Atmos Energy 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Baby Jessica McClure was

rescued from an abandoned

well pipe with the help of

our employees 19 years ago.

Because natural gas is one of

the most efficient energy

sources, its use has increased

35 percent during the past

decade and demand

is expected to grow by

40 percent by 2025.

19

35

16

–

17

to write off our irrigation properties

in West Texas. The volumes of natural gas

we deliver for irrigation pumping in

Texas have continued to decline year after

year and were not expected to generate

enough cash flow from operations to

recover our net investment.

On the positive side, our biggest

financial success came in breakthroughs

in rate design in our utility segment.

These changes should help return our

utility to strong performance in fiscal

2007 and beyond.

We secured protection from weather

in our two largest divisions. In Texas, the

Railroad Commission granted our

Mid-Tex Division a weather normalization

adjustment as part of a pending rate case.

In Louisiana, the Public Service

Commission allowed new rate provisions

that protect our margins from warm

winter weather, declining customer use

and greater conservation.

wellhead sales revenues, severance taxes,

property taxes and royalty-owner

revenues. Atmos Energy and our minority

partner, Kinzer Drilling Company,

plan to invest between $75 million and

$80 million in the project.

N E W R A T E D E S I G N S H O U L D H E L P U T I L I T Y S E G M E N T

Extremely volatile natural gas prices, one

of the warmest winters on record and

two of the worst hurricanes in American

history strained our utility business

by adding operating costs and lowering

utility revenues.

In particular, unseasonably warm

winter weather, which was 13 percent

warmer than normal, reduced our utility

earnings. Net income from utility

operations fell to $53.0 million from $81.1

million in fiscal 2005. In addition,

we lost approximately 230,000 utility

customers in Louisiana until service

could be restored after Hurricanes Katrina

and Rita. About 26,500 of these customers

became permanent losses with no plans

for rebuilding homes or businesses.

Utility earnings also were reduced by

a nonrecurring after-tax charge of

$14.6 million, or 18 cents per diluted share,

As a result of these changes, more

than 90 percent of our customer margins

are now substantially insulated from

the effects of adverse weather. This has

been a primary goal to help safeguard

our earnings.

We cannot control the weather and

we cannot control the cost of natural

gas; however, we can control how we

address adverse situations. We believe

that implementing sound rate-design

principles benefits both the company

and our customers over the long term.

K E E P I N G R A T E S C U R R E N T

We filed a number of rate cases during

2006, seeking rate increases and weather

normalization adjustments as well as

provisions to compensate for declining

customer use and to recoup our costs

for the natural gas consumed by customers

with uncollectible accounts.

In Louisiana, the Public Service

Commission acted quickly to allow a rate

increase, subject to refund, of $10.8 million.

The increase covered customer losses in

Katrina-affected parishes and increases in

rate base and operating expenses.

Our most significant rate filing was

for a $60 million increase in Texas by our

Mid-Tex Division to recover increases

in the division’s operating costs and its

allowed rate of return. A decision is due

no later than April 2007.

In Texas, we also continued to refresh

our rates under the state’s Gas Reliability

Infrastructure Program, or GRIP. The

program authorizes utilities to earn a rate

of return on their incremental annual

capital investments. It also reduces the

regulatory lag time between when we

make an investment and when we begin

earning a return on it.

Since 2003, we have been able to

increase base rates in Texas under GRIP

by about $190 million while earning

about $36 million in allowed return on

that investment.

In Missouri, we reached a tentative

settlement in a rate case seeking an

69

We cannot control the weather and we cannot control the cost of natural gas;

however, we can control how we address adverse situations.

In 1859, Edwin Drake drilled

the first commercial well

and hit oil and natural gas at

69 feet below the surface of the

earth. A two-inch-diameter

pipeline was built, running

5.5 miles from the well to the

village of Titusville,

Pennsylvania. This discovery

well is considered to be

the beginning of the natural

gas industry in America.

. . . . . the acquisition of Western Kentucky Gas. 1988: Energas changed its name to Atmos Energy Corporation and was listed on the NYSE (ATO). 1993: Atmos . . . . . . . . . . . . . . . . . . Energy acquired Greeley Gas operations in Colorado and Kansas. 1997: Atmos Energy doubled in size to one million customers through its merger with . . . . . . . . .

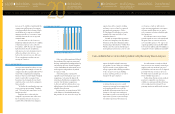

E A R N I N G S R E V I E W

$ 2 .0 0

1.60

1. 20

.8 0

.4 0

0

2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6

Net income per diluted share

$1.45

$1.54

$1.58

$1.72

$1.82