Charles Schwab 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Charles Schwab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

WHAT I’VE HEARD.

THE CHARLES SCHWAB CORPORATION

2011 Annual Report

Table of contents

-

Page 1

1 WHAT I'VE HEARD. THE CHARLES SCHWAB CORPORATION 2011 Annual Report -

Page 2

The Charles Schwab Corporation (NYSE: SCHW) is a leading provider of brokerage, banking, home loans, and other financial services to millions of individual investors. The firm also serves independent investment advisors and helps companies manage retirement and stock plans. TABLE OF CONTENTS 15 18 ... -

Page 3

... experience means listening to what people need and basing our innovations on what we learn. It means providing resources and knowledge that help our clients shape their futures. It means creating a culture of service, and it means providing direct access to the markets. But don't take it from me... -

Page 4

...20, 2011, and suddenly trips or house improvements became less important than "the diaper fund." Fortunately, their families live nearby and are quick to help out, but Nathan and Jamie also rely on their Schwab financial consultant. "It was really important to me to make sure that we were investing... -

Page 5

3 Hear Nathan and Jamie Wulf share their story in their own words at www.aboutschwab.com -

Page 6

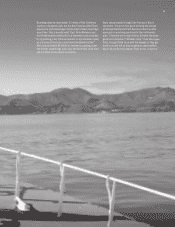

4 "In my piloting, I don't like excitement. In my retirement plan, as a trustee of the plan, I don't want excitement either." - Capt. Peter McIsaac, San Francisco Bar Pilots Hear Capt. Peter McIsaac share his story in his own words at www.aboutschwab.com -

Page 7

... in commerce passing under the Golden Gate Bridge every day, the Bar Pilots know their job is critical to the nation's economy. Every vessel transit through San Francisco Bay is important. The pilots feel good knowing the people at Schwab Retirement Plan Services take the same approach in providing... -

Page 8

6 "During the economic crisis, I thought to myself, 'Gee, if we could change a generation around financial literacy, it would impact the country.'" - Roxanne Spillett, President Emeritus of Boys & Girls Clubs of America Hear Roxanne Spillett share her story in her own words at www.aboutschwab.com -

Page 9

... financially literate. Club members learn everything from how to open a checking or savings account to more advanced lessons such as paying for college or even starting a business. Developing the curriculum with Schwab, Spillett quickly realized financial literacy was a real passion for the company... -

Page 10

8 Hear Carol Benz share her story in her own words at www.aboutschwab.com "It's almost as if Schwab is part of our firm. It's as if they have an office down the hall." - Carol Benz, Principal, Bingham, Osborn & Scarborough, LLC, Wealth Management -

Page 11

... of investment vehicles to meet the needs of their clients," instead of pushing proprietary products. But running an independent advisory isn't as simple as providing transparent, conflict-free advice. It's a business that requires human resources, strategic planning, technology, operations, and... -

Page 12

.... "Every time we meet with Schwab they review what our needs are: Where do we stand, what are our thoughts, where do we want to be. They listen to me." Today, Gus and Betty continue to seek that help and guidance by driving 120 miles round-trip to see their trusted Schwab financial consultant, Steve... -

Page 13

11 "The biggest change for me was when I saw this was going to be something that Gus and I can do together." - Betty Franke, Investor -

Page 14

..., studying companies that show long-term value and avoiding the impulse to buy and sell every day. Over the years, this approach gave Kirk a broad range of investments from a broad range of financial services firms, including Schwab. Then around 2008, Kirk saw the benefit of bringing his assets... -

Page 15

13 Hear Kirk Larson share his story in his own words at www.aboutschwab.com -

Page 16

14 LETTER FROM THE CHIEF EXECUTIVE OFFICER Walt Bettinger, President and Chief Executive Officer -

Page 17

... building a strong franchise for the long term? Next, we look at our current year results. Did we grow revenue and earnings? On both measures, we delivered quality results in 2011 despite difficult economic times. Clients continued to entrust their assets to Schwab, bringing $82.3 billion in net new... -

Page 18

... advice, and related services directly to millions of individual investors. As of December 31, 2011, Investor Services accounted for total client assets of $697.9 billion. Institutional Services, our business-to-business segment, serves independent investment advisors and company benefit plan... -

Page 19

... record-low levels. Nevertheless, your management team remains focused on continuing to build the Schwab brand and franchise, serving millions more clients and gathering billions of dollars in new assets. Each and every day, we apply our efforts to building earnings power that will benefit our long... -

