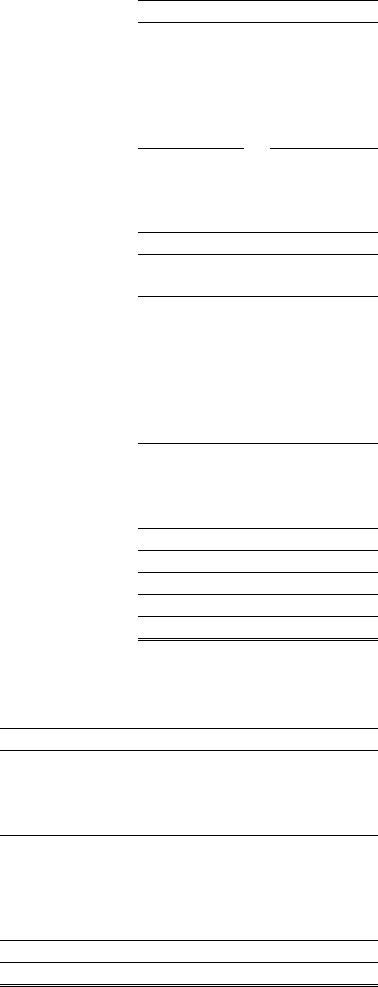

The components of the (provision for) benefit from income taxes are as follows (in thousands):

Year Ended December 31,

1997 1998 1999

Current (provision) benefit:

Federal .................................................................... $ (373) $ 15 $ –

State... ..................................................................... (9) 18 (45)

Foreign .................................................................... (137) (77) (108)

(519) (44) (153)

Deferred (provision) benefit:

Federal .................................................................... 104,992 86,604 286,195

State........................................................................ 7,860 6,463 27,748

Increase in valuation allowance ................................. (112,479) (93,067) (313,943)

373 – –

Total (provision) benefit........................................ $ (146) $ (44) $ (153)