Carnival Cruises 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 ANNUAL REPORT

Table of contents

-

Page 1

2009 ANNUAL REPORT -

Page 2

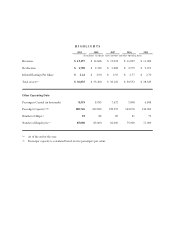

... Carried (in thousands) Passenger Capacity(a)(b) Number of Ships(a) Number of Employees(a) 8,519 180,746 93 85,000 8,183 169,040 88 83,000 7,672 158,352 85 81,000 7,008 143,676 81 75,000 6,848 136,960 79 71,000 (a) (b) As of the end of the year. Passenger capacity is calculated based on two... -

Page 3

...-passenger Dream-class ship for Carnival Cruise Lines that is set to debut in 2012. With this announcement, our order book is now complete through 2012, with 13 new ships driving a 6 percent average annual capacity growth. Six of those vessels will enter service in 2010-four for our European brands... -

Page 4

...I would like to acknowledge Meshulam Zonis, who passed away last year. He was a long-time Carnival Cruise Lines executive who was part of the team that founded the company in 1972. He was an original member of the Carnival Corporation board of directors when we went public in 1987, and served on the... -

Page 5

... shares (e.g., photocopy of shareholder proxy card, shares certificate or a current brokerage or nominee statement) and the initial deposit to your travel agent or to the cruise line you have selected. NORTH AMERICAN BRANDS CARNIVAL CRUISE LINES Guest Administration 3655 N.W. 87th Avenue Miami, FL... -

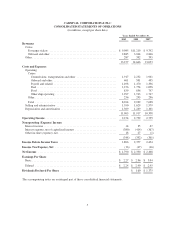

Page 6

CARNIVAL CORPORATION & PLC CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except per share data) Years Ended November 30, 2009 2008 2007 Revenues Cruise Passenger tickets ...Onboard and other ...Other ...Costs and Expenses Operating Cruise Commissions, transportation and other ...Onboard and ... -

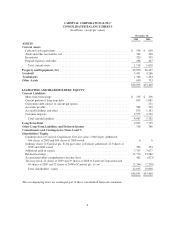

Page 7

...Customer deposits ...Total current liabilities ...Long-Term Debt ...Other Long-Term Liabilities and Deferred Income ...Commitments and Contingencies (Notes 6 and 7) Shareholders' Equity Common stock of Carnival Corporation; $.01 par value; 1,960 shares authorized; 644 shares at 2009 and 643 shares... -

Page 8

CARNIVAL CORPORATION & PLC CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Years Ended November 30, 2009 2008 2007 OPERATING ACTIVITIES Net income ...Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization ...Share-based compensation ...... -

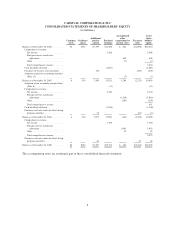

Page 9

... at November 30, 2008 ...Comprehensive income: Net income ...Foreign currency translation adjustment ...Other ...Total comprehensive income ...Purchases and sales under the Stock Swap programs and other ...Balances at November 30, 2009 ...$6 Ordinary shares $354 Retained earnings $11,600 2,408... -

Page 10

... company's shares are publicly traded; on the New York Stock Exchange ("NYSE") for Carnival Corporation and the London Stock Exchange for Carnival plc. In addition, Carnival plc American Depository Shares are traded on the NYSE. See Note 3. The accompanying consolidated financial statements include... -

Page 11

... short-term investments. Inventories Inventories consist primarily of food and beverage provisions, hotel and restaurant products and supplies, gift shop and art merchandise held for resale and fuel, which are all carried at the lower of cost or market. Cost is determined using the weighted-average... -

Page 12

... and from our ships and the related cost of purchasing this service are recorded as cruise passenger ticket revenues and cruise transportation costs, respectively. The proceeds that we collect from the sale of third party shore excursions and on behalf of onboard concessionaires, net of the amounts... -

Page 13

... collected from our guests. Insurance and Self-Insurance We use a combination of insurance and self-insurance to address a number of risks including, among others, claims related to crew and guests, hull and machinery, war risk, workers' compensation, shoreside employee health, property damage... -