Page 20

... Chuck campaign. In Institutional Services, Schwab gained new clients in two important segments - Registered Investment Advisors (RIAs) and company plan sponsors. In our retirement plan business, 2012 opened with the launch of Schwab Index Advantageâ„¢ - a one-of-a-kind 401(k) plan offer designed to... -

Page 21

... brokerage website to allow clients to publicly rate and review Schwab accounts. Plus, we pursued innovative new ways to connect with clients and prospects through third-party social media networks, including Facebook, LinkedIn, Twitter, and YouTube. We also expanded access through Schwab Mobile... -

Page 22

... the future. year, including optionsXpress accounts and assets. I think it's fair to say we hit a bump in the road. Still, we met both our financial commitments and planned investment in our clients for 2011. We originally thought we could deliver 10 percent revenue growth against 8 percent expense... -

Page 23

...in the road on the way to a healthier economy, but we remain prepared to serve clients, deliver on our commitments, and build a thriving franchise for the long run. 2007 2008 2009 2010 2011 * Amounts are presented on a continuing operations basis to exclude the impact of the sale of U.S. Trust... -

Page 24

... Items optionsXpress expenses (2) Class action litigation and regulatory reserve Money market mutual fund charges Other expense Total expenses excluded Reported Expenses Excluding Interest Income Excluding Certain Items Before Taxes on Income Net Income Excluding Certain Items Add: Revenues excluded... -

Page 25

...-only services, which totaled $5.2 billion at May 31, 2007, related to the March 2007 acquisition of The 401(k) Company. (4) Includes 315,000 new brokerage accounts from the acquisition of optionsXpress Holdings, Inc. in 2011. (5) Effective 2010, the number of banking accounts excludes credit cards... -

Page 26

...Executive Vice President, Human Resources and Employee Services RON CARTER Executive Vice President, Operational Services MARIE A. CHANDOHA President, Chief Executive Officer, and Chief Investment Officer, Charles Schwab Investment Management, Inc. BERNARD J. CLARK Executive Vice President, Advisor... -

Page 27

... Employer Identification Number) 211 Main Street, San Francisco, CA 94105 (Address of principal executive offices and zip code) Registrant's telephone number, including area code: (415) 667-7000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Common Stock - $.01 par... -

Page 28

... Matters and Issuer Purchases of Equity Securities Selected Financial Data Management's Discussion and Analysis of Financial Condition and Results of Operations Overview Current Market and Regulatory Environment Results of Operations Liquidity and Capital Resources Risk Management Fair Value... -

Page 29

... an online brokerage firm primarily focused on equity option securities and futures. The optionsXpressïƒ' brokerage platform provides active investors and traders trading tools, analytics and education to execute a variety of investment strategies. The combination of optionsXpress and Schwab offers... -

Page 30

... 401(k) plans can take advantage of the Company's bundled offering of multiple investment choices, education, and third-party advice. Management also believes the Company is able to compete with the wide variety of financial services firms striving to attract individual client relationships by... -

Page 31

...options, and futures; ï,· Banking - checking accounts linked to brokerage accounts, savings accounts, certificates of deposit, demand deposit accounts, first mortgages, home equity lines of credit (HELOCs), and personal loans collateralized by securities; ï,· Trust - trust custody services, personal... -

Page 32

... to deliver information, education, technology, service, and pricing that meet the specific needs of clients who trade actively. Schwab offers integrated Web- and software-based trading platforms, which incorporate intelligent order routing technology, real-time market data, options trading, premium... -

Page 33

...companies and firms with special requirements to monitor employee personal trading, including trade surveillance technology. The Corporate Brokerage Services unit also provides mutual fund clearing services to banks, brokerage firms and trust companies and offers Schwabgenerated Investment Solutions... -

Page 34

...on interest-earning assets (such as cash, short- and long-term investments, and mortgage and margin loans) and interest paid on funding sources (including banking deposits and client cash in brokerage accounts, short-term borrowings, and long-term debt). The Company generates trading revenue through... -

Page 35

... investor engagement, and are outside of the Company's control. Deterioration in the housing and credit markets, reductions in short-term interest rates, and decreases in securities valuations negatively impact the Company's net interest revenue, asset management and administration fees, and capital... -

