Atmos Energy 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our consistent dividend increases, along with

recent cuts in the federal income tax on dividends,

have made our stock more attractive to investors

seeking value and growth. To the extent our operating

results and financial condition permit, the Board

of Directors remains committed to raising the dividend

annually and to lowering the payout ratio in the

future to around 65 percent of earnings.

2003IN REVIEW

Fiscal 2003 was not without challenges. One of the

major hurdles we had to overcome was natural gas

prices that were both high and volatile.

Zig-zagging gas prices put additional

demands on our collection efforts and

cut into both our utility and nonutility

earnings. Like other corporations,

we also faced the added challenge of

controlling rapidly rising costs for

our employee pension plan, medical

coverage and liability insurance.

Through the dedicated determi-

nation of our employees, we not only

managed those matters, but also achieved other

successes. Ten achievements stand out because they

will contribute to our long-term success.

10MAJOR ACHIEVEMENTS

First, we took advantage of a window of opportunity

to sell 4.1 million common shares. The sale strength-

ened our balance sheet by improving our debt-to-equity

ratio and bolstered our high credit ratings.

5

DEAR FELLOW SHAREHOLDERS:

I am extremely proud of all the work by Atmos

Energy’s employees who made our 20th anniversary

year such a success.

Atmos Energy is a company that works. Our 2,905

employees work hard to serve our customers and to

deliver strong financial results. For the past two

decades, their efforts have produced consistent growth

and above-average returns for our 70,000 owners.

That was true again in fiscal 2003. We achieved

a 20 percent increase in net income and a 6percent

rise in earnings per diluted share.

In fiscal 2003, Atmos Energy earned

$71.7 million. Earnings per diluted

share were $1.54 and were within our

stated guidance of $1.52 to $1.58 per

diluted share. Moreover, we exceeded

our industry peer group’s average

total return of 16.4 percent, delivering

a solid 17.2 percent total return to

our shareholders. Return on average

shareholders’ equity was 9.9 percent.

Recognizing these successful results, the Board

of Directors in November 2003 increased the annual

dividend rate by 2 cents per share. In fiscal 2003,

Atmos Energy paid total cash dividends of $1.20 per

share. The indicated annual dividend rate for fiscal

2004 is $1.22 per share.

Paying cash dividends consistently is one of the

best measures of a company’s financial strength.

Atmos Energy’s record of consecutive annual dividend

increases ranks it among the top 2.5 percent of

corporations that pay dividends.

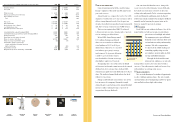

Year ended September 30 (Dollars in thousands, except per share data) 2003 2002 Change

Operating revenues $ 2,799,916 $ 1,650,964 69.6%

Gross profit $ 534,976 $ 431,140 24.1%

Utility net income $ 62,137 $ 42,994 44.5%

Natural gas marketing net income (loss) (970) 12,614 -107.7%

Other nonutility net income 10,521 4,048 159.9%

Total $ 71,688 $ 59,656 20.2%

Total assets $ 2,518,508 $ 1,981,385 27.1%

Total capitalization $ 1,721,435 $ 1,243,698 38.4%

Net income per share – diluted $ 1.54 $ 1.45 6.2%

Cash dividends per share $ 1.20 $ 1.18 1.7%

Book value per share at end of year $ 16.66 $ 13.75 21.2%

Consolidated utility segment throughput (MMcf) 247,965 208,541 18.9%

Consolidated natural gas marketing segment throughput (MMcf) 225,961 204,027 10.8%

Heating degree days 3,473 3,368 3.1%

Degree days as a percentage of normal 101% 94% 7.4%

Meters in service at end of year 1,672,798 1,389,341 20.4%

Return on average shareholders’ equity 9.9% 9.9% —

Shareholders’ equity as a percentage

of total capitalization (including short-term

debt) at end of year 46.4% 40.6% 14.3%

Shareholders of record 28,510 28,829 -1.1%

Weighted average shares outstanding – diluted (000s) 46,496 41,250 12.7%

Letter to Shareholders

Letter to

Shareholders

5 8 22 30 31 32

Operational

Review

Financial

Review

Atmos Energy

Officers

Board of

Directors

Corporate

Information

0.00

0.60

1.20

$1.80

1.50

0.90

0.30

1999 2000 2001 2002 2003

Cash dividends per share

Earnings per share