BT 1997 Annual Report Download

Download and view the complete annual report

Please find the complete 1997 BT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

Contents

2Chairman’s statement

4An interview with Chief Executive, Sir Peter Bonfield

6Business review

13 Financial review

21 Report of the directors

22 Board of directors

24 Corporate governance

26 Auditors’ report on corporate governance matters

27 Report of the Board Committee on Executive Remuneration

34 Statement of directors’ responsibility

34 Report of the auditors

35 Five year financial summary

36 Accounting policies

38 Consolidated financial statements

61 Subsidiary and associated undertakings

63 Quarterly analysis of turnover and profit

64 Financial statistics

65 Operational statistics

66 Regulatory statistics and information

67 United States Generally Accepted Accounting

Principles reconciliations

69 Additional information for shareholders

72 Index

3Proposed merger with MCI announced to form group

with annual turnover of around £26 billion

3Prices reduced by over £800 million in the year

3Strategic alliances and joint ventures in Europe and

Asia announced or completed in year

3Operating cash flow grew by 6 per cent to £6.2 billion

3Capital expenditure maintained at over £2.7 billion

36.1 per cent increase in ordinary dividends per share

with a special dividend of 35 pence per share

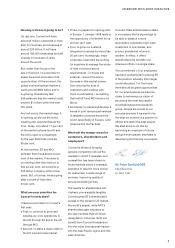

Earnings & dividends

per share (pence)

19.8

15.6

28.5

16.7

27.8

17.7

31.6

18.7

32.8

54.85

93 94 95 96 97

Earnings per share

Dividends per share

Capital expenditure (£m)

