Columbia Sportswear 1999 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1999 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

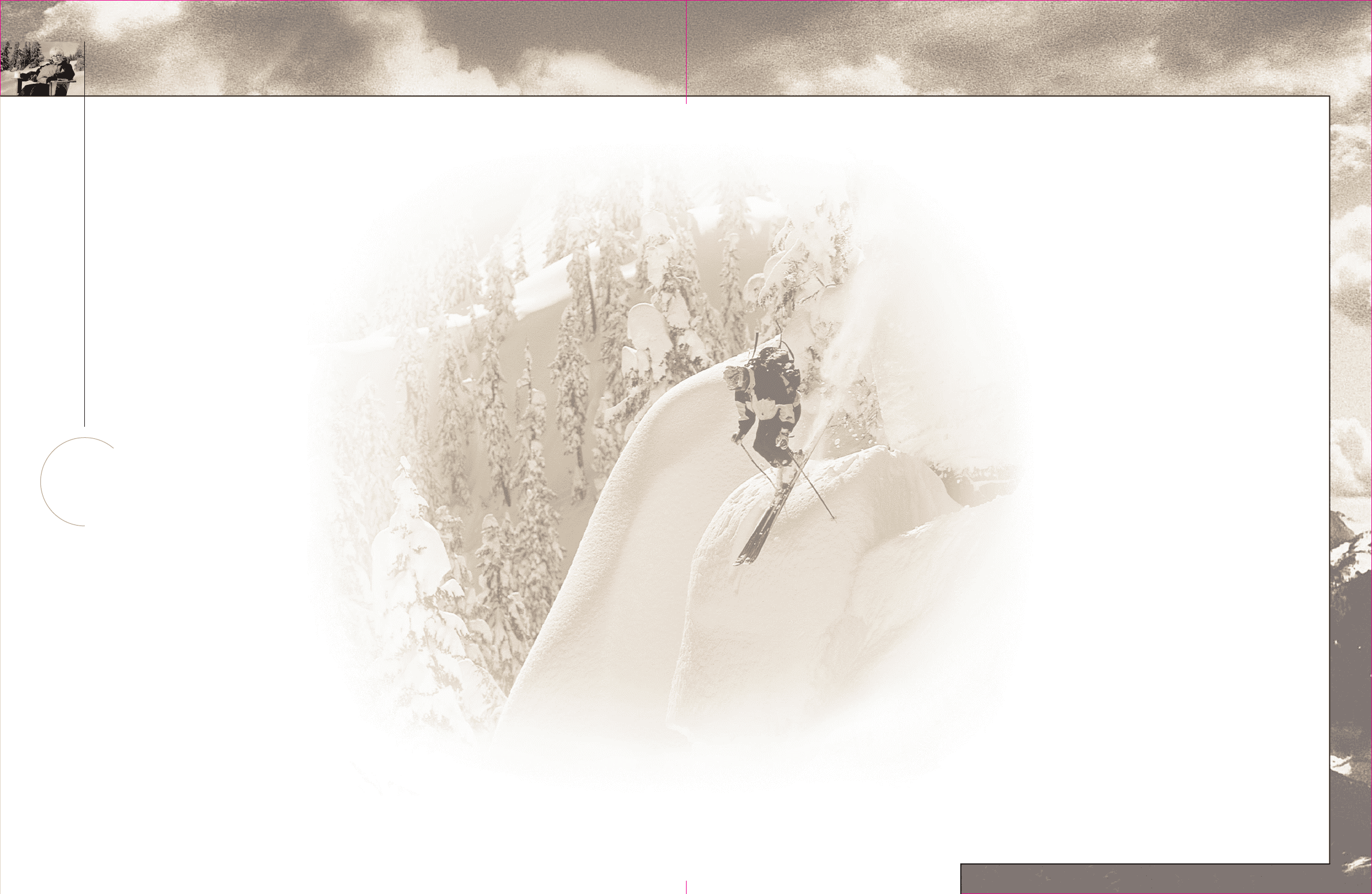

Growth Strategies

We’ve succeeded over the past seven years in increasing the diversity of

Columbia’s geographic revenue base substantially. In 1999, 28 percent of

sales came from international markets, up from 12 percent in 1993. Canada,

Western Europe and Asia are Columbia’s three largest international markets. In

addition, we have distributors selling our products in Eastern Europe, South America

and the South Pacific ... 38 countries in all. With overall international sales climbing 42

percent from $91 million in 1998 to $129 million in 1999, we’ve strengthened Columbia’s

foothold in foreign markets and have capitalized on significant expansion opportunities to help drive

Company growth.

