CDW 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 CDW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CDW CORP

FORM 10-K

(Annual Report)

Filed 02/26/15 for the Period Ending 12/31/14

Address 200 N MILWAUKEE AVE

VERNON HILLS, IL 60061

Telephone 8474656000

CIK 0001402057

Symbol CDW

SIC Code 5961 - Catalog and Mail-Order Houses

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2015, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

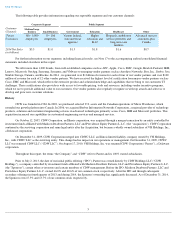

Page 1

... 10-K (Annual Report) Filed 02/26/15 for the Period Ending 12/31/14 Address Telephone CIK Symbol SIC Code Fiscal Year 200 N MILWAUKEE AVE VERNON HILLS, IL 60061 8474656000 0001402057 CDW 5961 - Catalog and Mail-Order Houses 12/31 http://www.edgar-online.com © Copyright 2015, EDGAR Online, Inc... -

Page 2

...(I.R.S. Employer Identification No.) 200 N. Milwaukee Avenue Vernon Hills, Illinois (Address of principal executive offices) 60061 (Zip Code) (847) 465-6000 (Registrant's telephone number, including area code) None (Former name, former address and former fiscal year, if changed since last report... -

Page 3

Non-accelerated filer 3 (Do not check if a smaller reporting company) Smaller reporting company 3 Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). 3 Yes 1 No -

Page 4

...voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2014 , the last business day of the registrant's most recently completed second fiscal quarter, was $2,762.3 million , based on the per share closing sale price of $31.88 on that date. As of February 20, 2015... -

Page 5

... Accountants on Accounting and Financial Disclosure Item 9A. Controls and Procedures Item 9B. Other Information PART III Item 10. Directors, Executive Officers and Corporate Governance Item 11. Executive Compensation Item 12. Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 6

... statements also relate to our future prospects, developments and business strategies. We claim the protection of The Private Securities Litigation Reform Act of 1995 for all forward-looking statements in this report. These forward-looking statements are identified by the use of terms and phrases... -

Page 7

... marketing programs that generate end-user demand Our customers include private sector businesses many of which employ fewer than 5,000 employees, government agencies and educational and healthcare institutions. We serve our customers through channel-specific sales teams and service delivery teams... -

Page 8

.... Prior to July 2, 2013, the date of our initial public offering ("IPO"), Parent was owned directly by CDW Holdings LLC ("CDW Holdings"), a company controlled by investment funds affiliated with Madison Dearborn Partners, LLC and Providence Equity Partners L.L.C. (the "Sponsors"), certain... -

Page 9

... in this report for additional discussion of the IPO. On November 10, 2014, we completed the acquisition of a 35% non-controlling equity interest in Kelway TopCo Limited ("Kelway"), a UK-based IT solutions provider, which has global supply chain relationships that enable it to conduct business in... -

Page 10

... as delivery charges to customers and certain commission revenue. Our Customers We provide integrated IT solutions to approximately 250,000 small, medium and large business, government, education and healthcare customers throughout the U.S. and Canada. Sales to the U.S. federal government, which... -

Page 11

... wholesale distributors provide logistics management and supply-chain services for us, as well as for our vendor partners. For the year ended December 31, 2014 , we purchased 54% of the products we sold as discrete products or as components of a solution directly from our vendor partners and the... -

Page 12

... on technology products and services by our Public segment customers. Our sales to our Public segment customers are impacted by government spending policies, budget priorities and revenue levels. Although our sales to the federal government are diversified across multiple agencies and departments... -

Page 13

... channel restrictions, product return privileges, price protection policies, purchase discounts and vendor partner programs and funding, including purchase rebates, sales volume rebates, purchasing incentives and cooperative advertising reimbursements. However, we do not have any long-term contracts... -

Page 14

... to: • conduct business with our customers, including delivering services and solutions to them; • manage our inventory and accounts receivable; • purchase, sell, ship and invoice our hardware and software products and provide and invoice our services efficiently and on a timely basis; and... -

Page 15

... entities, educational institutions and healthcare customers, through various contracts and open market sales of products and services. Sales to Public segment customers are highly regulated. Noncompliance with contract provisions, government procurement regulations or other applicable laws or... -

Page 16

... data centers could damage our business. Substantially all of our corporate, warehouse and distribution functions are located at our Vernon Hills, Illinois facilities and our second distribution center in North Las Vegas, Nevada. If the warehouse and distribution equipment at one of our distribution... -

Page 17

... products and services. Because of our significant sales to governmental entities, we also are subject to audits by federal, state and local authorities. We also are subject to audits by various vendor partners and large customers, including government agencies, relating to purchases and sales... -