Page 14

... is required to make a payment to the other company to equalize the possible net distribution to shareholders, subject to certain exceptions. At the closing of the DLC transaction, Carnival Corporation and Carnival plc also executed deeds of guarantee. Under the terms of Carnival Corporation's deed... -

Page 15

... of guarantee, the cash flow and assets of one company are required to be used to pay the obligations of the other company, if necessary. Given the DLC structure as described above, we believe that providing separate financial statements for each of Carnival Corporation and Carnival plc would not... -

Page 16

... until April 2011. We received approximately $50 million as a down payment and provided interest-bearing seller-financing, secured by the ship, for the remaining portion of the sales price. This sale resulted in a gain, which we had deferred and not recognized in our 2009 Consolidated Statements of... -

Page 17

... 2012 ...Publicly-Traded Convertible Notes Notes, bearing interest at 2%, due in 2021, with next put option in 2011 ...Notes, bearing interest at 1.75%, net of discount ...Other ...Total Unsecured Long-term Debt ...UNSECURED SHORT-TERM BORROWINGS Bank loans, with aggregate weighted-average interest... -

Page 18

... of fixed rate export credit facilities was released in January 2010 and, accordingly, this debt is no longer secured. (c) Includes an aggregate $3.7 billion of debt whose interest rate will increase upon a reduction in the senior unsecured credit ratings of Carnival Corporation or Carnival plc from... -

Page 19

... draw in order to pay for a portion of certain ships' purchase prices. These commitments, if drawn, are repayable semi-annually over at least a 12-year period, and we have the option to cancel each one up until 60 days prior to the underlying ship's delivery date. At November 30, 2009, our committed... -

Page 20

... 30, 2009 and anticipate paying the remaining estimated total costs as follows: $3.4 billion, $2.2 billion and $1.8 billion in fiscal 2010, 2011 and 2012, respectively. Operating Leases, Port Facilities and Other Commitments Rent expense under our operating leases, primarily for office and warehouse... -

Page 21

... at no cost to us. In certain cases, if the credit ratings of the financial institutions who are directly paying the contingent obligations fall below AA-, then Carnival Corporation will be required to replace these financial institutions with other financial institutions whose credit ratings are at... -

Page 22

..., Ocean Village, P&O Cruises and P&O Cruises Australia are subject to income tax under the tonnage tax regimes of either Italy or the United Kingdom. Under both tonnage tax regimes, shipping profits, as defined under the applicable law, are subject to corporation tax by reference to the net tonnage... -

Page 23

... We use the "Stock Swap" programs in situations where we can obtain an economic benefit because either Carnival Corporation common stock or Carnival plc ordinary shares are trading at a price that is at a premium or discount to the price of Carnival plc ordinary shares or Carnival Corporation common... -

Page 24

...The net difference between the fair values of our publicly-traded convertible notes and their carrying values was primarily due to the impact of changes in the Carnival Corporation common stock price underlying the value of our convertible notes at November 30, 2009, and higher market interest rates... -

Page 25

... publiclytraded companies. The principal assumptions used in our cash flow analysis related to forecasting future operating results, including net revenue yields, net cruise costs including fuel prices, capacity increases, weighted-average cost of capital for comparable publicly-traded companies and... -

Page 26

... currency cash balances, to manage our exposure to fluctuations in foreign currency exchange rates, and interest rate swaps to manage our interest rate exposure in order to achieve a desired proportion of floating and fixed rate debt. Our policy is to not use any financial instruments for trading or... -

Page 27

... has the financial statement effect of decreasing the U.S. dollar values reported for cruise revenues and cruise expenses in our accompanying Consolidated Statements of Operations. Weakening of the U.S. dollar has the opposite effect. Most of our brands have non-functional currency risk related to... -

Page 28

... order future new cruise ships for U.S. dollar or sterling functional currency brands. Interest Rate Risks We manage our exposure to fluctuations in interest rates through our investment and debt portfolio management strategies. These strategies include purchasing high quality short-term investments... -

Page 29

... Alaska Tours, and shore excursion and port hospitality services provided to cruise guests by this tour company. These intersegment revenues, which are included in full in the cruise segment, are eliminated directly against the other segment revenues and operating expenses in the line "Intersegment... -