We are bullish about prospects in our three key international markets because they are

characteristically similar in many ways to the United States. Specifically, the population and

demographics within these markets match our strategic targeting objectives, consumer income and

spending at this time are relatively strong, and the climates are generally well-suited to the types of

products we design. In addition, these markets are currently dominated by small regional brands

that have neither the global brand identity nor the sourcing and distribution capabilities that

Columbia has established.

Columbia Sportswear has shown impressive top line growth over the past seven years, driving sales

from $192 million in 1993 to $471 million in 1999. We’ve achieved this growth by staying true to

our 62 year-old active outdoor roots, both in product offering and brand identity. Using five key

words – Outdoor, Active, Authentic, American and Value – to drive merchandising and

marketing strategies, Columbia has catapulted to the top of the outdoor apparel

industry, securing a place as the nation’s number-one skiwear label and one of

the largest outerwear companies in the world.

Moving forward into the new millennium, Columbia will continue to

focus on four key strategies to drive top line growth and increase

market share.

Canada

Columbia first entered the Canadian market in 1988,

where the country’s cold, wet climate presented a

great sales opportunity for an established U.S.

outerwear brand. Moving from distributorship to

subsidiary in 1992, our Canadian operations

have grown every year without fail,

achieving net sales of $50 million in

1999, a 28 percent rise over net

sales of $39 million in 1998.

To sustain this growth, we

have maintained the same

consistent marketing

message that has served

to build broad

awareness of the brand

and an appreciation for

its characteristic value

and quality attributes.

To support strong

categorical expansion in

Canada, we’re mirroring our

U.S. strategy for distribution.

Specifically, we are further

developing the Columbia presence

across multiple retail channels, while

continuing to nurture our relationships with

sporting goods chains throughout the country.

Europe

Columbia’s European direct business grew 52

percent in 1999, from revenues of $27 million in

1998 to revenues of $41 million in 1999. This

increase is the result of calculated efforts on the part

of our management team to strengthen European

operational infrastructure and unify our global

marketing message.

A trend toward greater market acceptance of

American outdoor products has also added to our

success in this region.

With 12 direct markets and 12 distributors across

Europe, we’ve built a foundation that will help

Columbia to maneuver in the complex and

challenging European retail environment in 2000

and beyond. Going forward, we will focus on

expanding Columbia’s presence in Germany and

France, two of the largest European markets. We also

plan to expand the Company’s customer base by

targeting large buying groups, which allows us to put

our products in front of thousands of buyers, and by

encouraging larger orders from existing customers.

Asia

Despite a difficult economic environment, Asia

remains one of the world’s largest retail markets,

with consumers there continuing to covet American

brands. Our established subsidiaries in Japan and

Korea position us to expand our business in these

regions as the Asian economies resume their growth.

The Company established subsidiary offices in Seoul,

Korea and Tokyo, Japan in 1996. Immediate

infrastructure and marketing investments were made

to strengthen the brand presence in these retail

markets. In Japan, we’ve achieved significant

penetration with key retailers across the country, and

have established a solid brand image through our

flagship store in Nagoya and concept shops within

prestigious department stores like Marui and Seibu.

With Korean consumer confidence and spending on

the rise, Columbia is setting its sights outside of

Seoul, where the Company’s brand image has been

elevated to the point that potential franchisees and

department stores have begun approaching us to do

business.

“This will help you grow big and strong.”

– Mother Gert Boyle e

Columbia Sportswear outlines growth strategies for 2000 and beyond.

Leverage brand in markets OUTSIDE THE USA

1 2 3 4

1

Leverage brand in

markets outside the USA