Page 18

... case in a manner that is not consistent with our historical practice within the meaning of the applicable Treasury Regulations. Prior to 2018, our willingness to pay dividends or make distributions with respect to our equity could be adversely affected if, at the time, we do not meet the 110% test... -

Page 19

... base at any time equals the sum of up to 85% of CDW LLC and its subsidiary guarantors' eligible accounts receivable (net of accounts reserves) (up to 30% of such eligible accounts receivable which can consist of federal government accounts receivable) plus the lesser of (i) 75% of CDW LLC and its... -

Page 20

...our scheduled debt service obligations or satisfy our capital requirements, or that these actions would be permitted under the terms of our existing or future debt agreements, including our senior credit facilities and indentures. In the absence of such operating results and resources, we could face... -

Page 21

..., and our resources and the attention of management could be diverted from our business. The Sponsors have influence over significant corporate activities and their interests may not align with yours. Madison Dearborn beneficially owns approximately 15.5% of our common stock and Providence Equity... -

Page 22

...General Corporation Law, and will prevent us from engaging in a business combination with a person who acquires at least 15% of our common stock for a period of three years from the date such person acquired such common stock, unless board or stockholder approval is obtained prior to the acquisition... -

Page 23

...foot distribution center in Vernon Hills, Illinois, and a 513,000 square foot distribution center in North Las Vegas, Nevada. In addition, we conduct sales, services and administrative activities in various leased locations throughout the U.S. and Canada, including data centers in Madison, Wisconsin... -

Page 24

... various partners, group purchasing organizations and customers, including government agencies, relating to purchases and sales under various contracts. In addition, we are subject to indemnification claims under various contracts. From time to time, certain of our customers file voluntary petitions... -

Page 25

...President - Public and Advanced Technology Sales Senior Vice President - Operations and Chief Information Officer Senior Vice President - Product and Partner Management Senior Vice President and Chief Financial Officer Thomas E. Richards serves as our Chairman, President and Chief Executive Officer... -

Page 26

... our technology specialist teams focusing on servers and storage, unified communications, security, wireless, power and cooling, networking, software licensing and mobility solutions. He also holds responsibility for CDW Canada, Inc. Mr. Eckrote joined CDW in 1989 as an account manager. Mr. Eckrote... -

Page 27

... as Senior Vice President and Chief Financial Officer. Prior to joining CDW, Ms. Ziegler spent 15 years at Sara Lee Corporation ("Sara Lee"), a global consumer goods company, in a number of executive roles including finance, mergers and acquisitions, strategy and general management positions in both... -

Page 28

...Issuer Purchases of Equity Securities Market Information Our common stock has been listed on the NASDAQ Global Select Market since June 27, 2013 under the symbol "CDW." Prior to that date, there was no public market for our common stock. Shares sold in our initial public offering ("IPO") were priced... -

Page 29

...to three times our revenue or enterprise value); (ii) operates in a business-to-business distribution environment; (iii) members of the technology industry; (iv) similar customers ( i.e. , business, government, healthcare, and education); (v) companies that provide services and/or solutions; and (vi... -

Page 30

... below as of December 31, 2014 and December 31, 2013 and for the years ended December 31, 2014, 2013, and 2012 from our audited consolidated financial statements and related notes, which are included elsewhere in this report. The selected financial data as of December 31, 2011 and December 31, 2010... -

Page 31

...Note 7 to the accompanying audited consolidated financial statements included elsewhere in this report for additional information on long-term debt. During the year ended December 31, 2013, we recorded IPO- and secondary-offering related expenses of $75.0 million. Refer to Note 9 to the accompanying... -

Page 32

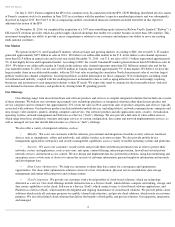

...) 2014 2013 2012 2011 2010 Statement of Operations Data: Net sales Cost of sales Gross profit Selling and administrative expenses Advertising expense Income from operations Interest expense, net Net (loss) gain on extinguishments of long-term debt Other income, net Income (loss) before income taxes... -

Page 33

-

Page 34

... for the periods presented: Years Ended December 31, (in millions) 2014 2013 2012 2011 2010 Net income (loss) Depreciation and amortization Income tax expense (benefit) Interest expense, net EBITDA Non-cash equity-based compensation Sponsor fees Consulting and debt-related professional fees Net... -

Page 35

..., and debt discount, net Deferred income taxes Allowance for doubtful accounts Realized loss on interest rate swap agreements Net loss (gain) on extinguishments of long-term debt Income from equity investments Changes in assets and liabilities Other non-cash items Net cash provided by operating... -

Page 36

...: (in millions) Years Ended December 31, 2014 2013 Acceleration charge for certain equity awards and related employer payroll taxes RDU Plan cash retention pool accrual Management services agreement termination fee Other expenses IPO- and secondary-offering related expenses $ - - - 1.4 1.4 $ 40... -