Page 36

...-earning assets (such as cash equivalents, short- and long-term investments, and mortgage and margin loans) relative to changes in the costs of its funding sources (including deposits in banking and brokerage accounts, short-term borrowings, and long-term debt). Changes in interest rates generally... -

Page 37

...and may continue to waive a portion of its management fees for certain Schwab-sponsored money market mutual funds. Such fee waivers negatively impact the Company's asset management and administration fees. The Company is subject to litigation and regulatory investigations and proceedings and may not... -

Page 38

... the SEC discretion to adopt rules regarding standards of conduct for broker-dealers providing investment advice to retail customers. The various studies required by the legislation could result in additional rulemaking or legislative action, which could impact the Company's business and financial... -

Page 39

... loans, fees for advisory services, and other fee structures to enhance its competitive position. Increased price competition from other financial services firms, such as reduced commissions to attract trading volume or higher deposit rates to attract client cash balances, could impact the Company... -

Page 40

... of the Company's stock price are the following: ï,· speculation in the investment community or the press about, or actual changes in, the Company's competitive position, organizational structure, executive team, operations, financial condition, financial reporting and results, effectiveness... -

Page 41

...offices are located in leased premises. The corporate headquarters, data centers, offices, and service centers support both of the Company's segments. Item 3. Legal Proceedings For a discussion of legal proceedings, see "Item 8 - Financial Statements and Supplementary Data - Notes to Consolidated... -

Page 42

... 12/31/07 12/31/08 12/31/09 12/31/10 12/31/11 December 31, The Charles Schwab Corporation Dow Jones U.S. Investment Services Index Standard & Poor's 500 Index 2006 $ 100 $ 100 $ 100 2007 $ 140 $ 90 $ 105 2008 $ 90 $ 30 $ 66 2009 $ 106 $ 47 $ 84 2010 $ 98 $ 49 $ 97 2011 $ 65 $ 32 $ 99 - 14 - -

Page 43

... shares. The Company may receive shares to pay the exercise price and/or to satisfy tax withholding obligations by employees who exercise stock options (granted under employee stock incentive plans), which are commonly referred to as stock swap exercises. Total Number of Shares Purchased (in... -

Page 44

... margin Return on stockholders' equity Financial Condition (at year end) Total assets Long-term debt Stockholders' equity Assets to stockholders' equity ratio Long-term debt to total financial capital (long-term debt plus stockholders' equity) Employee Information Full-time equivalent employees... -

Page 45

... of the Company's appeal in the marketplace. Additionally, fluctuations in certain components of client assets (e.g., Mutual Fund OneSource funds) directly impact asset management and administration fees. Clients' daily average trades is an indicator of client engagement with securities markets and... -

Page 46

... 2011 from 2010 due to increases in all of the Company's major sources of net revenues. Asset management and administration fees increased primarily due to an increase in revenue from the Company's advice solutions and continued asset inflows, partially offset by money market mutual fund fee waivers... -

Page 47

THE CHARLES SCHWAB CORPORATION Management's Discussion and Analysis of Financial Condition and Results of Operations (Tabular Amounts in Millions, Except Ratios, or as Noted) outflows related to a single mutual fund clearing client who completed a planned transfer to an internal platform during the... -

Page 48

... affect asset management and administration fees. The Company recorded net impairment charges of $31 million and $36 million related to certain non-agency residential mortgage-backed securities in 2011 and 2010, respectively, due to credit deterioration of the securities' underlying loans. Further... -

Page 49

...-2011 Asset management and administration fees Schwab money market funds before fee waivers Fee waivers Schwab money market funds after fee waivers Equity and bond funds Mutual Fund OneSourceïƒ' Total mutual funds Advice solutions Other Asset management and administration fees Net interest revenue... -

Page 50

... in 2011, 2010, and 2009, the overall yields on certain Schwab-sponsored money market mutual funds have remained at levels at or below the management fees on those funds. As a result, the Company waived a portion of its fees in order to provide a positive return to clients. Mutual fund service fees... -

Page 51

...CHARLES SCHWAB CORPORATION Management's Discussion and Analysis of Financial Condition and Results of Operations (Tabular Amounts in Millions, Except Ratios, or as Noted) The Company's interest-earning assets are financed primarily by brokerage client cash balances and deposits from banking clients... -

