Citibank 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

With our capital base strengthened, we have been conducting

an objective review of every one of our businesses to ensure

that the company is well positioned in light of new global

trends. I am keenly aware of the need to distinguish between

our strong operating assets and those that are lower-returning.

Our lower-returning assets need to be astutely managed as

they mature and wind down, and we are doing just that.

Citi’s strong operating businesses will fuel our future earnings

power. We are fortunate to have businesses that are specically

positioned to capture trends in global growth. With capital ows

around the world rising rapidly and sizable new wealth being

created in developing markets, the need for nancial products

and services is growing at a multiple of economic growth. Citi

sits squarely in the middle of these trends.

For example, our institutional businesses, such as Global

Transaction Services, have benetted from the dramatic rise in

the number and inuence of multinational corporations as well

as from the enormous growth in trade ows. Furthermore, our

Securities and Banking business is preeminently positioned to

take advantage of increasing foreign exchange, emerging

markets, and cross-border capital ows the world over.

Our consumer-related operations are capturing the gains from

the rising afuence of a new middle class in emerging

countries. As people begin to be able to purchase more goods,

they need dependable credit and payment vehicles and our

credit card business is serving such customers around the

world. For the developed and emerging markets’ booming

afuent communities, which may be new to nancial decisions,

Citi Private Bank and Smith Barney, as well as our CitiGold

offering, are helping clients to simplify and manage their assets

and liabilities.

Each business is rmly situated on a highway of vast global

and cross-border ows, in large part due to our long presence —

more than 100 years each — in countries such as Mexico, India,

Poland, and China; we were also early among international

banks in establishing a local bank in Russia, in 1994. Part of

Citi’s strength lies in its ability to bring its global reach together

with its local depth.

I am sharply focused on excellence in productivity, efcient use

of capital, operating excellence, and making sure the right

people are in the right place. Let me elaborate:

n Capital allocation. This is my top priority, and I am

aggressively building a new risk culture at Citi. We have

named a new Chief Risk Ofcer and I will stay actively

involved in strengthening and reshaping our risk philosophy

It is with a great sense of honor and pride that I address my

rst letter to you.

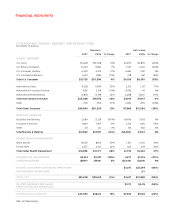

2007 was a year marked by both great successes and

signicant disappointments. Many of our large businesses,

including International Consumer, Global Wealth Management,

Global Transaction Services, and our franchises in Asia and

Latin America, generated record results and strong momentum.

These rm-wide successes were overshadowed, however, by

unprecedented losses resulting from the sudden and severe

deterioration in the U.S. sub-prime market. These losses,

combined with higher credit costs in the U.S. Consumer

portfolio, drove a sharp decline in earnings. Our overall results

for 2007 were clearly unacceptable to us all.

But 2008 is a new year, and I hope that after reading this letter

you will share my excitement about our businesses. In my rst

few months as CEO, we have taken decisive action on a number

of issues. Our actions will leverage Citi’s footprint and many

fundamental strengths, and enhance the company’s ability to

generate sustainable, long-term growth in earnings.

Since November we have raised more than $30 billion of new

capital through public and private offerings to long-term

investors. The success of these transactions speaks to the

underlying strength of our franchise and the growth

opportunities before us. Having raised this capital, we are well

positioned to endure a potential economic slowdown and stand

rmly by our clients in these volatile markets.

In January 2008, the company lowered the dividend to $0.32.

This was a very difcult but necessary decision. We realize its

signicance for many of you, particularly in these tough market

conditions. Nonetheless, this new dividend level will allow us to

reinvest in growth and at the same time ensure Citi is properly

positioned for both favorable and unfavorable economic conditions.