Page 37

... following: product return privileges, price protection policies, purchase discounts and vendor incentive programs, such as purchase or sales rebates and cooperative advertising reimbursements. We also resell software for major software publishers. Our agreements with software publishers allow the... -

Page 38

... EBITDA and Adjusted EBITDA, return on invested capital, cash and cash equivalents, cash flow, net working capital, cash conversion cycle (defined to be days of sales outstanding in accounts receivable plus days of supply in inventory minus days of purchases outstanding in accounts payable, based on... -

Page 39

...10,128.2 1,669.6 510.6 119.0 247.1 766.6 39.9 3,733.1 24 Cash conversion cycle is defined as days of sales outstanding in accounts receivable plus days of supply in inventory minus days of purchases outstanding in accounts payable, based on a rolling three-month average. The prior periods have been... -

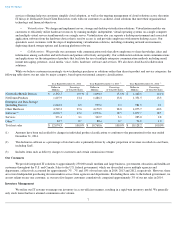

Page 40

...as technical specialists and service delivery roles. Growth in solutions-focused products, including netcomm and software, also contributed to the increase in net sales during 2014 . Corporate segment net sales in 2014 increased $515.4 million , or 8.6% , compared to 2013 , driven by sales growth in... -

Page 41

... purchase discounts, volume rebates and cooperative advertising. The gross profit margin may fluctuate based on various factors, including vendor incentive and inventory price protection programs, cooperative advertising funds classified as a reduction of cost of sales, product mix, net service... -

Page 42

... decrease in selling and administrative expenses as a percentage of net sales, which was driven by the absence of $74.3 million in costs related to our IPO in 2013, and was partially offset by a decrease in gross profit margin. Corporate segment income from operations was $439.8 million in 2014 , an... -

Page 43

... a loss on extinguishment of long-term debt of $16.7 million , representing the difference between the redemption price and the net carrying amount of the purchased debt, adjusted for a portion of the unamortized deferred financing costs. In April 2013, we entered into a new seven-year, $1,350... -

Page 44

... of Non-GAAP net income for the years ended December 31, 2014 and 2013 below. Non-GAAP net income excludes, among other things, charges related to the amortization of acquisition-related intangible assets, non-cash equity-based compensation, and gains and losses from the early extinguishment of debt... -

Page 45

... December 31, 2014 2013 Acceleration charge for certain equity awards and related employer payroll taxes RDU Plan cash retention pool accrual Management services agreement termination fee Other expenses IPO- and secondary-offering related expenses (5) Based on a normalized effective tax rate of 39... -

Page 46

...) Years Ended December 31, 2014 2013 Net income Depreciation and amortization Income tax expense Interest expense, net EBITDA Adjustments: Non-cash equity-based compensation Sponsor fee Net loss on extinguishments of long-term debt Litigation, net (1) IPO- and secondary-offering related expenses... -

Page 47

..., 2012 Dollars in Millions Percentage of Net Sales Net sales Cost of sales Gross profit Selling and administrative expenses Advertising expense Income from operations Interest expense, net Net loss on extinguishments of long-term debt Other income, net Income before income taxes Income tax expense... -

Page 48

... specialists and service delivery roles. Our total net sales growth for the year ended December 31, 2013 reflected growth in notebooks/mobile devices, netcomm products and software. Software gains were driven by growth in security, document management software and network management software... -

Page 49

... The gross profit margin may fluctuate based on various factors, including vendor incentive and inventory price protection programs, cooperative advertising funds classified as a reduction of cost of sales, product mix, net service contract revenue, commission revenue, pricing strategies, market... -

Page 50

...to 6.1% in 2013, from 6.3% in 2012. Results for 2013 included $26.4 million of IPO- and secondary-offering related expenses, which reduced Corporate segment operating margin by 40 basis points. Higher sales and gross profit dollars offset the effect of IPO- and secondary-offering related expenses on... -

Page 51

... income for the years ended December 31, 2013 and 2012 below. Non-GAAP net income excludes, among other things, charges related to the amortization of acquisition-related intangibles, non-cash equity-based compensation, IPO- and secondary-offering related expenses and gains and losses from the early... -

Page 52

... December 31, 2013 2012 Acceleration charge for certain equity awards and related employer payroll taxes RDU Plan cash retention pool accrual Management services agreement termination fee Other expenses IPO- and secondary-offering related expenses (5) Based on a normalized effective tax rate of 39... -

Page 53

...Years Ended December 31, 2013 2012 Net income Depreciation and amortization Income tax expense Interest expense, net EBITDA Adjustments: Non-cash equity-based compensation Sponsor fee Consulting and debt-related professional fees Net loss on extinguishments of long-term debt Litigation, net (1) IPO... -