Page 52

... in 2011, 2010, and 2009, respectively. For further discussion on the Company's credit risk and the allowance for loan losses, see "Risk Management - Credit Risk" and "Item 8 - Financial Statements and Supplementary Data - Notes to Consolidated Financial Statements - 7. Loans to Banking Clients and... -

Page 53

... Class action litigation and regulatory reserve Money market mutual fund charges Other Total expenses excluding interest Expenses as a percentage of total net revenues: Total expenses excluding interest Advertising and market development N/M Not meaningful. Compensation and Benefits 2011... -

Page 54

... to the amortization of its stock options and restricted stock units. Expenses Excluding Compensation and Benefits Professional services expense increased in 2011 from 2010 primarily due to an increase in fees relating to the Company's technology investments and client facing infrastructure, and... -

Page 55

...fully depreciated. In 2011 and 2010, the Company recorded class action litigation and regulatory reserves relating to the Schwab YieldPlus Fund. For further discussion of the Schwab YieldPlus Fund litigation and regulatory matters, see "Item 8 - Financial Statements and Supplementary Data - Notes to... -

Page 56

... mortgage-backed securities caused by higher mortgage prepayments in 2011. Asset management and administration fees increased primarily due to an increase in revenue from the Company's advice solutions and continued asset inflows, offset by money market mutual fund fee waivers. Trading revenue... -

Page 57

...with the Schwab Advisor Network to the Investor Services segment and started recording the related asset management and administration fee revenue to that segment. Trading revenue decreased due to lower average revenue per revenue trade resulting from improved online trade pricing for clients, which... -

Page 58

... Registration Statement) on file with the SEC which enables CSC to issue debt, equity and other securities. CSC maintains excess liquidity in the form of overnight cash deposits and short-term investments to cover daily funding needs and to support growth in the Company's business. Generally, CSC... -

Page 59

..., dealers, and clearing organizations primarily represent current open transactions, which usually settle, or can be closed out, within a few business days. Liquidity needs relating to client trading and margin borrowing activities are met primarily through cash balances in brokerage client accounts... -

Page 60

... the general financial soundness and liquidity of broker-dealers. These regulations prohibit optionsXpress, Inc. from paying cash dividends or making unsecured advances or loans to its parent company or employees if such payment would result in a net capital amount of less than 5% of aggregate debit... -

Page 61

... the Company's cash position and cash flows include investment activity in securities, levels of capital expenditures, acquisition and divestiture activity, banking client deposit activity, brokerage and banking client loan activity, financing activity in long-term debt, payments of dividends, and... -

Page 62

... Company's balance sheet growth, including expansion of its deposit base and migration of certain client balances from money market funds into deposit accounts at Schwab Bank. Dividends CSC paid common stock cash dividends of $295 million ($0.24 per share) and $288 million ($0.24 per share) in 2011... -

Page 63

... activity (e.g., margin lending activities and loans to banking clients), investing activities of certain of the Company's proprietary funds, corporate credit and investment activity, and market risk resulting from the Company taking positions in certain securities to facilitate client trading... -

Page 64

... is focused on meeting client needs, meeting market and regulatory changes, and deploying standardized technology platforms. Technology and operating risk also includes the risk of human error, employee misconduct, external fraud, computer viruses, distributed denial of service attacks, terrorist... -

Page 65

... position. The weighted-average originated FICO credit scores were 766 and 768 for the First Mortgage and HELOC portfolios, respectively. The Company does not offer loans that allow for negative amortization and does not originate or purchase subprime loans (generally defined as extensions of credit... -

Page 66

... settle transactions with clearing corporations, mutual funds, and other financial institutions even if Schwab's client or a counterparty fails to meet its obligations to Schwab. The Company sponsors a number of proprietary money market mutual funds and other proprietary funds. Although the Company... -

Page 67

... current market rates. At December 31, 2011, 44% of the residential real estate mortgages and 50% of the HELOC balances were secured by properties which are located in California. The Company also has exposure to concentration risk from its margin and securities lending activities collateralized... -

Page 68

... its investments in Schwab sponsored money market funds (collectively, the Funds) resulting from clearing activities. At December 31, 2011, the Company had $332 million in investments in these Funds. Certain of the Funds' positions include certificates of deposits, time deposits, commercial paper... -

Page 69

... litigation claims and prevent or detect violations of applicable legal and regulatory requirements. These procedures address issues such as business conduct and ethics, sales and trading practices, marketing and communications, extension of credit, client funds and securities, books and records... -

