Cemex 1997 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 1997 Cemex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consistent

growth and

returns

If there is one thing that distinguishes us

from our competitors, it is our highly adaptive

management culture and philosophy. This is

the driving force behind our ability to pro-

vide consistent growth and returns to you,

our employees, partners and customers.

This learning culture stems from our

emerging-market focus. Coming from an

emerging economy presents its own set of

distinct challenges. We constantly have to

look for new ways to capitalize on these

countries’ seemingly limitless range of prob-

lems and opportunities.

Our passion for change is, perhaps, best

exemplified by our ability to rapidly realize

the benefits of integration and efficiency. This

is where our management approach and our

investment in information technology and

skills have reaped significant returns. Most

recently, our multinational Post-Merger-

Integration (PMI) team expanded Colombia’s

cash flow to US$135 million in 1997, achieving

over US$30 million in recurring cost savings.

Quite simply, the creation of long-term

shareholder value is a must. With this in

mind, our goal is to achieve higher returns

through a mix of organic growth, efficiency

and selective external investments.

TO OUR STOCKHOLDERS

2

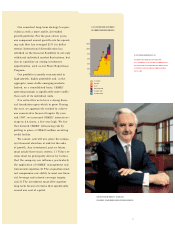

2.8%

22.1%

88-92

92-97

Margin volatility*

Consolidated stability

CEMEXÕ geographic diversification

has reduced the volatility of cash

flow margins.

ÒInternational diversification

has diversified cash flows. É

As a result of this broad diver-

sification, CEMEX has succeeded

in reducing the volatility of its

earnings. Reaching such levels

of diversification affords CEMEX

the financial flexibility to with-

stand individual market fluctu-

ations while continuing to capi-

talize on other expansion

opportunities É .Ó

Scott McKee, J.P. Morgan,

1/9/98 Credit Research Report

*Annual standard deviation of cash flow mar-

gins. Expressed as a percentage of the underly-

ing average cash flow margins.

After diversification

Before diversification