Page 54

Liquidity and Capital Resources 49 -

Page 55

..., depending on share price, market conditions and other factors. The share repurchase program does not obligate us to repurchase any dollar amount or number of shares, and repurchases may be commenced or suspended from time to time without prior notice. As of the date of this filing, no shares have... -

Page 56

... were as follows: (in millions) 2014 Years Ended December 31, 2013 2012 Net cash provided by (used in): Operating activities Investing activities Net change in accounts payable - inventory financing Other financing activities Financing activities Effect of exchange rate changes on cash and cash... -

Page 57

Table of Contents In order to manage our working capital and operating cash needs, we monitor our cash conversion cycle, defined as days of sales outstanding in accounts receivable plus days of supply in inventory minus days of purchases outstanding in accounts payable, based on a rolling three-... -

Page 58

... affiliate of Providence Equity in a privately-...plus accrued and unpaid interest through the date of redemption. Inventory Financing Agreements We have entered into agreements with certain financial intermediaries to facilitate the purchase of inventory from various suppliers under certain terms... -

Page 59

...December 2014 for our future headquarters in Lincolnshire, Illinois. Also reflected in these amounts is the future expiration of two leases in the first quarter of 2016 for facilities currently in use by us which we plan to consolidate into the new headquarters location and accordingly, these leases... -

Page 60

...the vendor or third-party service provider is recorded as a reduction to sales, resulting in net sales being equal to the gross profit on the transaction. Our larger customers are offered the opportunity by certain of our vendors to purchase software licenses and SA under enterprise agreements ("EAs... -

Page 61

...by management, additional inventory write-downs may be required. Vendor Programs We receive incentives from certain of our vendors related to cooperative advertising allowances, volume rebates, bid programs, price protection and other programs. These incentives generally relate to written agreements... -

Page 62

... of Market Risks Our market risks relate primarily to changes in interest rates. The interest rates on borrowings under our senior secured asset-based revolving credit facility and our senior secured term loan facility are floating and, therefore, are subject to fluctuations. In order to manage the... -

Page 63

... and Supplementary Data Index to Consolidated Financial Statements Page Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets as of December 31, 2014 and 2013 Consolidated Statements of Operations for the years ended December 31, 2014, 2013 and 2012 Consolidated... -

Page 64

... of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of CDW Corporation We have audited the accompanying consolidated balance sheets of CDW Corporation and subsidiaries as of December 31, 2014 and 2013, and the related consolidated statements of operations... -

Page 65

... Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable-trade Accounts payable-inventory financing Current maturities of long-term debt Deferred revenue Accrued expenses: Compensation Interest Sales taxes Advertising Income taxes Other Total current liabilities Long... -

Page 66

60 -

Page 67

... Ended December 31, 2014 2013 2012 Net sales Cost of sales Gross profit Selling and administrative expenses Advertising expense Income from operations Interest expense, net Net loss on extinguishments of long-term debt Other income, net Income before income taxes Income tax expense Net income Net... -

Page 68

... CDW CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) Years Ended December 31, 2014 2013 2012 Net income Foreign currency translation adjustment (net of tax benefit of $0.5 million, $0 million, and $0 million, respectively) Other comprehensive (loss... -

Page 69

... Investment from CDW Holdings LLC Repurchase of common shares Accrued charitable contribution related to the MPK Coworker Incentive Plan II, net of tax Net income Incentive compensation plan units withheld for taxes Foreign currency translation adjustment Balance at December 31, 2012 Equity-based... -

Page 70

...-term liabilities Net cash provided by operating activities Cash flows from investing activities: Capital expenditures Payment for equity investment Payment of accrued charitable contribution related to the MPK Coworker Incentive Plan II Premium payments on interest rate cap agreements Net cash used... -

Page 71

Interest paid Taxes paid, net of taxes refunded Non-cash investing and financing activities: Capital expenditures accrued in accounts payable-trade $ $ (195.8) (241.2) $ $ (267.6) (82.5) $ $ (302.7) (123.2) $ 0.6 $ 0.2 $ 0.5 The accompanying notes are an integral part of the ... -

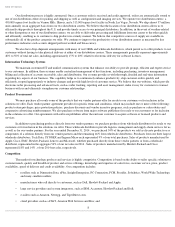

Page 72

...integrated information technology ("IT") solutions to small, medium and large business, government, education and healthcare customers in the U.S. and Canada. The Company's offerings range from discrete hardware and software products to integrated IT solutions such as mobility, security, data center... -

Page 73

... consist of amounts due from vendors. The Company receives incentives from vendors related to cooperative advertising allowances, volume rebates, bid programs, price protection and other programs. These incentives generally relate to written vendor agreements with specified performance requirements... -

