Costco 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YEAR ENDED SEPTEMBER 1, 2002

Annual

Report

2002

2002

Annual

Report

2002

Table of contents

-

Page 1

Annual Report 2002 2002 YEAR ENDED SEPTEMBER 1, 2002 -

Page 2

... and Analysis of Financial Condition and Results of Operations ...Certifications of CEO and CFO ...Independent Auditors' Report ...1 2 4 6 7 8 10 19 21 Report of Independent Public Accountants ...22 Consolidated Financial Statements ...Notes to Consolidated Financial Statements ...Market for Costco... -

Page 3

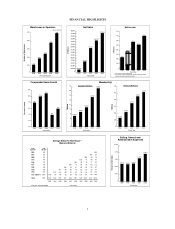

... 2002 * Income from continuing operations ** Income from continuing operations excluding asset impairment/ closing costs and/or accounting change 0 1998 1999 2000 2001 2002 At Fiscal Year End 0 Comparable Sales Growth 15 12% 11% 10% 10% Membership Gold Star Members 14.597 4.6 Business Members... -

Page 4

...Kansas and Illinois. New market openings also included two in Puerto Rico and two in the Pittsburgh, Pennsylvania area. Openings in existing markets included new warehouses in California, Oregon, Nevada, Colorado, New York, North Carolina, Maryland, Virginia, and a new Business Center in Arizona, as... -

Page 5

... to our Executive Members-telephone service, auto buying, check processing, auto and home insurance, credit card processing, real estate and mortgage services and payroll processing-we have added, or are testing in selected markets, healthcare insurance, financial planning, sharebuilding services... -

Page 6

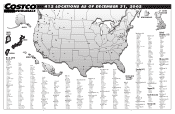

... Robinson South Carolina (1) Charleston Tennessee (3) Brentwood NE Memphis SE Memphis Texas (10) Arlington Austin East Plano Fort Worth Katy Freeway NW San Antonio Sonterra Park Southlake West Plano Willowbrook 5 3 Canada (61) PUERTO RICO Utah (5) Midvale Orem St. George Salt Lake City Sandy... -

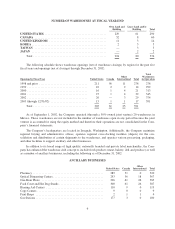

Page 7

...number of ancillary businesses, including the following as of December 31, 2002: ANCILLARY BUSINESSES United States Canada Other International Total Pharmacy ...Optical Dispensing Centers ...One-Hour Photo ...Food Court and Hot Dog Stands ...Hearing Aid Centers ...Copy Centers ...Print Shops ...Gas... -

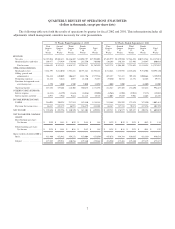

Page 8

... per share data) The following table sets forth the results of operations by quarter for fiscal 2002 and 2001. This information includes all adjustments which management considers necessary for a fair presentation. 52 Weeks Ended September 1, 2002 First Quarter 12 Weeks Second Quarter 12 Weeks Third... -

Page 9

... of accounting change, net of tax ...Income from continuing operations ...Discontinued operations: Income (loss), net of tax ...Loss on disposal ...Net income (loss) ...Shares used in calculation (000's) ...Balance Sheet Data Working capital (deficit) ...Property and equipment, net ...Total assets... -

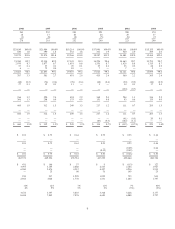

Page 10

1998 261 18 (1) 278 1997 252 17 (8) 261 1996 240 20 (8) 252 1995 221 24 (5) 240 1994 200 29 (8) 221 1993 170 37 (7) 200 $23,830 440 24,270 21,380 2,070 27 6 23,483 787 (48) 27 - 100.0% 1.8 101.8 89.7 8.7 0.1 - 98.5 3.3 (0.2) 0.1 - $21,484 390 21,874 19,314 1,877 27 75 21,293 581 (76) 15 - ... -

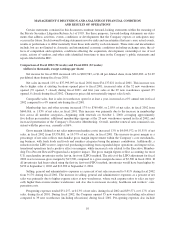

Page 11

... from expanded depot operations and improved international operations had a positive effect on margins, while increased costs related to the Executive Membership Two-Percent Reward Program had a negative impact. The gross margin figures reflect accounting for most U.S. merchandise inventories on the... -

Page 12

... fiscal 2001. The fiscal 2002 provision included charges of $7,765 for the Canadian administrative reorganization (See "Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations"-Liquidity and Capital Resources) and $13,683 for warehouse closing expenses which were... -

