Carnival Cruises 2009 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2009 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

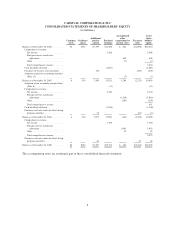

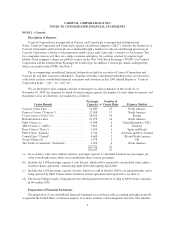

CARNIVAL CORPORATION & PLC

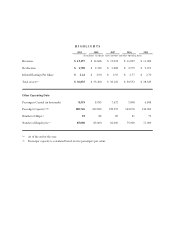

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(in millions)

Common

stock

Ordinary

shares

Additional

paid-in

capital

Retained

earnings

Accumulated

other

comprehensive

income (loss)

Treasury

stock

Total

share-

holders’

equity

Balances at November 30, 2006 .......... $6 $354 $7,479 $11,600 $ 661 $(1,890) $18,210

Comprehensive income:

Net income ...................... 2,408 2,408

Foreign currency translation

adjustment ..................... 649 649

Other ........................... (7) (7)

Total comprehensive income ........ 3,050

Cash dividends declared .............. (1,087) (1,087)

Purchases of treasury stock and other .... 120 (323) (203)

Adoption of pension accounting standard

(Note 12) ........................ (7) (7)

Balances at November 30, 2007 .......... 6 354 7,599 12,921 1,296 (2,213) 19,963

Adoption of tax accounting interpretation

(Note 8) ......................... (11) (11)

Comprehensive income:

Net income ...................... 2,330 2,330

Foreign currency translation

adjustment ..................... (1,816) (1,816)

Other ........................... (103) (103)

Total comprehensive income ........ 411

Cash dividends declared .............. (1,260) (1,260)

Purchases and sales under the Stock Swap

program and other ................. 78 (83) (5)

Balances at November 30, 2008 .......... 6 354 7,677 13,980 (623) (2,296) 19,098

Comprehensive income:

Net income ...................... 1,790 1,790

Foreign currency translation

adjustment ..................... 1,043 1,043

Other ........................... 42 42

Total comprehensive income ........ 2,875

Purchases and sales under the Stock Swap

programs and other ................ 30 32 62

Balances at November 30, 2009 .......... $6 $354 $7,707 $15,770 $ 462 $(2,264) $22,035

The accompanying notes are an integral part of these consolidated financial statements.

8