Bank of the West 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

relationship bankers offer specialized expertise in

agribusiness, commercial real estate, construction,

financial institutions, healthcare, municipalities and

religious institutions.

Supporting Our Communities

Throughout our footprint, Bank of the West actively

supports the economic health of our communities. From

college athletic programs and events sponsorships to

financial literacy seminars and corporate philanthropy,

we focus on building vibrant communities where we

and our neighbors can thrive.

Our dedicated employees are the lifeblood of Bank

of the West’s service culture. They are customer

service representatives, relationship managers, home

mortgage consultants, financial advisors, branch tellers,

loan officers, private bankers and wealth management

advisors.

Along with the thousands of employees who support

the bank’s operations, our bankers and their commit-

ment to serving our customers make relationship

banking the key to our success.

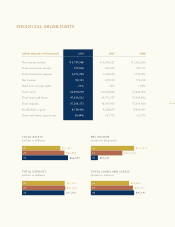

2008 Highlights

•“Highest in Customer Satisfaction among Retail

Banks in the West” J.D. Power and Associates

•Eight Outstanding Customer Service awards for

business banking, Greenwich Associates

•BancWest Investment Services, 2008 Program of the

Year, Bank Insurance & Securities Association

•Total assets up 8% at $66.9 billion

•Loans and leases up 8% at $47.1 billion

•Mortgage growth of 28%

•Opened branches in Arizona, California, Idaho

and Utah

Our strength and stability are measured by:

Strong Credit Ratings

Credit ratings* are a key measure of capital strength

and financial stability. They are also a recognition

from rating agencies of a strong balance sheet and

consistent financial performance.

* long-term deposit ratings

As of December 31, 2008

Moody’s Aa3

Standard & Poor’s AA-

Fitch AA

Strong Capital Position

Bank of the West is one of the 25 largest commercial

banks in the United States. Our capital position

exceeds regulatory requirements.

Tier 1 Leverage

Ratio 7.65% 5.00%

Tier 1 Risk-Based

Capital Ratio 9.15% 6.00%

Total Risk-Based

Capital Ratio 10.44% 10.00%

Bank of the West Well-Capitalized

Q4, 2008 Requirement