Big Lots 2007 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2007 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

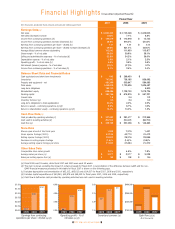

Fiscal Year

2007 2006 2005

($ in thousands, except per share amounts and sales per selling square foot)

Earnings Data

(a)

Net sales

$ 4,656,302 $ 4,743,048 $ 4,429,905

Net sales (decrease) increase

(1.8)% 7.1% 6.8%

Income from continuing operations (b)

$ 145,079 $ 112,618 $ 15,725

Income from continuing operations increase (decrease) (b)

28.8% 616.2% (50.0)%

Earnings from continuing operations per share - diluted (b)

$ 1.41 $ 1.01 $ 0.14

Earnings from continuing operations per share - diluted increase (decrease) (b)

39.6% 621.4% (48.1)%

Average diluted common shares outstanding

102,542 111,930 113,677

Gross margin - % of net sales

39.5% 39.9% 39.1%

Selling and administrative expenses - % of net sales (b)

32.8% 34.2% 36.0%

Depreciation expense - % of net sales

1.9% 2.1% 2.5%

Operating profi t - % of net sales (b)

4.9% 3.5% 0.6%

Net interest (income) expense - % of net sales

(0.1)% (0.1)% 0.1%

Income from continuing operations - % of net sales (b)

3.1% 2.4% 0.4%

Balance Sheet Data and Financial Ratios

Cash equivalents and short-term investments

$ 643 $ 269,430 $ -

Inventories

747,942 758,185 836,092

Property and equipment - net

481,366 505,647 584,083

Total assets

1,443,815 1,720,526 1,625,497

Long-term obligations

163,700 - 5,500

Shareholders’ equity

638,486 1,129,703 1,078,724

Working capital

$ 390,766 $ 674,815 $ 557,231

Current ratio

1.8 2.4 2.3

Inventory turnover (a)

3.5 3.4 3.0

Long-term obligations to total capitalization

20.4% 0.0% 0.5%

Return on assets - continuing operations (a) (b)

9.2% 6.7% 0.9%

Return on shareholders’ equity - continuing operations (a) (b)

16.4% 10.2% 1.5%

Cash Flow Data

(a)

Cash provided by operating activities (c)

$ 307,932 $ 381,477 $ 212,965

Cash used in investing activities (d)

(58,764) (30,421) (66,702)

Cash fl ow (e)

$ 249,168 $ 351,056 $ 146,263

Store Data

Stores open at end of the fi scal year

1,353 1,375 1,401

Gross square footage (000’s)

40,195 40,770 41,413

Selling square footage (000’s)

28,902 29,376 29,856

Decrease in selling square footage

(1.6)% (1.6)% (3.5)%

Average selling square footage per store

21,362 21,364 21,310

Other Sales Data

Comparable store sales growth

2.0% 4.6% 1.8%

Average sales per store (a)

$ 3,377 $ 3,377 $ 3,028

Sales per selling square foot (a)

$ 158 $ 158 $ 146

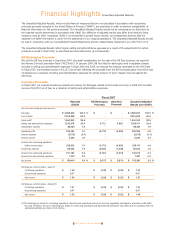

Financial Highlights(Unaudited Adjusted Results)

$1.50

$1.25

$1.00

$0.75

$0.50

$0.25

$0.00

Earnings from continuing

operations per share - diluted

(a) (b)

$1.01

6.0%

4.0%

2.0%

0.0%

Operating profi t - % of

net sales

(a) (b)

0.6%

3.5%

4.9%

(a) Fiscal 2006 was 53 weeks, while fi scal 2007 and 2005 were each 52 weeks.

(b) This item is shown excluding the impact of certain proceeds for fi scal 2007. A reconciliation of the difference between GAAP and the non-

GAAP fi nancial measures presented in this table for fi scal 2007 is shown on the following page.

(c) Includes depreciation and amortization of $83,103, $95,613 and $114,617 for fi scal 2007, 2006 and 2005, respectively.

(d) Includes capital expenditures of $60,360, $35,878 and $68,503 for fi scal years 2007, 2006 and 2005, respectively.

(e) Cash fl ow is defi ned as cash provided by operating activities less cash used in investing activities.

2005 2006 20072005 2006 2007

$0.14

$1.41

3.6

3.2

2.8

2.4

Inventory turnover

(a)

3.0

3.4

3.5

$400,000

$300,000

$200,000

$100,000

Cash fl ow

(a) (e)

($ in thousands)

$146,263

$351,056

$249,168

2005 2006 2007 2005 2006 2007 2005 2006 2007

2007 Big Lots Annual Report