Big Lots 2011 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2011 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

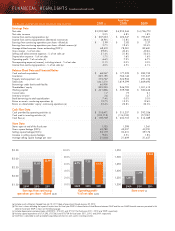

Earnings Data

Net sales $ 5,202,269 $ 4,952,244 $ 4,726,772

Net sales increase 5.0% 4.8% 1.8%

Income from continuing operations (b) $ 207,235 $ 222,547 $ 195,627

Income from continuing operations (decrease) increase (b) (6.9)% 13.8% 26.4%

Earnings from continuing operations per share - diluted (b) $ 2.99 $ 2.83 $ 2.37

Earnings from continuing operations per share - diluted increase (b) 5.7% 19.4% 25.4%

Average diluted common shares outstanding (000's) 69,419 78,581 82,681

Gross margin - % of net sales 39.8% 40.6% 40.6%

Selling and administrative expenses - % of net sales (b) 31.4% 31.8% 32.3%

Depreciation expense - % of net sales 1.7% 1.6% 1.6%

Operating profit - % of net sales (b) 6.6% 7.2% 6.7%

Non-operating expense (income), including interest - % of net sales 0.1% 0.0% 0.0%

Income from continuing operations - % of net sales (b) 4.0% 4.5% 4.1%

Balance Sheet Data and Financial Ratios

Cash and cash equivalents $ 68,547 $ 177,539 $ 283,733

Inventories 825,195 762,146 731,337

Property and equipment - net 572,767 524,906 491,256

Total assets 1,641,310 1,619,599 1,669,493

Borrowings under bank credit facility 65,900 – –

Shareholders’ equity 823,233 946,793 1,001,412

Working capital $ 421,836 $ 509,788 $ 580,446

Current ratio 1.7 1.9 2.1

Inventory turnover 3.6 3.6 3.7

Bank borrowings to total capitalization 7.4% 0.0% 0.0%

Return on assets - continuing operations (b) 12.7% 13.5% 12.6%

Return on shareholders’ equity - continuing operations (b) 23.4% 22.8% 22.0%

Cash Flow Data

Cash provided by operating activities (c) $ 318,471 $ 315,257 $ 392,026

Cash used in investing activities (d) (120,712) (114,552) (77,937)

Cash flow (e) $ 197,759 $ 200,705 $ 314,089

Store Data

Stores open at end of the fiscal year 1,533 1,398 1,361

Gross square footage (000’s) 45,780 42,037 40,591

Selling square footage (000’s) 33,119 30,210 29,176

Increase in selling square footage 9.6% 3.5% 1.8%

Average selling square footage per store 21,604 21,609 21,437

FINANCIAL HIGHLIGHTS (Unaudited Adjusted Results)

($ in thousands, except per share amounts and sales per selling square foot) 2 011 ( a ) 2 010 2009

Fiscal Year

(a)

Includes results of Big Lots Canada from July 18, 2011 (date of acquisition) through January 28, 2012.

(b)

This item is shown excluding the impact of certain items for fiscal year 2009. A reconciliation of the difference between GAAP and the non-GAAP financial measures presented in this

table for fiscal year 2009 is shown on the following page.

(c)

Includes depreciation and amortization of $82,851, $74,041, and $71,501 for fiscal years 2011, 2010, and 2009, respectively.

(d)

Includes capital expenditures of $131,293, $107,563, and $78,708 for fiscal years 2011, 2010, and 2009, respectively.

(e)

Cash flow is calculated as cash provided by operating activities less cash used in investing activities.

$3.50

$3.00

$2.50

$2.00

$1.50 2009 2010

Earnings from continuing

operations per share - diluted (a) (b)

$2.83

$2.37

$2.99

2 011

1,550

1,500

1,450

1,400

1,350

1,300 2009 2010

Store count

(a)

1,398

1,361

1,533

2 011

10.0%

8.0%

6.0%

4.0%

2.0%

0.0% 2009 2010

Operating profit -

% of net sales (a) ( b)

7.2 %

6.7% 6.6%

2 011