Costco 2002 Annual Report Download - page 34

Download and view the complete annual report

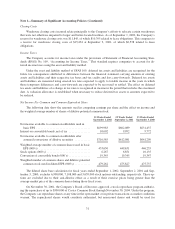

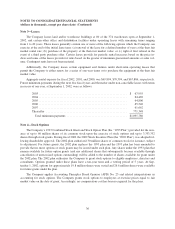

Please find page 34 of the 2002 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 2—Debt

Bank Lines of Credit and Commercial Paper Programs

The Company has in place a $500,000 commercial paper program supported by a $400,000 bank credit

facility with a group of 10 banks, of which $200,000 expires on November 11, 2003 and $200,000 expires on

November 15, 2005. At September 1, 2002, no amounts were outstanding under the commercial paper program

and no amounts were outstanding under the loan facility. Covenants related to the credit facility place limitations

on total company indebtedness. As of September 1, 2002, the Company was in compliance with all restrictive

covenants.

In addition, a wholly owned Canadian subsidiary has a $128,000 commercial paper program supported by a

$51,000 bank credit facility with three Canadian banks, which expires in March, 2003. At September 1, 2002, no

amounts were outstanding under the bank credit facility or the Canadian commercial paper program.

The Company has agreed to limit the combined amount outstanding under the U.S. and Canadian commer-

cial paper programs to the $451,000 combined amounts of the respective supporting bank credit facilities.

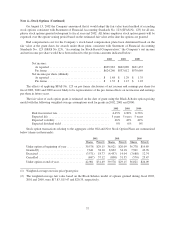

The Company’s wholly-owned Japanese subsidiary has a short-term ¥4 billion bank line of credit, equal to

approximately $33,600, of which ¥1 billion ($8,400) expires in April 2003 and ¥3 billion ($25,200) expires in

November 2003. At September 1, 2002, $18,480 was outstanding under the line of credit with an applicable

interest rate of 1.375%.

The Company’s 80%-owned UK subsidiary has a £60 million ($93,048) bank revolving credit facility and a

£20 million ($31,016) bank overdraft facility, both expiring in February 2007. At September 1, 2002, $85,294

was outstanding under the revolving credit facility with an applicable interest rate of 4.413% and no balance was

outstanding under the bank overdraft facility.

Letters of Credit

The Company has separate letter of credit facilities (for commercial and standby letters of credit), totaling

approximately $373,000. The outstanding commitments under these facilities at September 1, 2002 totaled ap-

proximately $142,000 including approximately $32,000 in standby letters of credit.

33