Cash America 2004 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2004 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

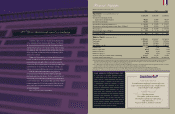

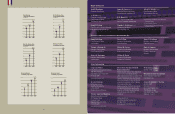

(Dollars in thousands, except per share data)

2004 2003 2002

Operations – years ended December 31 (a)

Total revenue $ 469,478 $ 388,635 $ 350,501

Income from operations before

depreciation and amortization 78,623 55,088 40,359

Income from operations 61,413 41,819 27,872

Income from continuing operations (b) $ 34,965 $ 22,030 $ 11,917

Income from continuing operations per share – Diluted $ 1.18 $ 0.83 $ 0.48

Net income (b) $ 56,835 $ 30,036 $ 19,309

Net income per share – Diluted $ 1.92 $ 1.13 $ 0.78

Dividends per share $ 0.37 $ 0.07 $ 0.05

Balance Sheets – at December 31 (a)

Earning assets $ 212,893 $ 158,987 $ 130,818

Total assets 555,165 377,194 287,006

Total debt 166,626 148,040 137,000

Stockholdersʼ equity 333,936 276,493 192,335

Current ratio 4.6x 4.3x 4.0x

Debt to equity ratio 49.9% 53.5% 71.2%

Return on assets (c) 8.3% 6.9% 4.2%

Return on equity (c) 11.7% 9.8% 6.7%

Net book value per common share outstanding $ 11.37 $ 9.78 $ 7.89

Common shares outstanding (d) 29,366,713 28,259,726 24,362,190

(a) In September 2004, the Company sold its foreign pawn lending operations. The amounts for all periods presented have been reclassified to reflect the foreign

operations as discontinued operations. In addition, in September 2001, the Company announced plans to exit the rent-to-own business. The amounts for

2002 also reflect the reclassified rent-to-own business as discontinued operations.

(b) See “Managementʼs Discussion and Analysis of Financial Condition and Results of Operations” and “Financial Statements and Supplementary Data” for amounts

related to details of discontinued operations for all periods presented and the gain on disposal of assets for 2003.

(c) Returns based on Income from Continuing Operations after taxes divided by average total assets and average total equity of the Company.

(d) Includes 69,935 shares, 64,742 shares and 66,820 shares in 2004, 2003 and 2002, respectively, held in the Companyʼs Nonqualified Savings Plan.

Financial Highlights

1

C o r e P u r p o s e

We provide financial solutions that

help ordinary people meet their needs

and pursue their dreams!

C o r e V a l u e s

We are family.

We strive for excellence.

We bring honor to our team.

We have fun.

We act with a servant’s heart.

CASH AMERICA INTERNATIONAL, INC.

is a provider of specialty financial services

to individuals in the United States with 839

total locations. Cash America is the nation’s

largest provider of secured non-recourse loans

to individuals, commonly referred to as pawn

loans, through 452 locations in 21 states

under the brand names Cash America Pawn

and SuperPawn. The Company also offers

short-term cash advances in 253 locations

under the brand names Cash America Payday

Advance and Cashland. In addition, check

cashing services are provided through 134

franchised and Company-owned Mr. Payroll

check cashing centers. Cash America com-

mon shares are listed on the New York Stock

Exchange under the symbol “CSH”.

Current ratio 4.6x 4.3x 4.0x

Debt to equity ratio 49.9% 53.5% 71.2%

Return on assets (c) 8.3% 6.9% 4.2%

Return on equity (c) 11.7% 9.8% 6.7%

Net book value per common share outstanding $ 11.37 $ 9.78 $ 7.89

Common shares outstanding (d) 29,366,713 28,259,726 24,362,190

20 Years that transformed an industry.

Inside this report youʼll see a timeline that highlights some

of the milestones of Cash Americaʼs first 20 years. Youʼll see it

all, from the first store to todayʼs total of 839 Company owned

and franchised locations, from 8-tracks to iPods. There are many

firsts along the way—like being the first national chain of pawn

stores to go public, and the first to have its headquarters almost

destroyed by a tornado.

During our 20-year history, weʼve taken the best lessons of

business and the most recent advances in computerized infor-

mation technology and applied them to an industry in need of

advancement. We developed a plan, set our goals and defined the

kind of business we wanted it to be. We stuck to it. Today, our

business is growing and thriving, and our core values are intact.

Over the years we have built off our core purpose of

providing financial solutions that help ordinary people meet

their needs and pursue their dreams. We have expanded beyond

offering only pawn loans to short-term unsecured cash advances

to serve our customers. We are pleased that cash advance related

revenue accounted for 21% of total revenue in 2004, but we are

just as pleased that our pawn related activities continue to post

strong growth figures.

Hereʼs to 20 more years of innovations.