Page 70

... as its annual goodwill impairment testing date. In testing for a potential impairment of goodwill on April 1, 2011, management estimated the fair value of each of the Company's reporting units (generally defined as the Company's businesses for which financial information is available and reviewed... -

Page 71

THE CHARLES SCHWAB CORPORATION Management's Discussion and Analysis of Financial Condition and Results of Operations (Tabular Amounts in Millions, Except Ratios, or as Noted) in a loss) are estimated from the Company's historical loss experience adjusted for current trends and market information. ... -

Page 72

... on the Company's results of operations of recording stock option expense (see "Item 8 - Financial Statements and Supplementary Data - Notes to Consolidated Financial Statements - 20. Employee Incentive, Deferred Compensation, and Retirement Plans"). Achievement of the expressed beliefs, objectives... -

Page 73

... loaned out as part of the Company's securities lending activities. Equity market valuations may also affect the level of brokerage client trading activity, margin borrowing, and overall client engagement with the Company. Additionally, the Company earns mutual fund service fees and asset management... -

Page 74

... rate changes, as well as changes in market conditions and management strategies, including changes in asset and liability mix. As represented by the simulations presented below, the Company's investment strategy is structured to produce an increase in net interest revenue when interest rates rise... -

Page 75

... and Retirement Plans Note 21. Money Market Mutual Fund Charges Note 22. Taxes on Income Note 23. Earnings Per Share Note 24. Regulatory Requirements Note 25. Segment Information Note 26. Subsequent Event Note 27. The Charles Schwab Corporation - Parent Company Only Financial Statements Note... -

Page 76

... on securities (1) Total net revenues Expenses Excluding Interest Compensation and benefits Professional services Occupancy and equipment Advertising and market development Communications Depreciation and amortization Class action litigation and regulatory reserve Money market mutual fund charges... -

Page 77

... to banking clients - net Loans held for sale Equipment, office facilities, and property - net Goodwill Intangible assets - net Other assets Total assets Liabilities and Stockholders' Equity Deposits from banking clients Payables to brokers, dealers, and clearing organizations Payables to brokerage... -

Page 78

... assumed for business acquisitions (See note "3 - Business Acquisitions") Securities purchased during the year but settled after year end Non-cash financing activity: Transfer of trust related balances to deposits from banking clients See Notes to Consolidated Financial Statements. 2011 $ 864 18 31... -

Page 79

... securities available for sale Foreign currency translation adjustment Total comprehensive income Issuance of common stock for business acquisition Dividends declared on common stock Stock option exercises and other Stock-based compensation and related tax effects Other Balance at December 31, 2011... -

Page 80

... as trust fees, 401k record keeping fees, and mutual fund clearing and other fees. In 2011, 2010 and 2009, the Company waived a portion of its asset management fees earned from certain Schwab-sponsored money market mutual funds in order to provide a positive return to clients. Under agreements with... -

Page 81

...CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) money market funds, deposits with banks, certificates of deposit, federal funds sold, commercial paper, and treasury securities. Cash... -

Page 82

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Securities borrowed and securities loaned: Securities borrowed require the Company to deliver cash to the lender in exchange for ... -

Page 83

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Equipment, office facilities, and property are recorded at cost net of accumulated depreciation and amortization, except for land... -

Page 84

... an online brokerage firm primarily focused on equity option securities and futures. The optionsXpressïƒ' brokerage platform provides active investors and traders trading tools, analytics and education to execute a variety of investment strategies. The combination of optionsXpress and Schwab offers... -

Page 85

... SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) The following table summarizes the preliminary allocation of the purchase price to the net assets of optionsXpress as of September 1, 2011... -

Page 86

...acquisition, Windhaven Investment Management, Inc. was formed as a wholly-owned subsidiary of Schwab Holdings, Inc. The Company's consolidated financial statements include the net assets and results of operations associated with this acquisition from November 9, 2010. Pro forma financial information... -

Page 87

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 5. Other Securities Owned A summary of other securities owned is as follows: December 31, Schwab Funds money market funds ... -

Page 88

... CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) December 31, 2010 Securities available for sale: U.S. agency residential mortgage-backed securities Non-agency residential mortgage... -

Page 89

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) December 31, 2010 Securities available for sale: U.S. agency residential mortgage-backed securities $ 707 $ 3 $ - $ - $ 707 $ Non... -