Page 30

... Years Ended November 30, 2009 2008 2007 North America ...Europe ...Others ... $ 6,855 5,119 1,183 $13,157 $ 8,090 5,443 1,113 $14,646 $ 7,803 4,355 875 $13,033 NOTE 12 - Benefit Plans Equity Plans We issue our share-based compensation awards under the Carnival Corporation and Carnival plc stock... -

Page 31

...to non-executive board members, and will instead grant them RSAs and/or RSUs. A combined summary of Carnival Corporation and Carnival plc stock option activity during the year ended November 30, 2009 was as follows: WeightedAverage Exercise Price Weighted-Average Remaining Contractual Term (in years... -

Page 32

... quoted market price of the Carnival Corporation or Carnival plc shares on the date of grant, and is amortized to expense using the straight-line method from the grant date through the earlier of the vesting date or the estimated retirement eligibility date. During the year ended November 30, 2009... -

Page 33

... $55 million in fiscal 2009, 2008 and 2007, respectively. On November 30, 2007, we adopted a new accounting standard related to accounting for defined benefit pension plans. This standard required us, upon adoption, to recognize the funded status of our defined benefit single employer pension plans... -

Page 34

... Corporation treasury stock and newly issued Carnival Corporation common stock, which represented a noncash financing activity. NOTE 15 - Acquisition In September 2007, we entered into an agreement with Orizonia Corporation, Spain's largest travel company, to operate Ibero, a Spanish cruise line... -

Page 35

... internal control over financial reporting, as such term is defined in the Securities Exchange Act of 1934 Rule 13a-15(f). Under the supervision and with the participation of our management, including our Chief Executive Officer, Chief Operating Officer and Chief Financial Officer, we conducted an... -

Page 36

... the Boards of Directors and Shareholders of Carnival Corporation and Carnival plc: In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of operations, cash flows and shareholders' equity present fairly, in all material respects, the financial position... -

Page 37

... share, net revenue yields, booking levels, pricing, occupancy, operating, financing and tax costs, fuel expenses, costs per available lower berth day ("ALBD"), estimates of ship depreciable lives and residual values, liquidity, goodwill and trademark fair values and outlook. These factors include... -

Page 38

...environment in our history, including significantly increased unemployment rates, the deterioration in consumer confidence, travel restrictions to Mexico due to the flu virus and a significant reduction in discretionary spending, which ultimately led to the largest one-year cruise pricing decline in... -

Page 39

... 78% of our total assets. We make several critical accounting estimates dealing with our ship accounting. First, we compute our ships' depreciation expense, which represented 11% of our cruise costs and expenses in fiscal 2009 and which requires us to estimate the average useful life of each of our... -

Page 40

...of reporting units utilizing discounted future cash flow analysis, significant judgments are made related to forecasting future operating results, including net revenue yields, net cruise costs including fuel prices, capacity increases, weighted-average cost of capital for comparable publicly-traded... -

Page 41

... and many onboard activities, and sales of goods and services primarily onboard our ships not included in the cruise ticket price (which include, among other things, bar and some beverage sales, shore excursions, casino gaming, gift shop, photo and art sales, internet and spa services, and cellular... -

Page 42

...officers and crew and hotel and administrative employees, fuel costs, which include fuel delivery costs, food costs, which include both our guest and crew food costs, and other ship operating costs, which include port costs, repairs and maintenance, including minor improvements and dry-dock expenses... -

Page 43

... for sale accommodates two passengers and is computed by multiplying passenger capacity by revenue-producing ship operating days in the period. We use net cruise revenues per ALBD ("net revenue yields") and net cruise costs per ALBD as significant non-GAAP financial measures of our cruise segment... -

Page 44

...: Years Ended November 30, 2009 2008 Constant Constant Dollar 2008 Dollar (in millions, except ALBDs and yields) 2009 2007 Cruise revenues Passenger tickets ...Onboard and other ...Gross cruise revenues ...Less cruise costs Commissions, transportation and other ...Onboard and other ...Net cruise... -

