Dish Network 1999 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 1999 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

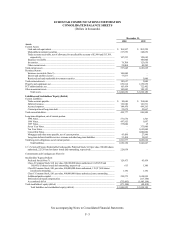

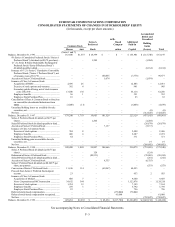

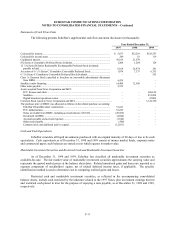

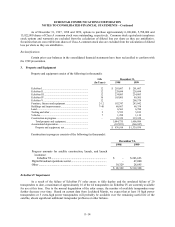

ECHOSTAR COMMUNICATIONS CORPORATION

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(In thousands, except per share amounts)

See accompanying Notes to Consolidated Financial Statements.

F–5

ock-

Accumulated

Deficit and

Unrealized

Common Stock

Series A

Preferred

Based

Compen-

Additional

Paid-In Holding

Gains

Shares Amt. Stock sation Capital (Losses) Total

(Notes 1 and 7)

Balance, December 31, 1996 ............................................ 163,680 $1,637 $ 18,399 $ – $ – $ 156,901 $ (115,740) $ 61,197

8% Series A Cumulative Preferred Stock (“Series A

Preferred Stock”) dividends (at $0.75 per share) .. – – 1,204 – – – (1,204) –

12 1/8% Series B Senior Redeemable Exchangeable

Preferred Stock (“Series B Preferred Stock”)

dividends payable in-kind ........................................ – – – – – – (6,164) (6,164)

Issuance of 6 3/4% Series C Cumulative Convertible

Preferred Stock (“Series C Preferred Stock”), net

of issuance costs of $3,778 ..................................... – – – 100,455 –(3,778) –96,677

Accretion of Series C Preferred Stock ......................... – – – 1,074 – – (1,074) –

Issuance of Class A Common Stock:

Acquisition of DBSC............................................... 2,596 26 – – – 12,005 –12,031

Exercise of stock options and warrants .................. 392 4 – – – 941 –945

Secondary public offering, net of stock issuance

costs of $2,648 .................................................... 13,580 136 – – – 63,114 –63,250

Employee benefits ................................................... 56 1 – – – 351 –352

Employee Stock Purchase Plan............................... 16 – – – – 63 – 63

Cancellation of Class A Common Stock to foreclose

on convertible subordinated debentures from

DBSI ......................................................................... (1,080) (11) – – – (4,468) –(4,479)

Unrealized holding losses on available-for-sale

securities, net ........................................................... – – – – – – (8) (8)

Net loss ......................................................................... – – – – – – (312,825) (312,825)

Balance, December 31, 1997 ............................................ 179,240 1,793 19,603 101,529 –225,129 (437,015) (88,961)

Series A Preferred Stock dividends (at $0.75 per

share) ........................................................................ – – 1,204 – – – (1,204) –

Series B Preferred Stock dividends payable in-kind .... – – – – – – (26,874) (26,874)

Accretion of Series C Preferred Stock ......................... – – – 7,137 – – (7,137) –

Issuance of Class A Common Stock:

Exercise of stock options ........................................ 784 8 – – – 2,488 –2,496

Employee benefits ................................................... 400 4 – – – 2,287 –2,291

Employee Stock Purchase Plan............................... 64 – – – – 371 –371

Unrealized holding gains on available-for-sale

securities, net ........................................................... – – – – – – 19 19

Net loss ......................................................................... – – – – – – (260,882) (260,882)

Balance, December 31, 1998 ............................................ 180,488 1,805 20,807 108,666 –230,275 (733,093) (371,540)

Series A Preferred Stock dividends (at $0.75 per

share) ........................................................................ – – 124 – – – (124) –

Retirement of Series A Preferred Stock ....................... – – (20,931) – – – (70,003) (90,934)

Series B Preferred Stock dividends payable in-kind .... – – – – – – (241) (241)

Accretion of Series C Preferred Stock ......................... – – – 6,335 – – (6,335) –

Series C Preferred Stock dividends (at $0.84375 per

share, per quarter)..................................................... – – – – – – (553) (553)

Conversion of Series C Preferred Stock ..................... 11,416 114 –(69,567) –69,453 – –

Proceeds from Series C Preferred Stock deposit

account...................................................................... 23 – – – – 953 2955

Issuance of Class A Common Stock:

Acquisition of Media4............................................. 688 7 – – – 9,600 –9,607

News Corporation and MCI transaction ................ 34,412 344 – – – 1,123,976 –1,124,320

Exercise of stock options ........................................ 1,934 19 – – – 7,145 –7,164

Employee benefits ................................................... 278 3 – – – 3,792 –3,795

Employee Stock Purchase Plan............................... 22 – – – – 796 –796

Deferred stock-based compensation ........................... – – – – (178,840) 178,840 – –

Deferred stock-based compensation recognized........ – – – – 61,060 –61,060

Net loss ......................................................................... – – – – – – (792,847) (792,847)

Balance, December 31, 1999 ............................................ 229,261 $2,292 $ – $ 45,434 $(117,780) $1,624,830 $(1,603,194) $ (48,418)