Cemex 1997 Annual Report Download

Download and view the complete annual report

Please find the complete 1997 Cemex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consistent

growth and

returns

A highly creative

and philosophy.

An openness and willingness to

embrace new ideas, diverse

cultures and different ways of

doing business É

management

culture

a passion for change

1997 Annual Report

Table of contents

-

Page 1

1997 Annual Report Consistent growth and returns A highly creative management culture and philosophy. An openness and willingness to embrace new ideas, diverse cultures and different ways of doing business É a passion for change -

Page 2

... for North American markets Spain's " Most Admired" company Highlights SpainÕs 8.2% surge in domestic cement demand, its recognition as SpainÕs most admired company, growing white cement exports and the successful new customer service laboratory. REGIONAL REVIEW OF OPERATIONS - CENTRAL AND SOUTH... -

Page 3

... the globe. CEMEX has market-leading operations in Mexico, Spain, Venezuela, Panama and the Dominican Republic, and a signiï¬cant presence in Colombia, the Caribbean, the Philippines and the southwest United States. It is also the world's leading producer of white cement and the world's largest... -

Page 4

... us from our competitors, it is our highly adaptive management culture and philosophy. This is the driving force behind our ability to provide consistent growth and returns to you, our employees, partners and customers. This learning culture stems from our emerging-market focus. Coming from... -

Page 5

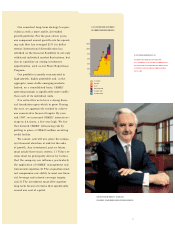

...cash flow (millions of dollars) Double-digit growth For the past eleven years, CEMEXÕ compound annual growth rate for operating cash flow has averaged 21 percent (in dollar terms). 87 89 91 93 95 97 Mexico Spain USA Venezuela Colombia Caribbean Lorenzo H. Zambrano Chairman of the Board and CEO 3 -

Page 6

... operating costs; Core cement, ready-mix concrete and aggregates base; State-of-the-art information systems and production technology; Aggressive yet prudent ï¬nancial management and capital structure; Emerging-market focus; and Management expertise, culture and philosophy. We manage our business... -

Page 7

... for 1997 and 1,303 million shares for 1996. Consolidated net sales* Consolidated operating cash flow* Total assets* CEMEXÕ top-line results demonstrate the success of its geographic diversification strategy. The sales gain resulting from strong performance in the companyÕs core businesses... -

Page 8

... their ongoing learning and decision-making process. ment techniques, technology and experience that the world has to offer. The company couples its highly adaptive culture with a genuine passion for change. CEMEX ' executives receive a trial by ï¬re, managing its international operations through... -

Page 9

for change CEMEXÕ highly adaptive management culture and philosophy stem primarily from its emergingmarket focus. Mexico is a large and profitable emerging market. The companyÕs ability to operate efficiently and profitably in this kind of environment is a key competitive advantage. -

Page 10

... Rizal Cement Plant in Philippines and It must offer superior long-term ï¬nancial returns that signiï¬cantly exceed our cost of capital. A diversiï¬ed Operating cash flow billions of constant " CEMEX has tranformed itself into a multinational powerhouse and taken on competitors in Mexico and... -

Page 11

portfolio Our portfolio is mostly concentrated in highly profitable CEMEXÕ future and, in the aggregate, relatively stable emerging markets. growth will come from increasing demand within these markets and from carefully selected investments outside of this portfolio. -

Page 12

.... International sales accounted for 59% of the companyÕs 1997 consolidated net sales. Emerging-market focus Presa Guri, Venezuela. Production capacity million metric tons 60 50 40 30 20 10 0 93 94 95 96 97 General data Headquarters: Monterrey, Mexico. Plants and terminals: 47 cement plants... -

Page 13

... year. CEMEX Mexico Plants and terminals: 21 cement plants (3 of them joint-owned), 79 land distribution centers, 5 marine terminals and 207 ready-mix and aggregates plants. Sales: US$435 million. Market: The primary end users of cement in CEMEX USA's operating region are small ready-mix companies... -