Page 90

... CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) The following table is a rollforward of the amount of credit losses recognized in earnings for OTTI securities held by the Company... -

Page 91

... Share Data, Option Price Amounts, Ratios, or as Noted) 7. Loans to Banking Clients and Related Allowance for Loan Losses The composition of loans to banking clients by loan segment is as follows: December 31, Residential real estate mortgages Home equity lines of credit Personal loans secured by... -

Page 92

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) The delinquency aging analysis by loan class is as follows: 30-59 days past due $ 16 2 5 1 24 60-89 days past due $ 2 2 4 Greater... -

Page 93

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Home equity December 31, 2011 Total lines of credit Year of origination Pre-2007 $ 291 $ 52 $ 343 $ 1,074 2007 278 8 286 232 2008... -

Page 94

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Home equity December 31, 2010 Total lines of credit Year of origination Pre-2007 $ 352 $ 58 $ 410 $ 1,132 2007 384 9 393 245 2008... -

Page 95

...CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 9. Intangible Assets and Goodwill The gross carrying value of intangible assets and accumulated amortization was: December 31, 2011... -

Page 96

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 11. Deposits from Banking Clients Deposits from banking clients consist of interest-bearing and noninterest-bearing deposits as... -

Page 97

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) The Senior Notes outstanding at December 31, 2011 have maturities ranging from 2014 to 2020 and fixed interest rates ranging from... -

Page 98

... Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) To manage short-term liquidity, Schwab maintains uncommitted, unsecured bank credit lines with a group of six banks totaling $875 million at December 31, 2011. CSC has direct access... -

Page 99

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) The Company has clients that sell (i.e., write) listed option contracts that are cleared by various clearing houses. The clearing... -

Page 100

...Schwab YieldPlus Fundïƒ'. On April 19, 2011, the court granted final approval of the settlement agreements and entered final judgment in the litigation. 16. Financial Instruments Subject to Off-Balance Sheet Risk, Credit Risk, or Market Risk Securities lending: The Company loans client securities... -

Page 101

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) securities from other broker-dealers to fulfill short sales by clients. The fair value of these borrowed securities was $44 ... -

Page 102

... CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) deposit for regulatory purposes, cash and cash equivalents, and other securities owned. At December 31, 2011 and 2010, the Company... -

Page 103

... ability to access. This category includes active exchange-traded money market funds, mutual funds, options, and equity securities. The Company did not transfer any assets or liabilities between Level 1 and Level 2 during 2011 or 2010. Level 2 inputs are inputs other than quoted prices included in... -

Page 104

... to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Assets and Liabilities Recorded at Fair Value The Company's assets recorded at fair value include certain cash equivalents, investments segregated and on deposit for... -

Page 105

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) December 31, 2010 Quoted Prices in Active Markets for Identical Assets (Level 1) Significant Other Observable Inputs (Level 2)... -

Page 106

... SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Loans to banking clients primarily include adjustable rate residential first-mortgage and HELOC loans. Loans to banking clients are recorded... -

Page 107

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 19. Accumulated Other Comprehensive Income (Loss) Accumulated other comprehensive income (loss) represents cumulative gains and... -

Page 108

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 20. Employee Incentive, Deferred Compensation, and Retirement Plans A summary of the Company's stock-based compensation and ... -

Page 109

...CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Information on stock options granted and exercised is presented below: Year Ended December 31, Weighted-average fair value of options... -

Page 110

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Employee Stock Purchase Plan Under the Company's Employee Stock Purchase Plan (ESPP), eligible employees can purchase shares of ... -

Page 111

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) The temporary differences that created deferred tax assets and liabilities are detailed below: December 31, Deferred tax assets: ... -

Page 112

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Federal tax examinations for all years ending through December 31, 2007, have been completed. The years open to examination by ... -

Page 113

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) The regulatory capital and ratios for Schwab Bank are as follows: Minimum Capital Requirement Amount Ratio $ 850 $ 1,701 $ 2,642 ... -

Page 114

... client service, opening new accounts, or business development) and a funds transfer pricing methodology to allocate certain revenues. The Company evaluates the performance of its segments on a pre-tax basis, excluding items such as impairment charges on non-financial assets, discontinued operations... -

Page 115

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Financial information for the Company's reportable segments is presented in the following table: Investor Services 2011 2010 2009... -