2,155

2,171

2,671

2,771

2,719

93 94 95 96 97

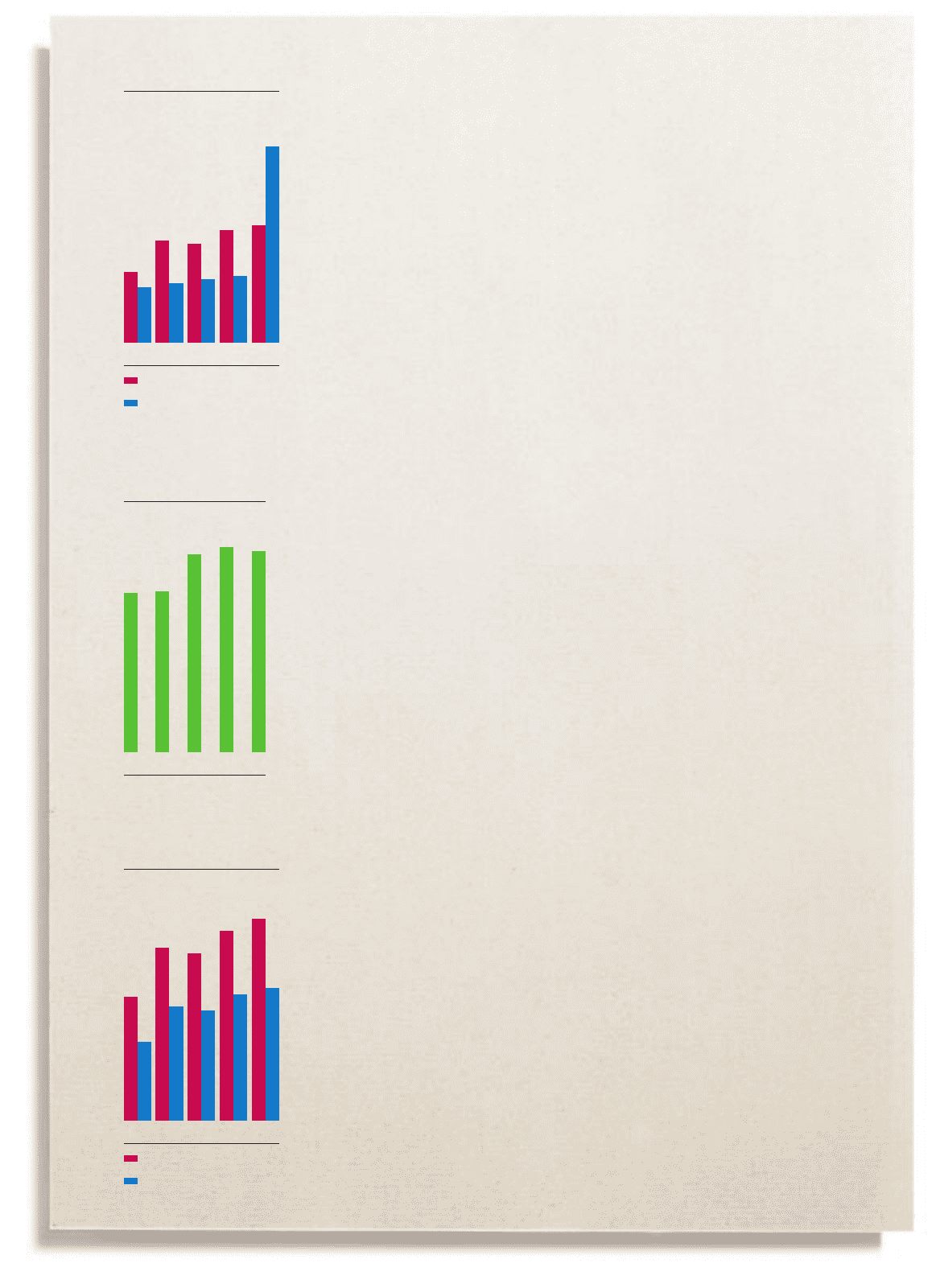

Profit before and after tax (£m)

1,972

1,248

2,756

1,805

2,662

1,736

3,019

1,992

3,203

2,101

93 94 95 96 97

Profit before tax

Profit after tax

Table of contents

-

Page 1

...Profit before and after tax (£m) 3 Proposed merger with MCI announced to form group with annual turnover of around £26 billion 2,756 3,019 3,203 2,662 3 Prices reduced by over £800 million in the year Strategic alliances and joint ventures in Europe and Asia announced or completed in year... -

Page 2

...range of call types and other services worth a total of over £800 million in the year. Earnings per share increased to 32.8p and I am pleased to report a final dividend for the year of 11.95p per share. This will be paid at the same time as the 35p per share special dividend, which was announced in... -

Page 3

... year, too, for awards to BT on its unique community programme. For business customers, the Internet and corporate intranet markets are growing at an exhilarating rate and BT and MCI in Concert will carry around half of the world's Internet traffic. We are focusing on developing integrated solutions... -

Page 4

... are you so convinced that the Concert merger is the right thing for BT? For a start, the timing of the merger is perfect. BT has done great things in the 12 years since privatisation, but we now need to become a global player. MCI also finds itself with opportunities to develop and grow. It has, of... -

Page 5

... already operative to result in more choice for customers, a wider range of services, improving quality of service and falling prices. The results for shareholders will, I believe, prove equally tangible. Concert gives BT's shareholders access to the dynamic US market, the world's largest, while MCI... -

Page 6

... of the year occurred on 3 November 1996 when BT and MCI announced that they had entered into a merger agreement to create Concert. The new company will be a world-leading communications provider with annual revenues of around £26 billion. On day one, Concert will have 43 million customers in 72... -

Page 7

... BT has a world-class reputation for technological innovation. Our investment in research and development amounts to about two per cent of annual turnover - £291 million for 1996/97. Our aim is to develop and enhance products and services which will add value to our customers' personal and business... -

Page 8

... Internet access product for business customers, BTnet, provides an "industrial strength" managed link to the Internet. And business customers will further benefit from Concert InternetPlus, the world's first high-speed, highreliability global Internet service, developed by BT and MCI. This network... -

Page 9

...year. At the end of April 1997, BT announced another ten per cent cut in its national daytime call prices and further simplified charging, with effect from 29 May 1997. The costs of calls to mobile phones on the Cellnet and Vodafone networks were cut by up to 55 per cent; a new, cheaper weekend rate... -

Page 10

... now outstrips the demand for new fixed lines. BT has a 60 per cent stake in Cellnet, the mobile network operator and, through BT Mobile, offers customers a range of mobile communications services. At the end of 1985, there were just 25,000 mobile phone users in the UK. By the middle of 1996, the... -

Page 11

.... BT is committed to providing the necessary development and training opportunities to equip our people with the skills they will need in the future. Our approach integrates development and training with business objectives, job performance and personal development needs. Last year, employees... -