Page 14

... CEMEX Colombia Plants and terminals: 6 cement plants, 9 land distribution centers, 1 mortar plant and 23 asphalt, ready-mix and aggregates plants. CEMEX ' total assets. CEMEX Trading Fleet and terminals: 15 ships (3 of them in time charter) and 40 marine terminals operated by CEMEX . Production... -

Page 15

...18/97 " Strategic role Gloria Elena, part of CEMEXÕ fleet. Our trading activity plays a key role in our diversification strategy. CEMEX is evolving from a capital-intensive operator into a cement management company. This evolution is guided by a consistent business strategy that will continue... -

Page 16

...the year. The main drivers of "It's the most global company in Latin America. It's made successful investments outside of its primary market, has a good man-agement team and can compete with major competitors around the world." Jean-Dominique Virchaux, Heidruck & Struggles (Latin Trade, 1/98) this... -

Page 17

...fueled across-the-board construction activity, including new hotels, resorts, shopping centers and housing. For 1998, we estimate that Mexico's cement and ready-mix consumption will continue to increase at a rate of 8% and 25% , respectively. Sales Soar 15% In 1997, the Mexican market showed strong... -

Page 18

...In 1997, we also introduced a 25-kilogram bag of our white cement, which ultimately accounted for over 15% of CEMEX Mexico's white cement sales volume. Because white cement is primarily used for small repairs and projects, this new bag entails less burden and waste to our customers. In the ready-mix... -

Page 19

... the ï¬rst cement plant in the Americas to receive ISO 14001 certiï¬cation. The Torreón, Barrientos, Mérida, Guadalajara, Huichapan and Ensenada plants further received national certiï¬cation for completing the Mexican government's voluntary environmental audits program. The Torreón plant also... -

Page 20

... Ã'white pavingÃ" and expanded our product offerings to include asphalt chips. Arizona customers to improve the quality, consistency and timeliness of our products - increasing our on-time deliveries by 5% in 1997, well above the regional average. We opened a new ready-mix facility in Dallas... -

Page 21

... 1998, we anticipate that domestic cement consumption will increase around 5% over 1997. Our major new construction projects include the North European bridge between Denmark and Sweden and Bilbao's new international airport. Bridging Europe CEMEX SpainÕs state-of-the-art customer laboratory. 15 -

Page 22

... Spain's most admired company by Actualidad Económica, a leading national business publication. CEMEX Spain received this award because of its White cement leaders CEMEX SpainÕs white cement exports increased more than 68% over 1996. strong brand, top-quality products, improved customer service... -

Page 23

... of CEMEX ' company-wide accident prevention and risk reduction program, Valenciana conducted industrial safety audits at all of its cement plants. In 1997, projects were also launched to meet new EEC regulations that apply to Spain's cement industry. All of our Spanish cement plants received ISO... -

Page 24

...Because cement is priced from 20 to 30% higher than clinker, this signiï¬cantly increased the value of 1997 export sales. For 1997 and the coming years, the company's primary corporate focus is providing quality products and service to its customers. During the last quarter of 1996, CEMEX Venezuela... -

Page 25

... management program for its senior executives. Lowest Accident Rate As part of CEMEX ' overall risk reduction program, the company conducted industrial safety audits at every cement production facility. CEMEX Venezuela cement/ CEMEX Venezuela enjoys the lowest industrial clinker export sales... -

Page 26

... minimize the waiting time and maximize the productivity of our trucks. CEMEX COLOMBIA Colombia Sees Signs Of Recovery Colombia's construction sector did not begin to see signs of the country's economic recovery until the fourth quarter of 1997. For the year, domestic cement and ready-mix demand... -

Page 27

... III97 IV97 Rapid Growth Our comprehensive reorganization program yielded $32 million of our anticipated $50 million in annual cost savings. Technological turnaround Buacaramanga plant ColombiaÕs cement, concrete and sales points are now linked through CEMEXÕ information management system. 21 -

