Chesapeake Energy 2011 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2011 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

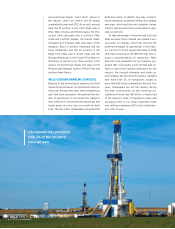

Chesapeake has produced

only 2% of the resource

base we own.

distinctive ability to identify new play concepts,

secure leasehold, accelerate drilling and validate

new plays, which would be very valuable to larger

industry partners who had not been able to repli-

cate our skill sets.

To take advantage of what we had built and

what we knew others needed, we created a very

successful JV strategy, which has become the

preferred template for partnership in the indus-

try. Our first JV in the Haynesville Shale in 2008

with Plains Exploration (NYSE:PXP) was the in-

dustry’s groundbreaking JV transaction. Many

observers and competitors of our company sug-

gested that it was likely a one-o deal and un-

likely to have much lasting significance for the

industry. We thought otherwise, and today our

bold strategy has become the industry standard

with more than 35 JV transactions valued at

more than $36 billion completed in the past four

years. Chesapeake has led the industry during

this time, closing seven JVs and receiving con-

sideration of more than $16 billion, or nearly half

of the industry’s total JV transaction value, and

recouping 120% of our initial investment while

only selling an average of 25% of our initial inter-

est in the JV plays.

8 | Letter to Shareholders

unconventional liquids “Land Rush” period in

the industry, which we believe will be largely

completed by year-end 2012. As a result, we now

have the #1 position in the Utica Shale play in

Ohio, West Virginia and Pennsylvania; the Mis-

sissippi Lime carbonate play in northern Okla-

homa and southern Kansas; the Granite Wash,

Cleveland and Tonkawa tight sand plays of the

Anadarko Basin in western Oklahoma and the

Texas Panhandle; and the #2 position in the

Eagle Ford Shale play in South Texas and the

Niobrara Shale play in the Powder River Basin in

Wyoming, as well as a top three position in the

various unconventional liquids-rich plays of the

Permian and Delaware basins of West Texas and

southern New Mexico.

VALUE-CREATING FINANCING STRATEGIES

Because of the technological advances and bold

moves discussed above, our investment opportu-

nities over the past few years have exceeded our

cash flow from operations. We believed the win-

dow of opportunity to lock down the industry’s

best collection of unconventional natural gas and

liquids assets at a very low cost would be short

lived. We also knew Chesapeake possessed the