Page 12

... to Total Quality Management, a well-defined human resources policy and a positive impact on society. In the annual Management Today survey of the UK's most admired companies, BT's overall ranking moved up from eighth to fifth and, on issues of community and environmental responsibility, we moved up... -

Page 13

... 80% of BT's residential customers by bill size. This new retail price control is estimated to cover services representing about 18% of the group's total turnover for the year to 31 March 1997. Interconnect charges are a key element in the development of network competition. Oftel is planning to... -

Page 14

... of increasing competition. Turnover by category £m Total 14,935 Inland telephone calls International telephone calls Telephone exchange line rentals Private circuits Mobile communications Customer premises equipment supply Yellow Pages and other directories Other sales and services Total turnover... -

Page 15

... in mobile call prices. Cellnet had 2.7 million customer connections, of which over 1.1 million were digital, at 31 March 1997. BT's expanding overseas operations in Continental Europe, including the group's systems integration business and the sales of advanced and managed network services, were... -

Page 16

...the year ending 31 March 1998 will not include the costs of these benefits under BT's current accounting policies. Associates, bond repurchase and interest charge The group's £139 million share of profits of associated undertakings consists primarily of the company's share of MCI's profits less BT... -

Page 17

... earnings at a higher level, which would lead to an increase in dividend cover over time. Financing 1997 £m 1996 £m Net cash inflow from operating activities Net cash outflow for returns on investments and servicing of finance Tax paid Capital expenditure and financial investment Acquisitions... -

Page 18

...digital cellular GSM network. Expenditure on tangible fixed assets £m Total 2,719 4 Transmission equipment Other network equipment Telephone exchanges Computers and office equipment Other 1,131 503 445 350 290 4 Capital resources At 31 March 1997, the group had cash and short-term investments... -

Page 19

... charged against the profit in the period in which people leave, whilst the most recent valuation shows the fund to be in surplus. Return on capital employed The group made a return of 18.9% on the average capital employed, on a historical cost basis, in its business in the year ended 31 March 1997... -

Page 20

...and incoming international calls with overseas telecommunication operators. To date, these imbalances have not been material. As a result, the group's profit has not been materially affected by movements in exchange rates. The merger with MCI will naturally lead to an increase in the group's foreign... -

Page 21

...the report of the Board Committee on Executive Remuneration on pages 27 to 33 form part of this report. The audited financial statements are presented on pages 36 to 62. The group's principal activity is the supply of telecommunication services and equipment. In the year, 97% of group turnover arose... -

Page 22

... Stock Exchange and president of the Confederation of British Industry. Aged 63. Sir Peter Bonfield CBE Chief Executive (a) (b) (c) (i) Sir Peter was appointed to the Board on 1 January 1996 as Chief Executive. He is also a director of BT's associated company, MCI Communications Corporation. Sir... -

Page 23

... director of Coutts & Co and a governor of the London Business School. Aged 56. (a) Member of Chairman's Committee (b) Member of Executive Committee (c) Member of Investment Committee (d) Member of Board Audit Committee (e) Member of Board Committee on Pensions (f) Member of Board Community... -

Page 24

... Chairman, as senior member. However, the Board operates as a single team. The executive directors have service agreements which are reviewed by the Board Committee on Executive Remuneration. Information about the periods of these contracts is in the report of the Committee on page 29. The Board... -

Page 25

... control The directors are responsible for the group's systems of internal financial control. Such systems can provide only reasonable and not absolute assurance against material financial misstatement or loss. Key elements are: 3 Pension fund BT's main pension fund - the BT Pension Scheme - is not... -

Page 26

...us to perform the additional work necessary to, and we do not, express any opinion on the effectiveness of either the company's system of internal financial control or its corporate governance procedures nor on the ability of the company to continue in operational existence. Opinion With respect to... -

Page 27

... the start of the financial year based on key corporate objectives - such as profitability, quality of service, customer satisfaction and revenue growth; specific weighted targets are attached to each item. Objectives are set on the basis of the BT Corporate Scorecard. This enables the Committee to... -