Page 28

...delay of some expected public works, 1997 cement sales volume grew 29% . This jump resulted from the company's increased share of the country's cement and ready-mix markets and a two-month strike at its local competitor, Cemento Panama. During the strike period, the company managed to supply 100% of... -

Page 29

... entered the local ready-mix market, starting with 10 trucks and two plants. By year-end 1997, these operations grew to 40 trucks and six plants. We are working to consolidate CEMEX ' uniform business culture and standards, such as efficiency and customer service quality, across the region. There is... -

Page 30

In the Dominican Republic, we undertook training programs to promote client services. These programs were geared to personnel from the sales, quality control and logistics areas. Rescuing The Whales CEMEX ' Dominican Republic unit worked Southeast Asia's growth potential jointly with its ... -

Page 31

... the government's commitment to economic reform and privatization. CEMEX PHILIPPINES SE Asian Foothold The Philippines is the third largest cement market in Southeast Asia, after Thailand and Indonesia. It accounts for approximately 12% of the region's total market. Historically, Philippine cement... -

Page 32

...exibility. As the second-largest cement producer in the Philippines, Rizal enjoys a leading market share in Central Luzon, the main consumption region that includes Manila. Rizal is also strategically located just outside of this region, allowing it to beneï¬t from low transportation costs and easy... -

Page 33

...,000-metric-ton floating silo can store and supply cement wherever our customers need it. Export diversity destination by region in percentage EXPORTS FROM SPAIN DESTINATION MEXICO VENEZUELA Asia South America North America Central America Caribbean Europe Africa TOTAL Export diversity 33.6 26... -

Page 34

...A R I E S Our board of directors CHAIRMAN: HONORARY CHAIRMAN: Lorenzo H. Zambrano Marcelo Zambrano Hellion DIRECTORS Juan F. MuÂ-oz Terrazas Eduardo Brittingham Lorenzo Milmo Armando J. GarcÂ'a Rodolfo GarcÂ'a Muriel Bernardo Quintana Isaac Rogelio Zambrano Roberto Zambrano Dionisio Garza Medina... -

Page 35

...1997, except share and per share amounts) 1987 Income Statement Information Net Sales Cost of Sales (1) Gross Proï¬t Operating Expenses Operating....1% 15.6% 8.6% Other Financial Data Operating Margin EBITD (10) Depreciation and Amortization Net Resources Provided by Operating Activities (11) 23.8%... -

Page 36

... an increase of 6% in real terms and 10% in dollars over that of 1996. The operating cash ï¬,ow margin was 31.5% during the year, as compared with 32.3% in 1996. CEMEXÕ international operations are 54% of consolidated revenues. Central America & the Caribbean 6% USA Venezuela Mexico Spain 4% 14... -

Page 37

... extraordinary gains and the mark-to-market value of the company's shares portfolio. million over the last decade to implement and modernize its information technology infrastructure. In 1997, it launched CEMEX 2000, a company-wide initiative to obtain certification of year 2000 compliance not only... -

Page 38

... of the total sales from Mexico's operations during the year was as follows: 70% domestic cement, 17% ready-mix, 8% exports and 5% tourism and others. Prices and Volumes The volume of domestic gray cement sold by CEMEX Mexico grew 12% during the year, and the volume of ready-mix increased by 33... -

Page 39

... demand caused exports to decrease 4% during the year. In peseta terms, the average price of domestic cement decreased 3% vis-à -vis the preceding year. Additionally, the average price of ready-mix dropped 1% for the period. Improved efficiency Vilanova plant, Spain. CEMEX SpainÕs production costs... -

Page 40

... sales volume grew 40% due to new regional market expansion. As a result of rising domestic demand, the volume of Venezuelan exports dropped 4% for the year, but still represented 48% of Vencemos' total sales volume. In 1997, cement prices decreased 3% in real terms, while ready-mix prices increased... -

