Chesapeake Energy 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

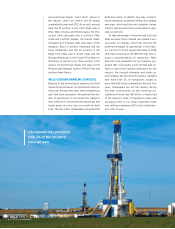

wells to develop 8.7 tcfe of proved undeveloped

reserves and 350 tcfe of unrisked unproved re-

sources that underlie our leasehold. In other words,

Chesapeake has produced only 2% of the resource

base we own. This bodes extremely well for the

predictability of our growth and the ultimate value

of the company’s assets and stock price. In addi-

tion, much of our shale gas leasehold has been

initially drilled upon and is now considered “held

by production” or “HBP’ed,” which turns it from a

temporary asset into a permanent asset. This HBP

process is also underway on our liquids-rich lease-

hold and should be largely brought to a conclusion

within the next three years.

Chesapeake’s total es-

timated unrisked unproved

resource base of 350 tcfe

is by far the largest such

resource base in the U.S. Chesapeake’s market

valuation today very clearly does not give this un-

rivaled resource upside any value. We presume this

is because of investors’ overwhelmingly negative

view about the near-term future of U.S. natural gas

prices. We believe this is a shortsighted approach

to determining the value of our company and our

unproved resource base. We are determined to

unlock this value for our shareholders.

BIG OPPORTUNITY FOR U.S. NATURAL GAS —

THE WORLD’S MOST UNDERVALUED ASSET

We believe U.S. natural gas is the most under-

valued asset in the world, and it represents a

once-in-a-generation investment opportunity.

To supplement funding of Chesapeake’s rapid

growth, we developed a number of value-creating

financing strategies specifically tailored to the risk

profile of dierent assets and designed to secure

low-cost financing, limit financial leverage and

minimize shareholder dilution. We have executed

these strategies very successfully, enabling us to

secure a much larger and more valuable resource

base than we otherwise would have been able to

secure using only our cash flow from operations.

BOLD 25/25 PLAN

In early 2011, we outlined our bold 25/25 Plan

that was designed to achieve balance sheet met-

rics worthy of an investment grade rating and

thereby improve the value of our common stock.

The plan calls for reducing our long-term debt

by 25% and increasing our production by 25%

over the two-year period ending De-

cember 2012. Concurrently, we plan

to complete a transformational shift

to more liquids production, build one

of the largest U.S. onshore oilfield

services companies and further ex-

pand our industry-leading gathering

and processing operations.

This is clearly a bold plan that

few energy companies of any size

would have the ability to accomplish,

especially during this challenging period of low

natural gas prices. I look forward to writing next

year’s letter with this achievement in hand.

BIG FUTURE — CHESAPEAKE HAS CAPTURED

THE LARGEST U.S. RESOURCE BASE

I am quite confident that when the history of this

era of the oil and gas industry is written, the compa-

nies that will have performed the best will be those

few bold companies that first recognized how un-

conventional resource development in the U.S.

would end the first 150 years of industry history and

set the course for the next era. I believe this new era

will dominate our industry’s future for at least the

next 50 years. I further believe Chesapeake is the

best-positioned E&P company to benefit from

what lies ahead because our assets and human

resources are second to none in quality and size.

On Chesapeake’s 15.3 million net acres of lease-

hold (by comparison, about the size of West Vir-

ginia), we have produced 6.6 trillion cubic feet of

natural gas equivalent (tcfe) to date from 22,000

net wells and have another 10.1 tcfe left of proved

reserves to produce from these existing wells. We

could potentially drill up to another 125,000 net

2011 Annual Report | 9

U.S. natural gas

is the most under-

valued asset in

the world, and it

represents a once-

in-a-generation

investment

opportunity.