Page 45

... Dollar 2008 Dollar (in millions, except ALBDs and costs per ALBD) 2009 2007 Cruise operating expenses ...Cruise selling and administrative expenses ...Gross cruise costs ...Less cruise costs included in net cruise revenues Commissions, transportation and other ...Onboard and other ...Net cruise... -

Page 46

... increases in cruise ticket pricing, including the implementation of our fuel supplements, and the impact of the weaker U.S. dollar against the euro compared to 2007. Our capacity increased 3.6% for our North American cruise brands and 20.6% for our European and other cruise brands in 2008 compared... -

Page 47

... million gain from a hurricane insurance settlement for damages to our Cozumel, Mexico port facility in 2005 and lower selling and administrative expenses achieved primarily through economies of scale and tight cost controls. Net cruise costs per ALBD as measured on a constant dollar basis increased... -

Page 48

... a working capital deficit for the foreseeable future. During fiscal 2009, our net expenditures for capital projects were $3.4 billion, of which $2.8 billion was spent on our ongoing new shipbuilding program, including $2.1 billion for the final delivery payments for AIDAluna, Carnival Dream, Costa... -

Page 49

...require annual shareholder approval. In addition to the general repurchase authorization, the Boards of Directors have authorized the repurchase of up to 19.2 million Carnival plc ordinary shares and up to 25 million shares of Carnival Corporation common stock under the "Stock Swap" programs. We use... -

Page 50

... About Market Risk For a discussion of our hedging strategies and market risks see the discussion below and "Note 10 - Fair Value Measurements, Derivative Instruments and Hedging Activities," in the accompanying consolidated financial statements. Foreign Currency Exchange Rate Risks Operational and... -

Page 51

... in the U.S. dollar value of the related foreign currency ship construction contract and result in no net impact to us. At November 30, 2009, we have three euro-denominated shipbuilding commitments scheduled for delivery between May 2010 and May 2011, with remaining total payments of $1.3 billion... -

Page 52

... November 30, 2009 interest rates, our annual interest expense on floating rate debt, including the effect of our interest rate swaps, would change by an insignificant amount. Finally, based upon a hypothetical 10% change in Carnival Corporation's November 30, 2009 common stock price, the fair value... -

Page 53

...$ 1.25 1.83 (a) The 2006 net income was reduced by $57 million of share-based compensation expense related to the expensing of stock options and RSUs as a result of our adoption of a new accounting standard in 2006. (b) Percentage of total debt to the sum of total debt and shareholders' equity. 52 -

Page 54

... and will be based on a number of factors, including our earnings, liquidity position, financial condition, tone of business, capital requirements, credit ratings and the availability and cost of obtaining new debt. We cannot be certain that Carnival Corporation and Carnival plc will continue their... -

Page 55

... Carnival Corporation dividends are reinvested on an annual basis, multiplied by the market price of the shares at the end of each fiscal year. 5-YEAR CUMULATIVE TOTAL RETURNS $150.00 $125.00 $100.00 $75.00 $50.00 $25.00 2004 2005 2006 2007 2008 2009 Carnival Corporation Common Stock... -

Page 56

...noted below. The Price Performance is calculated in a similar manner as noted above. 5-YEAR CUMULATIVE TOTAL RETURNS $150.00 $125.00 $100.00 $75.00 $50.00 $25.00 2004 2005 2006 2007 2008 2009 Carnival plc ADS S&P 500 Index Dow Jones Index FTSE 100 Index Assumes $100 Invested on December... -

Page 57

... FINANCIAL DATA (UNAUDITED) Our revenues from the sale of passenger tickets are seasonal. Historically, demand for cruises has been greatest during our third fiscal quarter, which includes the Northern Hemisphere summer months. This higher demand during the third quarter results in higher net... -

Page 58

... Annual Accounts and all amendments to those reports, press releases and other documents, as well as information on our cruise brands are available through our website at www.carnivalcorp.com or www.carnivalplc.com. 5 Audit Committee Compensation Committee Executive Committee Health, Environmental... -

Page 59

Carnival Place 3665 N.W. 87th Avenue Miami Florida 33178-2428 U.S.A www.carnivalcorp.com Carnival House 5 Gainsford Street London SE1 2NE UK www.carnivalplc.com