Page 41

... 95 96 96 97 93 97 Net sales Operating cash flow millions of dollars Rising domestic cement demand led to VenezuelaÕs 1997 sales growth. The economic recovery and operational efficiencies increased operating cash flow. Sales Cementos Diamante's Net Sales were $479.217 billion Colombian pesos (US... -

Page 42

...by increases in the selling price of cement and ready-mix, as well as improvement in non-cement operations. CEMEX USA Prices and Volumes CEMEX USA's cement sales volume decreased by 3% in 1997 versus 1996, mostly because of distribution problems associated with third-party transportation services... -

Page 43

... CEMEX USA's operating income decreased 12% to Central America and the Caribbean net sales millions of dollars US$28 million. Operating Margin consequently declined from 7.7% in 1996 to 6.4% in 1997. Individually, the operating margin of the cement business (including ready-mix and aggregates... -

Page 44

... the acquisition of a 30% minority interest in the Philippine company Rizal Cement Inc. for a total of US$93 million, through its Spanish subsidiary, and signed an agreement in which CEMEX will provide technical assistance and consulting services to Rizal. This investment has been recorded on the... -

Page 45

... the BB rating given by S&P to Mexican sovereign debt. Equity Transactions • At the 1996 General Annual Stockholders Meeting held on April 24, 1997, the stockholders approved the CEMEX Share Repurchase Program. On March 30, the Board of Directors of CEMEX approved the repurchase. As of December... -

Page 46

... Increasing operating cash flow and decreases in financial expense resulted in expanded interest coverage capacity. Trailing 12 months for each period. *Before lease payments and cost of sales restatement. Plan for CEMEX Shares, by means of which the company is authorized to give senior managers... -

Page 47

MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS Footnotes to Selected Consolidated Financial Information (1) Cost of sales includes depreciation. Comprehensive ï¬nancing income (cost) includes ï¬nancial expense, ï¬nancial income, gains (losses) on marketable ... -

Page 48

Financial statements -

Page 49

... D I A R I E S Auditors' report The Board of Directors and Stockholders Cemex, S.A. de C.V.: (Thousands of Mexican pesos) We have audited the consolidated and parent company-only balance sheets of Cemex, S.A. de C.V. and Cemex, S.A. de C.V. and Subsidiaries as of December 31, 1997 and 1996, and the... -

Page 50

..., based on our audit and the reports of other auditors, the system of internal accounting control of Cemex, S.A. de C.V. and Subsidiaries for the year ended December 31, 1997, taken as a whole, was sufficient to meet management's objectives and to provide reasonable assurance that material errors or... -

Page 51

..., which included a review and evaluation of control systems and performance of such test of accounting information records as they considered neccesary in order to reach their opinion. Their report is presented separately. Lorenzo H. Zambrano Chairman of the Board and Chief Executive Officer 45 -

Page 52

... D I A R I E S Consolidated balance sheets (Thousands of constant Mexican pesos as of December 31, 1997) December 31 ASSETS CURRENT ASSETS Cash and temporary investments Trade accounts receivable, less allowance for doubtful accounts of $483,632 in 1997 and $469,809 in 1996 Other receivables (note... -

Page 53

...EQUITY CURRENT LIABILITIES Bank loans (note 8) Notes payable (note 8) Current maturities of long-term debt (notes 8 and 9) Trade accounts payable Other accounts payable and accrued expenses Total current liabilities $ 1997 2,826,610 887,925 1,590,621 2,379,065 2,561,623 10,245,844 1996 959,862 797... -

Page 54

... E S Consolidated statements of income (Thousands of constant Mexican pesos as of December 31, 1997, except for earnings per share) Years ended on December 31 1997 Net sales Cost of sales $ 30,573,187 (18,735,000) 11,838,187 1996 28,249,204 (17,129,381) 11,119,823 Gross profit Operating expenses... -

Page 55

... Consolidated statements of changes in ï¬nancial position (Thousands of constant Mexican pesos as of December 31, 1997) Years ended on December 31 1997 Operating activities Majority interest net income Charges to operations which did not require resources (note 17) Resources provided by operating... -