Page 74

...recognized in interest expense over the estimated life of the related debt instrument using the effective interest method or straight-line method, as applicable. Derivatives The Company has entered into interest rate cap agreements for the purpose of economically hedging its exposure to fluctuations... -

Page 75

...vendor or third-party service provider is recorded as a reduction to sales, resulting in net sales being equal to the gross profit on the transaction. The Company's larger customers are offered the opportunity by certain of its vendors to purchase software licenses and SA under enterprise agreements... -

Page 76

..., the Company uses its best estimate of selling prices. The Company records freight billed to its customers as net sales and the related freight costs as a cost of sales. Deferred revenue includes (1) payments received from customers in advance of providing the product or performing services, and... -

Page 77

... impairment. The annual test for impairment is conducted as of December 1. The Company's reporting units used to assess potential goodwill impairment are the same as its operating segments. The Company has two reportable segments: Corporate, which is comprised primarily of business customers, 70 -

Page 78

... six years. The Company used a 3.5% long-term assumed consolidated annual revenue growth rate for periods after the six-year forecast. The estimated future cash flows for the Corporate and Public reporting units were discounted at 10.0% ; cash flows for the Canada and CDW Advanced Services reporting... -

Page 79

... six years. The Company used a 3.5% long-term assumed consolidated annual revenue growth rate for periods after the six-year forecast. The estimated future cash flows for the Corporate and Public reporting units were discounted at 11.5% ; cash flows for the Canada and CDW Advanced Services reporting... -

Page 80

....0 During 2014, the Company recorded disposals of $41.7 million to remove fully amortized internally developed software assets that were no longer in use from intangible assets. Amortization expense related to intangible assets for the years ended December 31, 2014, 2013 and 2012 was $182.1 million... -

Page 81

-

Page 82

... by the inventory purchased under these financing agreements and a second lien on the related accounts receivable. 6. Lease Commitments The Company is obligated under various non-cancelable operating lease agreements for office facilities that generally provide for minimum rent payments and... -

Page 83

74 -

Page 84

...for as long as, CDW LLC's corporate credit rating from Standard & Poor's Rating Services is BB or better and CDW LLC's corporate family rating from Moody's Investors Service, Inc. is Ba3 or better (in each case with stable or better outlook). Under the new Revolving Loan, the Company is permitted to... -

Page 85

... alternate base rate ("ABR") plus a margin or (b) LIBOR plus a margin; provided that for the purposes of the Term Loan, LIBOR shall not be less than 1.00% per annum at any time ("LIBOR Floor"). The margin is based upon a net leverage ratio as defined in the agreement governing the Term Loan, ranging... -

Page 86

.... The counterparty credit spreads are based on publicly available credit information obtained from a third party credit data provider. See Note 20 for a description of the interest rate cap agreements entered into during the first quarter of 2015. On January 30, 2013, the Company made an optional... -

Page 87

... semi-annually on February 15 and August 15 of each year. The first interest payment date was February 15, 2015. CDW LLC and CDW Finance Corporation are the co-issuers of the 2022 Senior Notes and the obligations under the notes are guaranteed by Parent and each of CDW LLC's direct and indirect... -

Page 88

...CDW Finance Corporation are the co-issuers of the 2024 Senior Notes and the obligations under the notes are guaranteed by Parent and each of CDW LLC's direct and indirect, wholly owned, domestic subsidiaries. The 2024 Senior Notes indenture contains negative covenants that, among other things, place... -

Page 89

... value of the Company's long-term debt instruments at December 31, 2014 was $3,208.7 million . The fair value of the 2019 Senior Notes, the 2022 Senior Notes, and the 2024 Senior Notes was estimated using quoted market prices for identical assets or liabilities that are traded in over-the-counter... -

Page 90

...) December 31, 2014 2013 Deferred Tax Assets: Deferred interest State net operating loss and credit carryforwards, net Payroll and benefits Rent Accounts receivable Equity compensation plans Trade credits Other Total deferred tax assets Deferred Tax Liabilities: Software and intangibles Deferred... -

Page 91

... from time to time without prior notice. As of the date of this filing, no shares have been repurchased under the share repurchase program. On January 1, 2014, the first offering period under the Company's Coworker Stock Purchase Plan (the "CSPP") commenced. The CSPP provides the opportunity for... -

Page 92

.... (in millions) Acceleration charge for certain equity awards and related employer payroll taxes (1) RDU Plan cash retention pool accrual Other expenses (4) IPO- and secondary-offering-related expenses (2) Year Ended December 31, 2014 2013 $ Management services agreement termination fee... -

Page 93

... the modification of Class B Common Unit awards granted pursuant to the CDW Holdings LLC 2007 Incentive Equity Plan to the Company's former Chief Executive Officer, as discussed further below in the section labeled "Class B Common Units." The total unrecognized compensation cost related to nonvested... -

