Atmos Energy 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have pursued a consistent strategy of running

our utilities well, of making sound acquisitions

and of expanding our nonutility business. Our reputa-

tion has grown not from our size, but from the

neighborliness, mettle and strength of character of

Atmos Energy’s employees.

Our commitment to strong ethics and integrity has

been part of the company since its founding, long

before the Sarbanes-Oxley Act was passed. To reiterate

that commitment, the Board of Directors this past year

reviewed and revised its committee charters and our

code of conduct for all directors, officers and employees.

We pledge to continue to manage

Atmos Energy for long-term success,

not for immediate or personal gains.

Our goals remain to grow and prosper

financially, to foster great customer

service, to be a safe and rewarding

place to work and to benefit all those

who associate with Atmos Energy—

our shareholders,

customers, communities and

employees.

I thank you, our owners, and all of our

employees for supporting these goals.

Consistency in purpose, financial results and

ethical conduct stands as Atmos Energy’s foremost

strength as we observe our 20th year.

Robert W. Best

Chairman, President and Chief Executive Officer

December 1, 2003

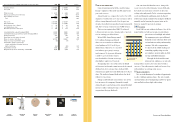

Second, we made a $77 million contribution to

our pension plan to adequately fund the plan. This

should help to protect our employees and retirees

and to reduce our future pension funding requirements.

Third, we closed our acquisition of Mississippi

Valley Gas Company and welcomed some 260,000 new

utility customers and 600 employees of Valley Gas

into Atmos Energy. The transaction was the company’s

ninth major acquisition.

Fourth, we renewed our credit facilities in both

our utility and nonutility operations. These credit

agreements have allowed us to finance all of our oper-

ations in an orderly and disciplined fashion.

Fifth, we received rate increases in Louisiana and in

Amarillo, Texas,

and we achieved

weather normaliza-

tion

adjustments

in Kansas and Amarillo. Our ability to grow our

earnings relies on our continual success in achieving

fair rate designs and keeping rates current.

Sixth, by using our 49.4 billion cubic feet of

usable and contracted natural gas storage and fixed-

forward supply contracts, we hedged about half

of our winter gas supply to save our utility customers

more than $67 million last year in gas costs.

Seventh, we took steps to enhance the profitability

of our nonutility operations by contracting for an

additional 1.25 billion cubic feet of natural gas storage,

installing a new billing system and renegotiating

contracts to reduce the risk of price volatility.

7

Eighth, we pursued our passion for customer service.

Excellence in customer service is an attitude and it

starts with each employee. During 2003, we launched

a systemwide customer service training program.

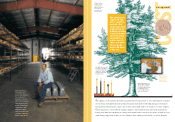

Ninth, our investments in technology yielded increas-

ing dividends. Our Enterprise Asset Management

Project, as described on page 18, is the latest in a long

list of information and telecommunications advances

we’ve made. With our highly automated Customer

Support Center and Internet site, we’re serving customers

better and at lower costs.

Tenth, we continued to manage our total spending

in strategic ways. Both our capital outlays and

operation and maintenance expense were under budget.

Capital expen-

ditures during

fiscal 2003 were

$159 million.

Our O&M expense per customer of $122 continues to

compare favorably to our peer group’s average

expense of $195. Closely managing capital and O&M

expenditures helps us stay highly competitive.

These 10 achievements reflect many of the

characteristics that differentiate Atmos Energy in the

business of delivering natural gas. This summary

annual report discusses those characteristics that

during the past 20 years have made Atmos Energy

a company that works.

2004OUTLOOK

We expect fiscal 2004 will be a challenging

year. High gas costs will make collecting customer

bills more difficult and will require us to make

higher cash outlays for gas supplies. We have targeted

annual earnings growth of 3percent to 5percent,

with our earnings per diluted share expected to range

from $1.55 to $1.60.

As Atmos Energy enters its third decade, the

company is well positioned for long-term growth and

continued success. Our balance sheet is strong;

our credit ratings are high; our rate filings have added

to revenues and have reduced the effects of weather

on profitability; and our earnings have grown at a steady

pace, enabling us to pay higher dividends each year.

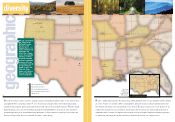

FOUNDATION OF SUCCESS

The foundation of Atmos Energy’s success has

been built on our utility operations,

which provide about 80 percent of

our net income. Through acquisitions,

we have evolved from a regional Texas

gas utility to one of the country’s largest

natural gas distribution companies.

We are known for making responsible,

disciplined and accretive acquisitions.

To strengthen the company’s foundation, we

have added opportunities for long-term growth

through our nonutility operations. Our natural

gas marketing business, for instance, ranks as one

of the best in the industry based on independent

customer satisfaction surveys.

6

These 10 achievements reflect many of the

characteristics that differentiate Atmos Energy

in the business of delivering natural gas.