Page 56

... AND BUILDINGS Land Buildings Accumulated depreciation Total property and buildings 941,023 241,961 (119,603) 1,063,381 1,519,212 934,046 241,282 (114,946) 1,060,382 1,430,898 DEFERRED CHARGES (note 7) TOTAL ASSETS $ 59,147,959 56,362,887 See accompanying notes to financial statements. 50 -

Page 57

... (note 8) Notes payable (note 8) Current maturities of long-term debt (note 8) Other accounts payable and accrued expenses Intercompany payables (note 10) Total current liabilities $ 1997 2,056,904 775,470 169,380 455,867 9,070,679 12,528,300 1996 393,581 --3,685,968 508,949 3,508,168 8,096,666... -

Page 58

... 2,365,603 (123,093) 7,567,761 633,994 8,201,755 Income before income taxes Income tax beneï¬t and business assets tax, net (note 14) Net income Basic Earnings Per Share (note 18) Diluted Earnings Per Share (note 18) $ $ 4.78 4.71 6.32 5.52 See accompanying notes to financial statements. 52 -

Page 59

...o n l y ) Statements of changes in ï¬nancial position (Thousands of constant Mexican pesos as of December 31, 1997) Years ended on December 31 1997 Operating activities Net income Charges to operations which did not require resources (note 17) Resources provided by operating activities (4,369,030... -

Page 60

...Statements of changes in stockholders' equity (Thousands of constant Mexican pesos as of December 31, 1997) COMMON STOCK SERIES A SERIES B Balances at December 31, 1995 Dividends declared (0.69 pesos per share... 31, 1996 Acquisition of shares under share repurchase program (note 12B) Appropiation of... -

Page 61

ADDITIONAL PAID-IN CAPITAL DEFICIT IN EQUITY RESTATEMENT RETAINED EARNINGS NET INCOME MAJORITY INTEREST MINORITY INTEREST TOTAL STOCKHOLDERS' EQUITY 9,420,364 --- --- 2,111,620 --- (11,466,209 9,971,907) 22,241,686 (1,076,740) 7,983,991 --- --- 7,983,991 --- (7,983,991) --- --- 30,267,... -

Page 62

... parent company only ï¬nancial statements December 31, 1997 and 1996 (Thousands of constant Mexican pesos as of December 31, 1997) 1.- DESCRIPTION OF BUSINESS Cemex, S.A. de C.V. (Cemex or the Company) is the parent company of entities engaged in the production and marketing of cement and concrete... -

Page 63

... US dollars 93 million. Rizal is a Philippine company that owns various cement plants. The investment in Rizal is included in the consolidated ï¬nancial statements under the equity method of accounting and totals $343,293 at December 31, 1997. All signiï¬cant intercompany balances and transactions... -

Page 64

... purchase price or production cost. The cost of sales also reï¬,ects replacement cost at the time of sale, expressed in constant pesos as of the date of the latest balance sheet. H) INVESTMENTS IN SUBSIDIARIES AND AFFILIATED COMPANIES ( NOTE 6 ) In the Parent company-only ï¬nancial statements... -

Page 65

... 438,603 1,548,820 150,077 4.- INVENTORIES Inventories are summarized as follows: Consolidated 1997 Finished goods Work-in-process Raw materials Supplies and spare parts Advances to suppliers Inventory in transit Real estate held for sale $ 679,672 204,698 444,504 1,742,120 185,962 29,777 162... -

Page 66

... cement-related assets, which are intended to be sold in the short-term, and that are stated at their estimated realizable value. These assets include securities and assets for lines of business other than the Company's. 6.- INVESTMENTS IN SUBSIDIARIES AND AFFILIATED COMPANIES Investments in shares... -

Page 67

... Colombian Pesos Mexican Pesos Dominican Pesos $ 4,119,709 1,152,585 17,346 15,516 ----$ 5,305,156 1996 5,769,307 345,005 136,346 504,005 41,971 45,921 6,842,555 At December 31, 1997, there were no deposits established to repay short term indebtedness. At December 31, 1996, the Company established... -