Page 28

... merger. 3 3 Pensions For executive directors and other senior executives, the policy is to provide pension benefits from all sources of two-thirds of final salary at normal retirement age of 60 with a two-thirds surviving spouse's pension. On death in service a lump sum equal to four times annual... -

Page 29

... table below shows the increase in the accrued benefits to which each director has become entitled during the year and the transfer value of the increase in accrued benefit: Increase in accrued annual pension in year ended 31 March 1997(a) £000 Total accrued annual Transfer pension value of as at... -

Page 30

... cover, financial counselling and share schemes. (b) Under the terms for his leaving the company on 31 December 1995, Mr Hepher continues to receive his salary and contractual benefits until his service contract expires on 5 August 1997. The total salary payable during the year ended 31 March 1997... -

Page 31

...' interests The interests of directors and their families in the company's shares at 31 March 1997 and 1 April 1996, or date of appointment if later, are shown below: Beneficial holdings Sir Iain Vallance Sir Peter Bonfield A W Rudge R P Brace Sir Colin Marshall J I W Anderson M Argent B E Breuel... -

Page 32

... of share options held at 1 April 1996, granted and exercised under the share option schemes during the year, and the balance held at 31 March 1997 are as follows: Number of share options 1 April 1996 31 March 1997 Option exercise price per share Market price at date of exercise Usual date from... -

Page 33

... plan (see page 31). (b) Based on the market value of the company's shares at 31 March 1997. The minimum figure represents those shares held at 31 March 1997 which will transfer to each director at the end of year five of the plan (1999 to 2001) provided the individual is still employed by the group... -

Page 34

... of the financial year and of the profit or loss, total recognised gains or losses and cash flows of the group for that period. The directors consider that, in preparing the financial statements for the year ended 31 March 1997 on pages 36 to 62, the company has used appropriate accounting policies... -

Page 35

...year fınancial summary YEARS ENDED 31 MARCH 1993 £m 1994 £m 1995 £m 1996 £m 1997 £m Profit and loss account Turnover Operating profit Group's share of profits of associated undertakings Profit (loss) on sale of group undertakings Net interest payable Premium on repurchase of bonds Profit... -

Page 36

... tangible fixed assets are: Freehold buildings - Leasehold land and buildings - 40 years Unexpired portion of lease or 40 years, whichever is the shorter Transmission equipment: duct - cable - radio and repeater equipment - Digital telephone exchange equipment - Computers and office equipment... -

Page 37

... into sterling at year-end exchange rates. Investments in associated undertakings are stated in the group balance sheet at the group's share of their net assets. The group's share of profits less losses of associated undertakings is included in the group profit and loss account. Investments in other... -

Page 38

... and loss account FOR THE YEAR ENDED 31 MARCH 1997 Notes 1997 £m 1996 £m Turnover Operating costs (a) Operating profit Group's share of profits of associated undertakings Profit on sale of group undertakings Interest receivable Interest payable Premium on repurchase of bonds Profit on ordinary... -

Page 39

... cash flow statement FOR THE YEAR ENDED 31 MARCH 1997 Notes 1997 £m 1996 £m Net cash inflow from operating activities Returns on investments and servicing of finance Interest received Interest paid, including finance costs Premium paid on repurchase of bonds Dividends paid to minorities Net... -

Page 40

... more than one year Loans and other borrowings 15 2,693 3,322 Provisions for liabilities and charges 17 1,391 1,267 Minority interests 208 180 Capital and reserves Called up share capital Share premium account Other reserves Profit and loss account Total equity shareholders' funds 18 19 19... -

Page 41

... falling due after more than one year Loans and other borrowings 15 3,493 3,876 Provisions for liabilities and charges 17 1,341 1,050 Capital and reserves Called up share capital Share premium account Capital redemption reserve Profit and loss account Total equity shareholders' funds 18... -

Page 42

... to the fınancial statements 1. Turnover Inland telephone calls International telephone calls Telephone exchange line rentals Private circuits Mobile communications Customer premises equipment supply Yellow Pages and other directories Other sales and services Total turnover 1997 £m 1996 £m 4,874... -

Page 43

...49 1,102 8 39 1,027 The total tax charge for the year was £45m (1996 - £31m) higher than the result of applying the UK corporation tax rate of 33% to the group's profit on ordinary activities. This was primarily due to depreciation on certain tangible fixed assets not deductible for tax purposes... -