Page 94

... of Contents CDW CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Year Ended December 31, 2014 2013 Weighted-average grant date fair value Weighted-average volatility (1) Weighted-average risk-free rate (2) Dividend yield Expected term (in years) (3) (1) (2) (3) $ 7.23... -

Page 95

... the years ended December 31, 2014 and 2013 was $68.6 million and $26.7 million , respectively. Pre-IPO Equity Awards Prior to the IPO, the Company had the following equity-based compensation plans in place: Class B Common Units The Board of Managers of CDW Holdings adopted the CDW Holdings LLC 2007... -

Page 96

... at the time the awards were granted. On July 2, 2013, the Company completed an IPO of its common shares. Under the terms of the MPK Plan, vesting accelerated for all unvested units upon completion of the IPO. The Company recorded a pre-tax charge of $36.7 million for compensation expense related to... -

Page 97

... purchase price (goodwill) at the time the contingency is resolved. As of December 31, 2013, the Company accrued $20.9 million related to this arrangement within other current liabilities, as the Company realized the tax benefit of the compensation deductions during the 2013 tax year. The Company... -

Page 98

... Company acquired a 35% non-controlling interest in Kelway, a UK-based IT solutions provider, which has global supply chain relationships that enable it to conduct business in over 100 countries. The Company paid $86.8 million to acquire its ownership interest in Kelway, with the option to purchase... -

Page 99

... has two reportable segments: Corporate, which is comprised primarily of business customers, and Public, which is comprised of government entities and education and healthcare institutions. The Company also has three other operating segments, CDW Advanced Services, Canada and Kelway, which do not... -

Page 100

... Net Sales Year Ended December 31, 2013 Dollars in Millions Percentage of Total Net Sales Year Ended December 31, 2012 Dollars in Millions Percentage of Total Net Sales Notebooks/Mobile Devices $ NetComm Products Enterprise and Data Storage (Including Drives) Other Hardware Software Services Other... -

Page 101

... for the years ended December 31, 2014, 2013 and 2012 , in accordance with Rule 3-10 of Regulation S-X. The consolidating financial information includes the accounts of CDW Corporation (the "Parent Guarantor"), which has no independent assets or operations, the accounts of CDW LLC (the "Subsidiary... -

Page 102

... $ Liabilities and Shareholders' Equity Current liabilities: Accounts payable-trade $ Accounts payable-inventory financing Current maturities of long-term debt Deferred revenue Accrued expenses Total current liabilities Long-term liabilities: Debt Deferred income taxes Other liabilities Total long... -

Page 103

... $ Liabilities and Shareholders' Equity Current liabilities: $ Accounts payable-trade Accounts payable-inventory financing Current maturities of long-term debt Deferred revenue Accrued expenses Total current liabilities Long-term liabilities: Debt Deferred income taxes Other liabilities Total long... -

Page 104

... sales $ Cost of sales Gross profit Selling and administrative expenses Advertising expense (Loss) income from operations Interest (expense) income, net Net loss on extinguishments of longterm debt Management fee Other income, net (Loss) income before income taxes Income tax benefit (expense) (Loss... -

Page 105

... Net sales $ Cost of sales Gross profit Selling and administrative expenses Advertising expense (Loss) income from operations Interest (expense) income, net Net loss on extinguishments of longterm debt Management fee Other (expense) income, net (Loss) income before income taxes Income tax benefit... -

Page 106

... of Operations Year Ended December 31, 2012 (in millions) Parent Guarantor Subsidiary Issuer Guarantor Subsidiaries Non-Guarantor Subsidiary Co-Issuer Consolidating Adjustments Consolidated Net sales $ Cost of sales Gross profit Selling and administrative expenses Advertising expense (Loss) income... -

Page 107

97 -

Page 108

Table of Contents CDW CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Condensed Consolidating Statement of Comprehensive Income Year Ended December 31, 2014 (in millions) Parent Guarantor Subsidiary Issuer Guarantor Subsidiaries Non-Guarantor Subsidiary Co-Issuer ... -

Page 109

98 -

Page 110

Table of Contents CDW CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Condensed Consolidating Statement of Comprehensive Income Year Ended December 31, 2013 (in millions) Parent Guarantor Subsidiary Issuer Guarantor Subsidiaries Non-Guarantor Subsidiary Co-Issuer ... -

Page 111

99 -

Page 112

Table of Contents CDW CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Condensed Consolidating Statement of Comprehensive Income Year Ended December 31, 2012 (in millions) Parent Guarantor Subsidiary Issuer Guarantor Subsidiaries Non-Guarantor Subsidiary Co-Issuer ... -

