Cardinal Health 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 Cardinal Health annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

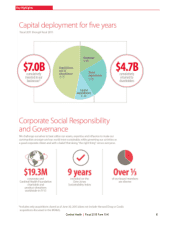

MD&A Liquidity and Capital Resources

Cardinal Health | Fiscal 2015 Form 10-K 16

Liquidity and Capital Resources

We currently believe that, based upon available capital resources (cash on hand and committed credit facilities) and projected operating cash

flow, we have adequate capital resources to fund working capital needs; currently anticipated capital expenditures, currently anticipated

business growth and expansion (including the pending acquisition of Cordis); contractual obligations; tax payments; and current and projected

debt service requirements, dividends and share repurchases. If we decide to engage in one or more additional acquisitions, depending on

the size and timing of such transactions, we may need to access capital markets for additional financing.

Cash and Equivalents

Our cash and equivalents balance was $4.6 billion at June 30, 2015

and $2.9 billion at June 30, 2014. We acquired Harvard Drug on July

2, 2015 for $1.1 billion, net of cash acquired, and expect to acquire

Cordis during the second quarter of fiscal 2016 for $1.9 billion. At

June 30, 2015, our cash and equivalents were held in cash depository

accounts with major banks or invested in high quality, short-term liquid

investments.

During fiscal 2015, net cash provided by operating activities of $2.5

billion was positively impacted by working capital improvements.

These funds were deployed for $1.0 billion of share repurchases,

$503 million of acquisitions and $460 million of cash dividends. In

addition, during the second quarter of fiscal 2015, we refinanced $1.2

billion of long-term debt at lower interest rates and longer maturities

and during the fourth quarter of fiscal 2015, we received proceeds

from the issuance of additional long-term debt of $1.5 billion to fund

the Harvard Drug and Cordis acquisitions.

The cash and equivalents balance at June 30, 2015 included $423

million of cash held by subsidiaries outside of the United States.

Although the vast majority of this cash is available for repatriation,

permanently bringing the money into the United States could trigger

U.S. federal, state and local income tax obligations. As a U.S. parent

company, we may temporarily access cash held by our foreign

subsidiaries without becoming subject to U.S. federal income tax

through intercompany loans.

During fiscal 2014 we deployed $673 million of cash on share

repurchases, $519 million on acquisitions and $415 million on

dividends. Net cash provided by operating activities of $2.5 billion

benefited from a net working capital decrease in excess of $500

million as a result of the Walgreens contract expiration.

During fiscal 2013, we deployed $2.2 billion of cash on acquisitions,

$450 million on share repurchases and $353 million on dividends.

During fiscal 2013, we received net proceeds from the issuance of

long-term debt of $981 million, which were used for the acquisition

of AssuraMed, Inc. Net cash provided by operating activities was $1.7

billion.

Changes in working capital, which impact operating cash flow, can

vary significantly depending on factors such as the timing of customer

payments, inventory purchases and payments to vendors in the

regular course of business, as well as fluctuating working capital

needs driven by customer and product mix.

Financial Instruments and Other Financing Arrangements

Credit Facilities and Commercial Paper

On November 3, 2014, we renewed our committed receivables sales

facility program through Cardinal Health Funding, LLC until

November 3, 2017 and increased the size of the facility from $700

million to $950 million with the inclusion of certain receivables from

the Medical segment. Other sources of liquidity include a $1.5 billion

revolving credit facility and a commercial paper program of up to $1.5

billion, backed by the revolving credit facility. At both June 30, 2015

and 2014, we had no outstanding balances or borrowings under these

facilities, except for standby letters of credit of $41 million under the

committed receivables sales facility program.

Our revolving credit facility and committed receivables sales facility

program require us to maintain, as of any fiscal quarter end, a

consolidated interest coverage ratio of at least 4-to-1 and a

consolidated leverage ratio of no more than 3.25-to-1. As of June 30,

2015, we were in compliance with these financial covenants.

Available-for-Sale Securities

At June 30, 2015 and 2014, we held $193 million and $100 million,

respectively, of marketable securities, which are classified as

available-for-sale.

Long-Term Obligations

In June 2015, we sold $550 million aggregate principal amount of

1.95% Notes that mature on June 15, 2018, $500 million aggregate

principal amount of 3.75% Notes that mature on September 15, 2025

and $450 million aggregate principal amount of 4.9% Notes that

mature on September 15, 2045. We used a portion of the proceeds

from this offering to acquire Harvard Drug on July 2, 2015 and plan

to use the remainder to acquire Cordis during the second quarter of

fiscal 2016.

In November 2014, we sold $450 million aggregate principal amount

of 2.4% Notes that mature on November 15, 2019, $400 million

aggregate principal amount of 3.5% Notes that mature on November

15, 2024, and $350 million aggregate principal amount of 4.5% Notes

that mature on November 15, 2044.