Page 44

...Increase in provisions Other Net cash inflow from operating activities 3,384 2,265 (132) 31 (168) 478 321 13 6,192 3,182 2,189 (77) 36 (335) 493 309 37 5,834 9. Management of liquid resources Purchase of short-term investments and payments into short-term deposits over 3 months Sale of short-term... -

Page 45

... fixed assets Group Cost Balances at 1 April 1996 Acquisitions of subsidiary undertakings Additions Transfers Disposals and adjustments Total cost at 31 March 1997 Depreciation Balances at 1 April 1996 Acquisitions of subsidiary undertakings Charge for the year Disposals and adjustments Total... -

Page 46

... S 11. Tangible fixed assets (continued) Company Cost Balances at 1 April 1996 Additions Transfers Other disposals and adjustments Total cost at 31 March 1997 Depreciation Balances at 1 April 1996 Charge for the year Other disposals and adjustments Total depreciation at 31 March 1997 Net book value... -

Page 47

...Interests in associated undertakings (a) (b) Share of post Other acquisition participating profits interests £m £m 12. Fixed asset investments Group Cost Balances at 1 April 1996 Additions Share of retained profits for the year Repayments, disposals and other transfers Currency movements Balances... -

Page 48

...to total a maximum of £2,300m, at $1.64 to £1, the rate ruling at 31 March 1997, with the final amounts being determined by the number of outstanding MCI shares at completion. The merger will be accounted for under the acquisition method of accounting. During the year ended 31 March 1997, MCI made... -

Page 49

... L S TAT E M E N T S Group 1997 £m 1996 £m 1997 £m Company 1996 £m 13. Debtors Trade debtors Amounts owed by subsidiary undertakings Amounts owed by associated undertakings Other debtors Advance corporation tax recoverable (a) Accrued income Prepayments Total debtors 1,757 - 72 304 456 1,084... -

Page 50

...N A N C I A L S TAT E M E N T S Group 1997 £m 1996 £m 1997 £m Company 1996 £m 14. Current asset investments Listed investments Other short-term deposits and investments Total current asset investments Market value of listed investments 115 2,859 2,974 115 179 2,389 2,568 179 16 2,893 2,909... -

Page 51

...the company for £422m and cancelled and the final bond series with a face value of £140m was repaid on maturity on 31 March 1997. The premium of £60m paid on the repurchase, which included the remaining unamortised increase in face values, has been charged against the profit for the year ended 31... -

Page 52

... (52) (256) 1,687 (296) 1,391 Advance corporation tax recoverable Total provisions at 31 March 1997 Company Balances at 1 April 1996 Charged (credited) against profit for the year: Regular pension cost Redundancy charges Other charges (credits) Utilised in the year (296) - 200 - - (99) - 101 980... -

Page 53

... reserved to meet options granted under the employee share option schemes described in note 26. Ordinary shares allotted during the year were as follows: Nominal value £ Consideration £ Number Savings related schemes Other share option schemes Totals for the year ended 31 March 1997 60,730,180... -

Page 54

... profit and loss account (a) Currency movements arising on consolidation of foreign subsidiary and associated undertakings (b) Other movements Balances at 31 March 1997 Company Balances at 1 April 1996 Premium on allotment of ordinary shares Transfer from reserves for the financial year (c) Currency... -

Page 55

... in respect of leases of land and buildings. On 12 May 1997, the group acquired an additional 8.5% interest in Airtel Moviles SA, a leading cellular telephone operator in Spain, for the equivalent of £114m to bring its total interest in the company to 15.8%. The company has agreed to purchase a 26... -

Page 56

... future increases in wages and salaries but not taking into account the cost of providing incremental pension benefits for employees taking early retirement under release schemes since that date. This cost, charged within redundancy costs, amounted to £258m in the year ended 31 March 1997 (1996... -

Page 57

... properties owned by the scheme on which an annual rental of £1.2m is payable. 23. Financial instruments and risk management The group uses derivative financial instruments primarily to manage its exposure to market risks from changes in interest and foreign exchange rates. The group does not enter... -

Page 58

... exercise of share options 93 6 (a) Payments to non-executive directors include fees paid to their principal employer of £31,000 (1996 - £24,000). (b) Disclosure has been amended in accordance with revised Companies Act disclosure requirements. Pensions in respect of the management services of... -