Page 68

..., is as follows: Net sales Operating income Net income Total assets Total liabilities Stockholders' equity $ 3,928,208 1,247,780 1,880,394 36,431,450 6,553,653 29,877,797 At December 31, 1997, the Company and its subsidiaries had the following lines of credit with annual interest rates ranging from... -

Page 69

...1,033 791 --------897 584,712 1997 Current Liabilities Cemex Control, S.A. de C.V. Cegusa, S. A. Cementos Monterrey, S.A. de C.V. Badenoch Corporation Concreto y Precolados, S.A. Concretos Monterrey, S.A. de C.V. Cementos Mexicanos, S. A. de C.V. Cemex Central, S.A. de C.V. Productora de Bolsas de... -

Page 70

...- 25% 15% 12.- STOCKHOLDERS' EQUITY A) CAPITAL STOCK Capital stock of the Company as of December 31, 1997, is as follows: Series A (1) Series B (2) Subscribed and paid shares Share repurchase program Treasury shares Trust subscribed shares without value 979,695,687 3,497,000 9,216,905 --- 992,409... -

Page 71

B) SHARE REPURCHASE PROGRAM Under the Company's share repurchase program, as of December 31, 1997, a total of 9,693,000 Series " A" and 14,436,099 Series " B" shares have been acquired and canceled in stockholders' equity of the Company', in the amount of $824 common stock and $956,125 charged ... -

Page 72

..., property, plant and equipment after deducting certain liabilities. The Company and its subsidiaries in Mexico, consolidate for income tax and business assets tax purposes. The amounts for income tax and business assets tax presented in the accompanying consolidated ï¬nancial statements represents... -

Page 73

... exceeding book depreciation Inventories Financing costs capitalized and other items $ $ The effects of inï¬,ation are not recognized for tax purposes in some countries in which the Company operates, or they are recognized in a manner different from the accounting principles used by the Company... -

Page 74

...16,594 224,163 16.- GEOGRAPHIC SEGMENT DATA A summary of condensed selected ï¬nancial information by principal geographic locations as of December 31, 1997 and 1996, is as follows: Net Sales Operating Income Total Assets 1997 Mexico Spain Venezuela United States Colombia Others $ 13,865,453 5,908... -

Page 75

... 62,577,742 shares related with ï¬nancing transactions (see note 9). 19.- CONTINGENCIES AND COMMITMENTS A) GUARANTEES At December 31, 1997, Cemex has signed as guarantor for loans made to certain subsidiaries in the amount of US dollars 273 million. B) TAX ASSESSMENTS The Company and certain of... -

Page 76

... anti-dumping duty deposits on imports of gray portland cement and clinker from Mexico since April 1990. The order is likely to continue for an indeï¬nite period, although under the new World Trade Organization rules, it will be reviewed by the U.S. government not later than July 2001 to determine... -

Page 77

... R S Our management team Lorenzo H. Zambrano, 53 Chairman of the Board and Chief Executive Officer Francisco Garza, 42 President of CEMEX Mexico Mr. Z ambrano joined CEMEX in 1968 and has been involved in all operational aspects of the business. He holds a degree in industrial engineering from... -

Page 78

... C T O R Y Our offices in the world New York IBM Building 590 Madison Av. 41st Floor New York, N.Y. 10022 U.S.A. Tel: (212) 317-6000 / Fax: (212) 317-6048 Bogota Carrera 14 No. 93 B-32 Piso 2 Bogotá, Colombia Tel: (571) 622-7232 / Fax: (571) 622-7615 Singapore Madrid Hernández de Tejada No... -

Page 79

... tons of gray Portland cement. Ready-mix: Ready-mix concrete is the mixture of cement, aggregates and water. It is a building material that is produced in batching plants and delivered directly to the building site. Stringent controls during the manufacturing process guarantee the high quality and... -

Page 80

DESIGN: SIGNI / PHOTOGRAPHY: G. COVIAN AND OTHERS / PRINTING WETMORE & CO.