Page 113

100 -

Page 114

... Net cash (used in) provided by $ operating activities Cash flows from investing activities: Capital expenditures Payment for equity investments Payment of accrued charitable contribution related to the MPK Coworker Incentive Plan II Premium payments on interest rate cap agreements Net cash used in... -

Page 115

... change in accounts payable- - inventory financing Payment of incentive compensation plan withholding taxes - (4.0) Net proceeds from issuance of common shares 424.7 - Dividends paid (7.3) - Advances to/from affiliates (402.2) 892.6 Other financing activities - 0.4 Net cash provided by (used in) 15... -

Page 116

...from issuance of longterm debt Payments to extinguish longterm debt Payment of debt financing costs Net change in accounts payableinventory financing Advances to/from affiliates Other financing activities Net cash provided by (used in) financing activities Effect of exchange rate changes on cash and... -

Page 117

... Third Quarter Fourth Quarter Net Sales Detail: Corporate: Medium/Large (2) Small Business (2) Total Corporate Public: Government Education Healthcare Total Public Other Net sales Gross profit Income from operations (3) Net income (loss) (3) Net income (loss) per common share (1)(3) : Basic Diluted... -

Page 118

... quarter of 2014. The third quarter of 2013 included pre-tax IPO-related charges of $74.1 million . See Note 9 for additional discussion of the IPO. Subsequent Events During the first quarter of 2015, the Company entered into six interest rate cap agreements with a combined notional amount of $400... -

Page 119

... of Period Charged to Costs and Expenses Deductions Balance at End of Period Allowance for doubtful accounts: Year Ended December 31, 2014 Year Ended December 31, 2013 Year Ended December 31, 2012 Reserve for sales returns: Year Ended December 31, 2014 Year Ended December 31, 2013 Year Ended... -

Page 120

...files or submits under the Exchange Act, and that information is accumulated and communicated to the Company's management, including the Company's Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely discussions regarding required disclosure. Management's Annual Report... -

Page 121

... accompanying Management's Annual Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the company's internal control over financial reporting based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting... -

Page 122

Table of Contents Item 9B. Other Information None. 109 -

Page 123

... PART III Item 10. Directors, Managers, Executive Officers and Corporate Governance We have adopted The CDW Way Code, our code of business conduct and ethics, that is applicable to all of our coworkers. Additionally, within The CDW Way Code is a Financial Integrity Code of Ethics that sets forth... -

Page 124

... are filed as part of this report: (1) Consolidated Financial Statements: Page Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets as of December 31, 2014 and 2013 Consolidated Statements of Operations for the years ended December 31, 2014, 2013 and 2012 Consolidated... -

Page 125

..., the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. CDW CORPORATION Date: February 26, 2015 By: /s/ Thomas E. Richards Thomas E. Richards Chairman, President and Chief Executive Officer Pursuant to the requirements of the Securities... -

Page 126

... Chairman, President and Chief Executive Officer (principal executive officer) and Director February 26, 2015 Senior Vice President and Chief Financial Officer (principal financial officer) February 26, 2015 Vice President and Controller (principal accounting officer) Director February 26... -

Page 127

... Company Agreement of CDW Direct, LLC, previously filed as Exhibit 3.10 with CDW Corporation's Form S-4 filed on September 7, 2010 (Reg. No. 333-169258) and incorporated herein by reference. 3.11 Articles of Organization of CDW Government LLC, previously filed as Exhibit 3.11 with CDW Corporation... -

Page 128

..., previously filed as Exhibit 4.1 with CDW Corporation's Amendment No. 3 to Form S1 filed on June 25, 2013 (Reg. No. 333-187472) and incorporated herein by reference. 4.2 Indenture, dated as of August 5, 2014, by and among CDW LLC, CDW Finance Corporation, the guarantors party thereto and... -

Page 129

...by reference. 4.10 Base Indenture, dated as of December 1, 2014, by and among CDW LLC, CDW Finance Corporation, CDW Corporation, the guarantors party thereto and U.S. Bank National Association as trustee, previously filed as Exhibit 4.1 with CDW Corporation's Form 8-K filed on December 1, 2014 and... -

Page 130

...-documentation agents party thereto, previously filed as Exhibit 10.1 with CDW Corporation's Form 8-K filed on May 1, 2013 and incorporated herein by reference. 10.3 First Amendment to Term Loan Agreement, dated as of May 30, 2013, by and among CDW LLC, the lenders from time to time party thereto... -

Page 131

... 10.2 with CDW Corporation's Form 8-K filed on May 1, 2013 and incorporated herein by reference. 10.7 Management Services Agreement, dated as of October 12, 2007, by and between CDW Corporation, Madison Dearborn Partners V-B, L.P. and Providence Equity Partners L.L.C., previously filed as Exhibit... -

