Atmos Energy 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

Atmos Energy helped create

two statues in West Texas

to commemorate the fallen

space shuttle Columbia.

The statue of pilot William

McCool stands in Lubbock,

and the statue of shuttle

commander Rick Husband

stands in Amarillo. Together,

their upraised hands point to

the trajectory of the shuttle

and her crew’s final mission.

18

–

19

increase of $3.4 million. Significantly, the

commission staff has agreed to support

a fixed monthly delivery charge, which

would allow us to earn our residential

margins regardless of customers’ usage.

A final decision in the case is expected

in March 2007.

In a contested case, the Tennessee

Regulatory Authority ordered a $6.1 million

reduction in our base rates, effective

December 1, 2006. Because the company

had absorbed a decade of inflation

and expenses for system improvements

without seeking a rate increase, we

believe the current rates are deficient.

We are continuing to analyze our rate

strategy in Tennessee.

S U C C E S S A N D I N D E P E N D E N C E

Strategic innovation has always set our

company apart. For example, in 1986, the

company was still a regional utility in West

Texas with a complementary irrigation

business. That year, CEO Charles Vaughan

made a tender offer to acquire Trans

Louisiana Gas Company. It was a bold

step that set the course for the company’s

future growth.

“We had to do something because our

service area was not growing,” Vaughan

said. “We had to buy something—or be

bought ourselves.”

Vaughan chose to diversify the

company’s operations into other states

but to maintain its basic strategy as a

regulated local distribution company.

Other successful acquisitions followed

that confirmed the corporate vision and

the long-standing belief in independence by

our board of directors. Charles Vaughan

set the dual hallmarks of financial success

and corporate independence by which

we operate today.

Atmos Energy has continued to

expand, largely through mergers and

acquisitions, to become the largest all-

natural-gas distribution company in the

country. Our 10 major acquisitions

to date not only have bolstered our core

utility business, but also have provided

valuable diversification.

In particular, our acquisition in 2001

of the balance of Woodward Marketing

has proved to be one of our best steps. We

acquired one of the country’s leading

and most respected mid-tier natural

gas marketing companies. Under

JD Woodward’s leadership, we greatly

expanded the scope and scale of our

nonutility business.

In 2004, we acquired the operations

of TXU Gas Company. Not only did we

obtain one of the most dynamic markets

for natural gas distribution—Dallas-Fort

Worth is now the nation’s fourth largest

metropolitan statistical area, but we also

acquired a highly valuable intrastate

gas pipeline system. Today, it is yielding

superior returns in our pipeline and

storage segment while offering growth due

to the extensive rate of gas drilling

in Texas and the producers’ needs to

transport the gas to markets.

S T R A T E G I C F O C U S

As Atmos Energy enters its second

century, our strategic focus remains fixed

on being financially successful by

profitably delivering natural gas to our

customers. We expect our earnings in

fiscal 2007 to grow at our stated goal of

4 percent to 6 percent a year, on average.

Our utility operations will remain our

core business. And we will remain

active in using acquisitions as an engine

of future growth. However, we expect

to be even more selective to find the right

fit of properties.

We will invest most of our future

growth capital in states with timely and

adequate rates of return as well as in

new nonutility projects. We expect our

capital expenditures in fiscal 2007 will be

between $425 million and $440 million, as

compared to $425.3 million in fiscal 2006.

We will continue to work for federal

laws to increase our country’s natural gas

supply in order to moderate gas prices.

Towards this end, our interests are aligned

perfectly with our customers’ interests.

We both want reasonable gas costs and

lower volatility in gas prices.

Today, Atmos Energy is in an excellent

position to expand its core business,

stabilize its earnings and take advantage

of its complementary strategy. We are

pursuing consistent and focused strategies

61,000

Atmos Energy Marketing

added the city of Hamilton,

Ohio (population 61,000),

to its more than 1,000

municipal and industrial

customers.

Atmos Energy’s Kentucky

Division was named one of

the 20 best places to work

in the state, coming in 12th.

I am confident that we are in a better position today than at any time in our past.

20

. . . . . United Cities Gas Company. 2001: Woodward Marketing became a wholly owned subsidiary, greatly expanding the company’s nonutility business. 2002: Mississippi Valley Gas, the state’s largest gas supplier, was acquired. 2004: Atmos Energy acquired the operations of TXU Gas in Texas, becoming . . . . . . . . . .

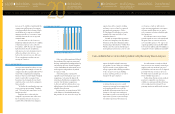

2 0 0 3 2 0 0 4

C A S H D I V I D E N D S P E R S H A R E

$ 1. 4 0

1. 2 0

1. 0 0

. 8 0

. 6 0

. 4 0

.2 0

0

2 0 0 5 2 0 0 6 2 0 0 7

20 07 dividend is the indicated rate

$1.20

$1.22

$1.24

$1.26

$1.28

2 0 0 2

$1.18