Page 116

...Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 27. The Charles Schwab Corporation - Parent Company Only Financial Statements Condensed Statements of Income Year Ended December 31, Interest revenue Interest... -

Page 117

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Condensed Statements of Cash Flows Year Ended December 31, Cash Flows from Operating Activities Net income Adjustments to ... -

Page 118

... SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 28. Quarterly Financial Information (Unaudited) Fourth Quarter Third Quarter Second Quarter First Quarter Year Ended December 31, 2011... -

Page 119

... The Charles Schwab Corporation and subsidiaries (the Company) as of December 31, 2011 and 2010, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2011. Our audits also included the financial statement... -

Page 120

... executive officer and chief financial officer to provide reasonable assurance regarding the reliability of financial reporting and the preparation of published financial statements in accordance with accounting principles generally accepted in the United States of America. As of December 31, 2011... -

Page 121

...management of the Company, with the participation of the Company's Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of the Company's disclosure controls and procedures (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934) as of December 31, 2011... -

Page 122

... Executive Officer Executive Vice President - Human Resources and Employee Services Executive Vice President - Investor Services Executive Vice President - Shared Strategic Services Executive Vice President, General Counsel and Corporate Secretary Executive Vice President and Chief Financial Officer... -

Page 123

... Executive Officer of The Charles Schwab Trust Company (CSTC) from 2005 until 2007. Mr. McCool served as Senior Vice President - Plan Administrative Services of CSTC from 2004 until 2005, Chief Operating Officer of CSTC from 2003 until 2004, and Vice President - Development and Business Technology... -

Page 124

... index appearing on page F-1. (b) Exhibits The exhibits listed below are filed as part of this annual report on Form 10-K. Exhibit Number 2.1 Exhibit Agreement and Plan of Merger, dated March 18, 2011, by and among The Charles Schwab Corporation, Neon Acquisition Corp. and optionsXpress... -

Page 125

... instruments with respect to long-term debt of lesser amounts will be provided to the SEC upon request. Voting Agreement, dated as of March 18, 2011, by and among The Charles Schwab Corporation, G-Bar Limited Partnership, JG 2002 delta Trust and optionsXpress Holdings, Inc., filed as Exhibit 10.1 to... -

Page 126

...CHARLES SCHWAB CORPORATION Exhibit Number 10.298 Exhibit Directed Employee Benefit Trust Agreement under the SchwabPlan Retirement Savings and Investment Plan dated August 17, 2007, filed...Premium-Priced Stock Option Agreement under The Charles Schwab Corporation 2004 Stock Incentive Plan, filed as ... -

Page 127

.... The Charles Schwab Corporation 2004 Stock Incentive Plan, as approved at the Annual Meeting of Stockholders on May 17, 2011 (supersedes Exhibit 10.327), filed as Exhibit 10.338 to the Registrant's Form 10-Q for the quarter ended June 30, 2011 and incorporated herein by reference. Credit Agreement... -

Page 128

... and Stock Option Agreement for Non-Employee Directors under The Charles Schwab Corporation Directors' Deferred Compensation Plan II. Computation of Ratio of Earnings to Fixed Charges. Subsidiaries of the Registrant. Independent Registered Public Accounting Firm's Consent. Certification Pursuant... -

Page 129

... this annual report on Form 10-K. Management contract or compensatory plan. Attached as Exhibit 101 to this Annual Report on Form 10-K for the annual period ended December 31, 2011, are the following materials formatted in XBRL (Extensible Business Reporting Language) (i) the Consolidated Statements... -

Page 130

...2012. Signature / Title /s/ Walter W. Bettinger II Walter W. Bettinger II, President and Chief Executive Officer Signature / Title /s/ Joseph R. Martinetto Joseph R. Martinetto, Executive Vice President and Chief Financial Officer (principal financial and accounting officer) /s/ Charles R. Schwab... -

Page 131

... Qualifying Accounts Supplemental Financial Data for Charles Schwab Bank (Unaudited) F-2 F-3 - F-8 Schedules not listed are omitted because of the absence of the conditions under which they are required or because the information is included in the Company's consolidated financial statements and... -

Page 132

... of brokerage clients (2) (1) (2) $ 4 $ 3 $ 2 $ (7) $ 2 Includes collections of previously written-off accounts Excludes banking-related valuation and qualifying accounts. See "Item 8 - Financial Statements and Supplementary Data Notes to Consolidated Financial Statements - 7. Loans to... -

