Cardinal Health 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 Cardinal Health annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MD&A Results of Operations

9Cardinal Health | Fiscal 2015 Form 10-K

Consolidated Results

Fiscal 2015 Overview

Revenue

Revenue for fiscal 2015 was $102.5 billion, a 13 percent increase

from the prior-year period due primarily to sales growth from existing

and new pharmaceutical distribution customers. Revenue growth was

negatively impacted in fiscal 2015 due to the previously disclosed

expiration of our pharmaceutical distribution contract with Walgreen

Co. ("Walgreens") on August 31, 2013.

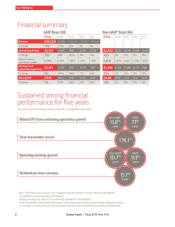

GAAP and Non-GAAP Operating Earnings

(in millions) 2015 2014 Change

GAAP $2,161 $1,885 15%

Restructuring and employee severance 44 31

Amortization and other acquisition-related costs 281 223

Impairments and (gain)/loss on disposal of assets (19) 15

Litigation (recoveries)/charges, net 5(21)

Non-GAAP $2,472 $2,133 16%

GAAP operating earnings increased 15 percent to $2.2 billion

compared to the prior year, reflecting sales growth from existing and

new customers and strong performance from our Pharmaceutical

segment generics program, offset in part by customer pricing changes

and the Walgreens contract expiration in the prior-year period. Non-

GAAP operating earnings increased 16 percent to $2.5 billion during

fiscal 2015 also due to the factors impacting GAAP operating

earnings.

GAAP and Non-GAAP Diluted EPS

2015 2014 Change

GAAP $ 3.61 $ 3.37 7%

Restructuring and employee severance 0.09 0.06

Amortization and other acquisition-related costs 0.54 0.42

Impairments and (gain)/loss on disposal of assets (0.03) 0.03

Litigation (recoveries)/charges, net 0.06 (0.04)

Loss on extinguishment of debt 0.11 —

Non-GAAP $ 4.38 $ 3.84 14%

GAAP diluted EPS increased $0.24 or 7 percent to $3.61 during fiscal

2015 and non-GAAP diluted EPS increased $0.54 or 14 percent to

$4.38 during fiscal 2015. GAAP and non-GAAP diluted EPS increased

primarily due to the factors impacting GAAP and non-GAAP operating

earnings as well as a lower share count driven by share repurchases

and partially offset by an increase in income taxes. GAAP diluted EPS

was also impacted by a $37 million after-tax loss on extinguishment

of debt in the current year.

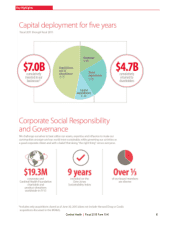

Cash and Equivalents

Our cash and equivalents balance was $4.6 billion and $2.9 billion at

June 30, 2015 and 2014, respectively. In June 2015, we issued $1.5

billion of additional debt to fund a portion of the acquisitions of The

Harvard Drug Group ("Harvard Drug"), which closed on July 2, 2015,

and the Cordis business of Johnson & Johnson, which is expected to

close during the second quarter of fiscal 2016. These acquisitions are

both discussed in more detail in "Significant Developments in Fiscal

2015 and Trends" that follows this section. During fiscal 2015, net

cash provided by operating activities of $2.5 billion was deployed for

share repurchases of $1.0 billion, acquisitions of $503 million and

cash dividends of $460 million. In addition, during the second quarter

of fiscal 2015, we refinanced $1.2 billion of long-term debt at lower

interest rates and longer maturities.