Page 59

...000 Year end '000 1996 Average '000 25. People employed Number of employees in the group: UK Overseas Total employees 123.3 4.2 127.5 125.8 3.8 129.6 127.8 2.9 130.7 132.6 2.6 135.2 26. Employee share schemes The company has a share ownership scheme used for employee share allocations (profit... -

Page 60

... information relating to the plans is as follows: PSP 1997 £m 1996 £m 1997 £m LTRP 1996 £m 1997 £m Total 1996 £m Value of range of possible future transfers: nil to Provision for the costs of the plans charged to the profit and loss account in year Nominal value of shares held in trust Market... -

Page 61

... SA (a) BT (Worldwide) Limited (a) Call Connections Limited (a) Cellnet Solutions Limited (a) Concert Communications Company (a) Activity Country of operations (c) Communication related services and products provider Communication related services and products provider Financial market... -

Page 62

... Cable Company Limited Yellow Pages Sales Limited (a) Activity Group interest in allotted capital (b) Country of operations (c) Systems integration and application development Telecommunication services supplier Systems integration and application development Mobile cellular telephone system... -

Page 63

... analysis of turnover and profıt (UNAUDITED) YEAR ENDED 31 MARCH 1997 Quarters 1st £m 2nd £m 3rd £m 4th £m Total £m Turnover Operating profit (a) Group's share of profits (losses) of associated undertakings Profit on sale of group undertakings Interest receivable Premium on repurchase... -

Page 64

... of times dividends are covered by earnings. Expenditure on research and development Y E A R ENDED 31 MARCH 1993 £m 1994 £m 1995 £m 1996 £m 1997 £m Total expenditure 233 265 271 282 291 Expenditure on tangible fixed assets Y E A R Plant and equipment Transmission Telephone exchanges... -

Page 65

Operational statistics Call growth Y E A R ENDED 31 MARCH 1993 1994 1995 1996 1997 % growth in telephone call volumes over the previous year: Inland International (a) (a) Outgoing, incoming and transit. - 6 6 6 7 5 6 9 7 7 Exchange line connections AT Business ('000) % growth over previous ... -

Page 66

... apportionments and allocations of expenditures and assets. BT is required to submit annual audited accounts in respect of the classified directory business to the Director of the Office of Fair Trading within nine months of the company's financial year end. Copies of these accounts, when available... -

Page 67

... with the employees. If staff terminations are likely to be enforced, then the termination benefits are charged against profits at the time when the group is committed to the staff terminations and the associated costs can be reasonably estimated. (f) Software capitalisation Under UK GAAP, the... -

Page 68

... 1997. (b) The disposal of the group's interest in AT&T Corporation shares which had been exchanged for shares in McCaw Cellular Communications, Inc, during the year ended 31 March 1995 gave rise to adjustments, increasing net income, of £125m to goodwill and £137m to mobile cellular telephone... -

Page 69

...''. In Japan, BT shares are traded on the Tokyo Stock Exchange under the code ''9484''. CREST: London Stock Exchange settlement system The company's ordinary shares began settling in CREST, the new computerised system for settling sales and purchases of shares, on 17 March 1997. CREST is a voluntary... -

Page 70

...file an annual report on Form 20-F with the Securities and Exchange Commission in the USA, by 30 September 1997. Regulatory financial statements The company will publish historical cost Financial Statements for the Businesses and Activities and Current Cost Financial Statements for the year ended 31... -

Page 71

...York ADR Service Center P.O. Box 8205 Boston, MA 02266-8205 USA Tel 1 800 634 8366 (toll free) or (617) 575 4328 When you use one of BT's Lo-call 0345 numbers from anywhere in the UK, you pay only the price of a local call. Different rates apply to calls from non-BT networks. BT North America Inc... -

Page 72

... Directors' interests 31, 32, 33 Share option schemes 59 Staff costs 42 Statement of total recognised gains and losses 38 Subsidiary undertakings 37, 43, 47, 48, 61, 62 Substantial shareholdings 21 Suppliers payment policy 21 Tangible fixed assets 36, 37, 45, 46, 64 Taxation 37, 43, 52, 53 Turnover...