Page 13

... in the entry level wage rate of hourly employees beginning in the fourth quarter of fiscal 2000; continued expansion of the Company's cobranded credit card program; higher utility and energy costs; and higher expenses associated with an increase in new warehouse openings year-over-year (a net of 32... -

Page 14

... warehouses in Japan. Other international markets are being assessed. Costco and its Mexico-based joint venture partner, Controladora Comercial Mexicana, each own a 50% interest in Costco Mexico. As of September 1, 2002, Costco Mexico operated 20 warehouses in Mexico and plans to open one or two new... -

Page 15

... 1, 2002 reflects the current balance outstanding of $506,883. Financing Activities During April 2001, the Company retired its unsecured note payable to banks of $140,000 using cash provided from operations, cash and cash equivalents and short-term borrowings under its commercial paper program. In... -

Page 16

... 30, 2004. Under the program, the Company can repurchase shares at any time in the open market or in private transactions as market conditions warrant. The repurchased shares would constitute authorized, but non-issued shares and would be used for general corporate purposes, including stock option... -

Page 17

... that affect the financial position and results of operations. Management continues to review its accounting policies and evaluate its estimates, including those related to merchandise inventory, impairment of long-lived assets and warehouse closing costs and insurance/self-insurance reserves. The... -

Page 18

... exercise prices equal to fair market value on the date of grant. Accordingly, no compensation cost has been recognized for the plans. On August 13, 2002 the Company announced that it would adopt the fair value based method of recording stock options consistent with Statement of Financial Accounting... -

Page 19

... rates on inventory purchases. The fair value of foreign exchange contracts outstanding at September 1, 2002 were not material to the Company's results of operations or its financial position. Change in Accountants On May 13, 2002, the Audit Committee of Costco Wholesale Corporation's Board of... -

Page 20

... D. Sinegal, certify that: 1) 2) I have reviewed this annual report on Form 10-K of Costco Wholesale Corporation. Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the... -

Page 21

... A. Galanti, certify that: 1) 2) I have reviewed this annual report on Form 10-K of Costco Wholesale Corporation. Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the... -

Page 22

... balance sheet of Costco Wholesale Corporation and subsidiaries as of September 1, 2002 and the related consolidated statements of income, stockholders' equity and cash flows for the 52 weeks then ended. These consolidated financial statements are the responsibility of the Company's management... -

Page 23

... INDEPENDENT PUBLIC ACCOUNTANTS To Costco Wholesale Corporation: We have audited the accompanying consolidated balance sheets of Costco Wholesale Corporation (a Washington corporation) and subsidiaries ("Costco") as of September 2, 2001 and September 3, 2000, and the related consolidated statements... -

Page 24

COSTCO WHOLESALE CORPORATION CONSOLIDATED BALANCE SHEETS (dollars in thousands except par value) September 1, 2002 September 2, 2001 ASSETS CURRENT ASSETS Cash and cash equivalents ...Short-term investments ...Receivables, net ...Merchandise inventories ...Other current assets ...Total current ... -

Page 25

COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF INCOME (dollars in thousands, except per share data) 52 Weeks Ended September 1, 2002 52 Weeks Ended September 2, 2001 53 Weeks Ended September 3, 2000 REVENUE Net sales ...Membership fees and other ...Total revenue ...OPERATING EXPENSES ... -

Page 26

COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY For the 52 weeks ended September 1, 2002, the 52 weeks ended September 2, 2001 and the 53 weeks ended September 3, 2000 (in thousands) Other Accumulated Comprehensive Income/(Loss) Common Stock Shares Amount Additional ... -

Page 27

...Tax benefit from exercise of stock options ...Change in receivables, other current assets, deferred income, accrued and other current liabilities ...Increase in merchandise inventories ...Increase in accounts payable ...Other ...Total adjustments ...Net cash provided by operating activities ...CASH... -

Page 28

... financial statements include the accounts of Costco Wholesale Corporation, a Washington corporation, and its subsidiaries ("Costco" or the "Company"). All material inter-company transactions between the Company and its subsidiaries have been eliminated in consolidation. Costco primarily operates... -

Page 29

... of accounting, and are stated using the first-in, first-out (FIFO) method. The Company believes the LIFO method more fairly presents the results of operations by more closely matching current costs with current revenues. The LIFO inventory adjustment for the fourth quarter of fiscal 2002 increased... -

Page 30

... equivalents on hand. Costco Wholesale UK Limited currently operates fourteen Costco warehouse locations. Accounts Payable The Company's banking system provides for the daily replenishment of major bank accounts as checks are presented. Accordingly, included in accounts payable at September 1, 2002... -