Page 133

...in Millions) The following supplemental financial data is consistent with the Securities Exchange Act of 1934, Industry Guide 3 - Statistical Disclosure by Bank Holding Companies. The accompanying unaudited financial information represents Charles Schwab Bank (Schwab Bank), which is a subsidiary of... -

Page 134

...Financial Data for Charles Schwab Bank (Unaudited) (Dollars in Millions) 2. Analysis of Change in Net Interest Revenue An analysis of the year-to-year changes in the categories of interest revenue and interest expense resulting from changes in volume and rate is as follows: 2011 Compared to 2010... -

Page 135

... 31, 2011 Securities available for sale: U.S. agency residential mortgage-backed securities Non-agency residential mortgage-backed securities Certificates of deposit Corporate debt securities U.S. agency notes Asset-backed and other securities Total securities available for sale Securities held to... -

Page 136

... Financial Data for Charles Schwab Bank (Unaudited) (Dollars in Millions) December 31, 2009 Securities available for sale: U.S. agency residential mortgage-backed securities Non-agency residential mortgage-backed securities Certificates of deposit Corporate debt securities U.S. agency notes Asset... -

Page 137

...: December 31, Residential real estate mortgages Home equity lines of credit Personal loans secured by securities Other Total loans to banking clients An analysis of nonaccrual loans is as follows: December 31, Nonaccrual loans Average nonaccrual loans $ $ 2011 52 51 $ $ 2010 51 40 $ $ 2009 34 17... -

Page 138

... Data for Charles Schwab Bank (Unaudited) (Dollars in Millions) The maturities of the loan portfolio at December 31, 2011, are as follows: After 1 year through 5 years 1,074 690 $ 1,764 $ $ Within 1 year Residential real estate mortgages (1) Home equity lines of credit (2) Personal loans secured... -

Page 139

...both deposits from banking clients and payables to brokerage clients is completely offset by interest revenue on related investments and loans, the Company considers such interest to be an operating expense. Accordingly, the ratio of earnings to fixed charges, excluding deposits from banking clients... -

Page 140

... subsidiaries of the Registrant: Schwab Holdings, Inc. (holding company for Charles Schwab & Co., Inc.), a Delaware corporation Charles Schwab & Co., Inc., a California corporation Charles Schwab Bank, a Federal Savings Association Charles Schwab Investment Management, Inc., a Delaware corporation -

Page 141

... control over financial reporting, appearing in this Annual Report on Form 10-K of The Charles Schwab Corporation for the year ended December 31, 2011. Filed on Form S-3: Registration Statement No. 333-178525 (Debt Securities, Preferred Stock, Depository Shares, Common Stock, Purchase Contracts... -

Page 142

... information; and b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 23, 2012 /s/ Walter W. Bettinger II Walter W. Bettinger II President and Chief Executive... -

Page 143

... b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 23, 2012 /s/ Joseph R. Martinetto Joseph R. Martinetto Executive Vice President and Chief Financial Officer -

Page 144

... respects, the financial condition and results of operations of the Company for the periods presented therein. (2) /s/ Walter W. Bettinger II Walter W. Bettinger II President and Chief Executive Officer Date: February 23, 2012 A signed original of this written statement required by Section... -

Page 145

...Martinetto Executive Vice President and Chief Financial Officer Date: February 23, 2012 A signed original of this written statement required by Section 906 has been provided to The Charles Schwab Corporation and will be retained by The Charles Schwab Corporation and furnished to the Securities and... -

Page 146

...Officer, The Charles Schwab Corporation Age: 51. Director since 2008; term expires in 2012. STEPHEN T. McLIN Chairman and Chief Executive Officer, STM Holdings LLC, which offers merger and acquisition advice Age: 65. Director since 1988; term expires in 2014. Chairman of the Audit Committee; member... -

Page 147

... plan participants, 780,000 banking accounts, and $1.68 trillion in client assets. Through its operating subsidiaries, the company provides a full range of securities brokerage, banking, money management, and financial advisory services to individual investors and independent investment advisors... -

Page 148

More people. More stories. Experience the real-life relationships we have with our clients at aboutschwab.com. THE CHARLES SCHWAB CORPORATION 211 Main Street San Francisco, CA 94105 (415) 667-7000 www.schwab.com www.aboutschwab.com MKT10448-24 (3/12)