CDW 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 CDW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We purchase products for resale from vendor partners, which include OEMs and software publishers, and wholesale distributors. For

the year ended December 31, 2014 , we purchased approximately 54% of the products we sold directly from vendor partners and the remaining

amount from wholesale distributors. We are authorized by vendor partners to sell all or some of their products via direct marketing activities.

Our authorization with each vendor partner is subject to specific terms and conditions regarding such things as sales channel restrictions, product

return privileges, price protection policies, purchase discounts and vendor partner programs and funding, including purchase rebates, sales

volume rebates, purchasing incentives and cooperative advertising reimbursements. However, we do not have any long-term contracts with our

vendor partners and many of these arrangements are terminable upon notice by either party. A reduction in vendor partner programs or funding

or our failure to timely react to changes in vendor partner programs or funding could have an adverse effect on our business, results of operations

or cash flows. In addition, a reduction in the amount of credit granted to us by our vendor partners could increase our need for, and the cost of,

working capital and could have an adverse effect on our business, results of operations or cash flows, particularly given our substantial

indebtedness.

From time to time, vendor partners may terminate or limit our right to sell some or all of their products or change the terms and

conditions or reduce or discontinue the incentives that they offer us. For example, there is no assurance that, as our vendor partners continue to

sell directly to end users and through resellers, they will not limit or curtail the availability of their products to solutions providers like us. Any

such termination or limitation or the implementation of such changes could have a negative impact on our business, results of operations or cash

flows.

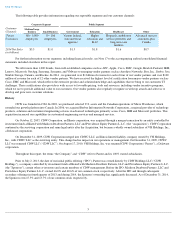

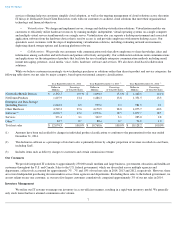

Although we purchase from a diverse vendor base, in 2014 , products we purchased from distributors Tech Data, SYNNEX and Ingram

Micro each represented 9% of our total purchases. In addition, sales of Apple, Cisco, EMC, Hewlett-Packard, Lenovo and Microsoft products

comprise a substantial portion of our sales, representing approximately 54% of net sales in 2014 . Sales of products manufactured by Hewlett-

Packard and Cisco represented approximately 18% and 14% , respectively, of our 2014 net sales. The loss of, or change in business relationship

with, any of these or any other key vendor partners, the diminished availability of their products, or backlogs for their products leading to

manufacturer allocation, could reduce the supply and increase the cost of products we sell and negatively impact our competitive position.

Additionally, the relocation of key distributors utilized in our purchasing model could increase our need for, and the cost of, working

capital and have an adverse effect on our business, results of operations or cash flows. Further, the sale, spin-off or combination of any of our

vendor partners and/or certain of their business units, including any such sale to or combination with a vendor with whom we do not currently

have a commercial relationship or whose products we do not sell, could have an adverse impact on our business, results of operations or cash

flows.

Our sales are dependent on continued innovations in hardware, software and services offerings by our vendor partners and the

competitiveness of their offerings, and our ability to partner with new and emerging technology providers.

The technology industry is characterized by rapid innovation and the frequent introduction of new and enhanced hardware, software and

services offerings, such as cloud-based solutions, including SaaS, IaaS and PaaS. We have been and will continue to be dependent on

innovations in hardware, software and services offerings, as well as the acceptance of those innovations by customers. A decrease in the rate of

innovation, or the lack of acceptance of innovations by customers, could have an adverse effect on our business, results of operations or cash

flows.

In addition, if we are unable to keep up with changes in technology and new hardware, software and services offerings, for example by

providing the appropriate training to our account managers, sales technology specialists and engineers to enable them to effectively sell and

deliver such new offerings to customers, our business, results of operations or cash flows could be adversely affected.

We also are dependent upon our vendor partners for the development and marketing of hardware, software and services to compete

effectively with hardware, software and services of vendors whose products and services we do not currently offer or that we are not authorized

to offer in one or more customer channels. In addition, our success is dependent on our ability to develop relationships with and sell hardware,

software and services from new emerging vendors and vendors that we have not historically represented in the marketplace. To the extent that a

vendor's offering that is highly in demand is not available to us for resale in one or more customer channels, and there is not a competitive

offering from another vendor that we are authorized to sell in such customer channels, or we are unable to develop relationships with new

technology providers or companies that we have not historically represented, our business, results of operations or cash flows could be adversely

impacted.

Substantial competition could reduce our market share and significantly harm our financial performance.

Our current competition includes:

10