Citibank 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

n

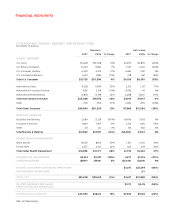

Average deposits and loans grew by 16% and 10%,

respectively. Revenues increased 6% for the fourth quarter

and 4% for the year, continuing the positive trend.

n

CitiFinancial opened 110 branches in 2007, bringing its total

branch network to 2,499. CitiFinancial is the leading

community-based lender in the U.S., with the largest

distribution network of any consumer nance business in

North America.

n

Citi Cards signicantly grew new accounts through afliate

channels, partners, and online acquisitions while

transforming its customer experience with e-mail alerts

and award-winning color statements.

n

CitiMortgage completed its acquisition and integration of

ABN Amro Holdings’ U.S.-based mortgage group, which

included $9 billion in net assets and a $224 billion mortgage

servicing portfolio. CitiMortgage is the fourth-largest

originator and the No. 3 servicer of residential mortgage

loans, according to Inside Mortgage Finance.

n

Forrester Research in November named Citibank.com the

No. 1 U.S. online banking site, saying Citibank “has the

strongest overall site” among the largest U.S. banks.

n

Average loans and deposits grew by 25% and 15%, respectively.

Investment sales rose 20%. Revenues increased 45% for the

fourth quarter and 28% for the year, driven primarily by organic

volume growth and the impact of recent acquisitions.

n

Citi continued to grow market share in key growth countries,

with a 21% increase of 6 million card accounts, 12% increase

of 6 million retail banking accounts, and the opening or

acquisition of 510 new branches in 2007.

n

Acquisitions helped spur growth of revenues and our

international client base. Citi acquired the Bank of Overseas

Chinese, expanding Citi’s network by 55 branches in Taiwan.

Citi completed the acquisition of Grupo Financiero Uno and

Grupo Cuscatlan in Central America. The company also

established a strategic partnership with Quiñenco through

which Citi operations in Chile will be combined with Banco de

Chile, the second-largest bank in Chile. These deals added

258 new branches, 3 million new retail accounts, and

4.2 million new card accounts internationally.

n

Client assets under fee-based management rose by 27% to

$507 billion. Gains in Citi Private Bank as well as Citi Smith

Barney combined to boost total Global Wealth Management

revenues by 28% and net income by 37%.

n

GWM’s international revenues and net income more

than doubled, leveraging market share gains in Asia,

Latin America, and the Middle East.

n

GWM added 2.3 million new client accounts and 1,487

new Financial Advisors through Citi’s acquisition of Nikko

Cordial Corporation.

n

U.S. Banker magazine named GWM “Top Wealth Management

Team,” and Citi Private Bank earned the title of “Overall Best

Global Private Bank” from AsiaMoney magazine for the third

straight year.

n

CAI client capital under management grew by 26% across its

diverse product line mainly from inows from institutional

and high-net-worth clients and the acquisition of Old Lane.

n

CAI made several key acquisitions and strengthened its

management team in its effort to create a world-class

alternatives platform characterized by outstanding investment

management, client service, and innovative products.

n

2007 was a record year in Asia and Latin America. In Asia,

revenues and net income increased, up 38% and 56%,

respectively. In Latin America, revenues grew 60% and net

income grew 70%.

n

Citi advised on seven of the world’s ten largest announced

mergers and acquisitions deals for 2007.

n

Citi was the leading debt and equity underwriter globally for

the sixth straight year.

n

In Japan, Citi took a 49% joint venture position with Nikko

Cordial Corporation, a leading Japanese securities rm, to

100% ownership in early January 2008.

n

Global Transaction Services reached record revenues of

$7.8 billion, up 31%, net income was $2.2 billion, up 55%, and

the business won more than 450 industry awards.

n

Revenue in Equity Markets rose 24%, reecting high equity

valuations, robust turnover and increased market share.