Page 31

... members and annual direct mail marketing programs to existing members promoting selected merchandise. Marketing and promotional costs are expensed as incurred. Preopening Expenses Preopening expenses related to new warehouses, major remodels/expansions, regional offices and other startup operations... -

Page 32

... to $500,000 of Costco Common Stock through November 30, 2004. Under the program, the Company can repurchase shares at any time in the open market or in private transactions as market conditions warrant. The repurchased shares would constitute authorized, but non-issued shares and would be used for... -

Page 33

... June 2001, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No. 143, "Accounting for Asset Retirement Obligations," which provides the accounting requirements for retirement obligations associated with tangible long-lived assets. SFAS No. 143... -

Page 34

... loan facility. Covenants related to the credit facility place limitations on total company indebtedness. As of September 1, 2002, the Company was in compliance with all restrictive covenants. In addition, a wholly owned Canadian subsidiary has a $128,000 commercial paper program supported by a $51... -

Page 35

... due March 2007 ...2.070% Promissory notes due October 2007 ...1.187% Promissory notes due July 2008 ...3 1â„ 2% Zero Coupon convertible subordinated notes due August 2017 ...Notes payable secured by trust deeds on real estate ...Capital lease obligations and other ...Less current portion (included... -

Page 36

... is due on July 9, 2008. During April 2001, the Company retired its unsecured note payable to banks of $140,000 using cash provided from operations, cash and cash equivalents, and short-term borrowings under its commercial paper program. On August 19, 1997, the Company completed the sale of $900,000... -

Page 37

...were vested and 26.6 million shares were available for future grants under the plan. The Company applies Accounting Principles Board Opinion (APB) No. 25 and related interpretations in accounting for stock options. The Company grants stock options to employees at exercise prices equal to fair market... -

Page 38

... 42% 0% Stock option transactions relating to the aggregate of the Old and New Stock Option Plans are summarized below (shares in thousands): 2002 Shares Price(1) 2001 Shares Price(1) 2000 Shares Price(1) Under option at beginning of year ...Granted(2) ...Exercised ...Cancelled ...Under option at... -

Page 39

...exercise prices of $21.57 and $16.35, respectively. Note 5-Retirement Plans The Company has a 401(k) Retirement Plan that is available to all U.S. employees who have completed 90 days of employment, except California union employees. The plan allows pre-tax deferral against which the Company matches... -

Page 40

...The components of the deferred tax assets and liabilities are as follows: September 1, 2002 September 2, 2001 Accrued liabilities ...Deferred membership fees ...Other ...Total deferred tax assets ...Property and equipment ...Merchandise inventories ...Other ...Total deferred tax liabilities ...Net... -

Page 41

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (dollars in thousands, except per share data) (Continued) Note 7-Commitments and Contingencies Legal Proceedings The Company is involved from time to time in claims, proceedings and litigation arising from its business and property ownership. The Company ... -

Page 42

... Stock Market's National Market under the symbol "COST." The following table sets forth the closing high and low sales prices of Costco Common Stock for the period January 1, 2000 through November 1, 2002. The quotations are as reported in published financial sources. Costco Common Stock High Low... -

Page 43

... Manager- Midwest Region Richard A. Galanti Executive Vice President, Chief Financial Officer Jaime Gonzalez Senior Vice President, General Manager-Mexico Bruce Greenwood Senior Vice President, General Manager- Los Angeles Region Robert D. Hicok Senior Vice President, General Manager- San Diego... -

Page 44

...President, Membership, Marketing, Member Services & Publishing Timothy L. Rose Senior Vice President, Merchandising-Foods, Sundries & Fresh Foods Doug Schutt Senior Vice President, E-commerce, Business Delivery & Special Order, Costco Home James D. Sinegal President & Chief Executive Officer Thomas... -

Page 45

...Western Canada Region Gary F. Ojendyk GMM-Corporate Non-Foods Richard J. Olin Legal, General Counsel Mario Omoss Operations-Texas Region John R. Osterhaus Photo, Optical & Hearing Aids Steve Pappas Country Manager-Korea Shawn Parks Operations-Los Angeles Region Roger E. Peterson Operations-San Diego... -

Page 46

...Plaza Sterling, VA 20166 Southeast Region 3980 Venture Drive, #W100 Duluth, GA 30096 Southwest Division Los Angeles Region 11000 Garden Grove, #201 Garden Grove, CA 92843 San Diego Region 4455 Morena Blvd. San Diego, CA 92117 Arizona Region 17550 N. 79th Ave., Suite 2 Glendale, AZ 85308 Texas Region... -

Page 47

PRINTED ON RECYCLED PAPER