Page 132

...Partners V-C, L.P., Madison Dearborn Capital Partners V Executive-A, L.P., Providence Equity Partners VI L.P., Providence Equity Partners VI-A L.P. and the other securityholders party thereto, previously filed as Exhibit 10.33 with CDW Corporation's Amendment No. 2 to Form S-1 filed on June 14, 2013... -

Page 133

...10.20§ CDW Corporation 2013 Long-Term Incentive Plan, previously filed as Exhibit 10.35 with CDW Corporation's Amendment No. 2 to Form S-1 filed on June 14, 2013 (Reg. No. 333-187472) and incorporated herein by reference. 10.21§ CDW Corporation Coworker Stock Purchase Plan, previously filed as... -

Page 134

...Non-Employee Director Restricted Stock Unit Award Agreement under the CDW Corporation 2013 Long-Term Incentive Plan, previously filed as Exhibit 10.6 with CDW Corporation's Form 10-Q filed on May 12, 2014 and incorporated herein by reference. 12.1* Computation of ratio of earnings to fixed charges... -

Page 135

Table of Contents Exhibit Number Description 23.1* 31.1* Consent of Ernst & Young LLP. Certification of Chief Executive Officer pursuant to Rule 13a-14(a) or Rule 15d-14(a) under the Securities Exchange Act of 1934. 31.2* Certification of Chief Financial Officer pursuant to Rule 13a-14(a) or ... -

Page 136

Exhibit 10.31 CDW CORPORATION 2013 LONG-TERM INCENTIVE PLAN PERFORMANCE SHARE AWARD AGREEMENT CDW Corporation, a Delaware corporation (the " Company "), hereby grants to the individual (the " Holder ") named in the award notice attached hereto (the " Award Notice ") as of the date set forth in the ... -

Page 137

... the 24-month anniversary of the first day of the Performance Period, the Performance Period shall end as of the date of the Change in Control, and the number of shares of Stock earned pursuant to Section 3.1 shall be based on the projected level of performance through the end of the Performance... -

Page 138

... earlier, the Holder's termination of employment; provided that to the extent that any Required Tax Payments are due prior to such vesting date, the Company shall withhold whole shares of Stock from the number of shares subject to the Award having an aggregate Fair Market Value, determined as of the... -

Page 139

... of employment at a time when (i) the Holder has attained age 55 and (B) the sum of the Holder's age and years of employment with or service to the Company or its Subsidiaries equals or exceeds 65; provided that such termination occurs at least six months after the Grant Date. (e) 4. Clawback... -

Page 140

... prior to the date of the Holder's termination of employment or service with the Company, the Fair Market Value of a share of Common Stock on the date such portion of the Award became vested, multiplied by the number of shares of Common Stock that became vested. The remedy provided by this Section... -

Page 141

... States mail or express courier service; provided , however , that if a notice, request or other communication sent to the Company is not received during regular business hours, it shall be deemed to be received on the next succeeding business day of the Company. 6.7. Governing Law . This Agreement... -

Page 142

...be governed by the laws of the State of Delaware and construed in accordance therewith without giving effect to principles of conflicts of laws. 6.8. Agreement Subject to the Plan . This Agreement is subject to the provisions of the Plan and shall be interpreted in accordance therewith. In the event... -

Page 143

....1 CDW CORPORATION COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES (unaudited) Years ended December 31, (dollars in millions) 2010 Computation of earnings: 2011 2012 2013 2014 Income (loss) before income taxes and adjustment for (income) loss from equity investees Distributed income from equity... -

Page 144

... Statement (Form S-3 ASR No. 333-199425) of CDW Corporation, and (2) Registration Statement (Form S-8 No. 333-189622) pertaining to the 2013 Long-Term Incentive Plan and Coworker Stock Purchase Plan of CDW Corporation; of our reports dated February 26, 2015, with respect to the consolidated... -

Page 145

... information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /s/ Thomas E. Richards Thomas E. Richards Chairman, President and Chief Executive Officer CDW Corporation... -

Page 146

... financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /s/ Ann E. Ziegler Ann E. Ziegler Senior Vice President and Chief Financial Officer CDW Corporation... -

Page 147

...1350 OF CHAPTER 63 OF TITLE 18 OF THE UNITED STATES CODE I, Thomas E. Richards, the chief executive officer of CDW Corporation ("CDW"), certify that (i) the Annual Report on Form 10-K for the year ended December 31, 2014 (the "10-K") of CDW fully complies with the requirements of Section 13(a) or 15... -

Page 148

... 1350 OF CHAPTER 63 OF TITLE 18 OF THE UNITED STATES CODE I, Ann E. Ziegler, the chief financial officer of CDW Corporation ("CDW"), certify that (i) the Annual Report on Form 10-K for the year ended December 31, 2014 (the "10-K") of CDW fully complies with the requirements of Section 13(a) or 15...