AutoNation 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 AutoNation annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

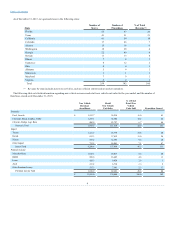

Our business benefits from a well-diversified portfolio of automotive retail franchises. In 2015, approximately 37% of our segment income was generated

by Premium Luxury franchises, approximately 33% by Domestic franchises, and approximately 30% by Import franchises. We believe that our business also

benefits from diverse revenue streams generated by our new and used vehicle sales, parts and service business, and finance and insurance sales. Our higher-

margin parts and service business has historically been less sensitive to macroeconomic conditions as compared to new and used vehicle sales.

Our capital allocation strategy is focused on maximizing stockholder returns. We invest capital in our business to maintain and upgrade our existing

facilities and to build new facilities for existing franchises, as well as for other strategic and technology initiatives. We also deploy capital opportunistically

to repurchase our common stock and/or debt or to complete dealership acquisitions and/or build facilities for newly awarded franchises. Our capital

allocation decisions are based on factors such as the expected rate of return on our investment, the market price of our common stock versus our view of its

intrinsic value, the market price of our debt, the potential impact on our capital structure, our ability to complete dealership acquisitions that meet our market

and vehicle brand criteria and return on investment threshold, and limitations set forth in our debt agreements. For additional information regarding our

capital allocation, please refer to “Liquidity and Capital Resources – Capital Allocation” in Part II, Item 7 of this Form 10‑K.

Each of our stores acquires new vehicles for retail sale either directly from the applicable automotive manufacturer or distributor or through dealer trades

with other stores of the same franchise. We generally acquire used vehicles from customers, primarily through trade-ins, as well as through auctions, lease

terminations, and other sources, and we generally recondition used vehicles acquired for retail sale in our parts and service departments. In 2015, we

implemented a policy not to retail any new or used vehicle that has an open safety recall. Used vehicles that we do not sell at our stores generally are sold at

wholesale prices through auctions. See also “Inventory Management” in Part II, Item 7 of this Form 10-K.

Our stores provide a wide range of vehicle maintenance, repair, and collision repair services, including manufacturer recall repairs and other warranty work

that can be performed only at franchised dealerships and customer-pay service work. Our parts and service departments also provide reconditioning repair

work for used vehicles acquired by our used vehicle departments and minor preparatory work for new vehicles acquired by our new vehicle departments. In

addition to our retail business, we also have a wholesale parts operation, which sells automotive parts to both collision repair shops and independent vehicle

repair providers.

We offer a wide variety of automotive finance and insurance products to our customers. We arrange for our customers to finance vehicles through

installment loans or leases with third-party lenders, including the vehicle manufacturers’ and distributors’ captive finance subsidiaries, in exchange for a

commission payable to us. We do not directly finance our customers’ vehicle leases or purchases, and our exposure to loss in connection with these financing

arrangements generally is limited to the commissions that we receive.

We also offer our customers various vehicle protection products, including an AutoNation-branded extended service contract (the AutoNation Vehicle

Protection Plan) in our Domestic and Import stores and other extended service contracts, maintenance programs, guaranteed auto protection (known as

“GAP,” this protection covers the shortfall between a customer’s loan balance and insurance payoff in the event of a casualty), “tire and wheel” protection,

and theft protection products. These products are underwritten and administered by independent third parties, including the vehicle manufacturers’ and

distributors’ captive finance subsidiaries. We primarily sell the products on a straight commission basis; however, we also participate in future underwriting

profit for certain products pursuant to retrospective commission arrangements. See also “Critical Accounting Policies and Estimates – Chargeback Reserve”

in Part II, Item 7 of this Form 10-K.

3