BT 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 BT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

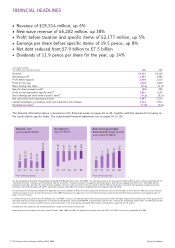

The news on dividends is again positive. Your Board is

recommending a full-year dividend of 11.9 pence per share –

a pay out ratio of 61% of earnings before specific items,

compared with 57% last year. We continue our progressive

dividend policy and expect our pay out ratio to rise to around

two-thirds of earnings in the 2008 financial year.

We operated our share buy back programme again in the

2006 financial year. This is being funded from cash generated

over and above that required for servicing our debt, which

remains below £8 billion.

BUSINESS PROGRESS

We continued to implement our strategy of growth through

business transformation. Your Board has given its backing to

targeted acquisitions that will help us confirm our status as a

leading player in the global networked IT services market. In the

2006 financial year, we acquired Atlanet in Italy (as part of a

major deal with Fiat), Cara Group in Ireland and Total Network

Solutions in the UK. And in the UK, we now have almost eight

million broadband lines over which we are able to offer

customers exciting, next-generation voice and entertainment

services. New wave revenue grew by 38% to £6.3 billion, and

accounted for around one-third of our total business.

REGULATION

We believe that a fair and flexible regulatory regime is vital for

our industry, for ensuring that we can meet customers’ growing

needs and for encouraging investment. We were pleased that,

following its strategic review of telecommunications, Ofcom

accepted the set of legally-binding Undertakings that BT

proposed in order to transform the regulatory landscape in the

UK. We believe that the impact of these Undertakings will be to

focus regulation where it remains necessary at the same time as

stimulating de-regulation wherever possible.

PENSIONS

BT stands fully behind its pension promise to pensioners and

members of the BT Pension Scheme (BTPS). The scheme is

well-managed and its assets have grown very significantly in

recent years, from £23 billion at the end of 2002 to more than

£35 billion currently. The accounting deficit has almost halved

in the last year alone. With the Trustees of the BTPS, we are

continuing discussions on the triennial funding valuation of the

scheme. In particular, we aim to review recent pensions

legislation and guidelines, and examine the implications and

extent of the Crown Guarantee given on privatisation in 1984.

The Crown Guarantee, which applies to liabilities assumed by

BT in 1984 and only in the event of insolvency, is an extra layer

of security for BT pensioners.

THE BOARD

There were a number of changes to your Board during the year.

I would like to welcome Matti Alahuhta and Phil Hodkinson as

non-executive directors. Matti has been President of Kone

Corporation since January 2005 and was previously at Nokia;

Phil is Group Finance Director of HBOS. Both bring a wide

range of commercial and senior management experience to

your company. I would also like to thank Lou Hughes who

stepped down as a non-executive director on 31 March 2006 for

his excellent contribution over more than six years. I’m pleased

that his experience is not lost to us: he has joined our Americas

Advisory Board.

OUR WIDER RESPONSIBILITIES

Our aim as a communications company is to operate in a

socially responsible and sustainable way and to ensure that we

help everyone benefit from improved communications and

enhanced connectivity. I’m very proud of the fact that, for the

fifth year in a row, BT was the highest placed

telecommunications company in the Dow Jones Sustainability

Index.

Climate change has been moving inexorably up the social

and corporate agendas for a number of years now. Although

telecommunications technology is environmentally friendly, BT

is one of the largest companies in the UK and one of the largest

consumers of electricity. Our operations inevitably have an

impact on the environment and we take the job of managing

that impact seriously. We are now, for example, meeting almost

all our UK electricity needs from environmentally friendly

sources, including wind generation, solar, wave and

hydroelectric schemes.

LOOKING FORWARD

I am very grateful to our shareholders and our customers for

their continued loyalty and the confidence that they have shown

in BT’s programme of transformation. I’d like to thank our

employees for making that programme happen.

Your company is well set for continued success in the years

ahead. Our performance underpins our confidence that we can

continue to grow revenue, EBITDA, earnings per share and

dividends over the coming year, and accelerate the strategic

transformation of the business.

Sir Christopher Bland

Chairman

17 May 2006

Our results for the 2006 financial year were excellent.

Earnings per share before specific items grew by 8% to

19.5 pence. We continued to invest significantly in

technologies and systems designed to transform our

customers’ experience, at the same time as generating free

cash flow of £1.6 billion.

CHAIRMAN’S MESSAGE

Chairman’s message BT Group plc Annual Report and Form 20-F 2006 3