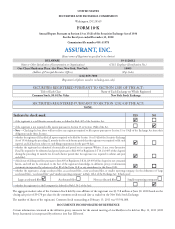

Assurant 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5ASSURANT, INC. 2010 Form 10K

PART I

ITEM 1 Business

In January 2009, we entered into an agreement to market, administer

and underwrite ESC products to Whirlpool Corporation (“Whirlpool”)

appliance customers in the U.S. and Canada. Whirlpool is a leading

manufacturer and marketer of major home appliances.

On September 26, 2008, the Company acquired the Warranty

Management Group business from GE Consumer & Industrial, a

unit of General Electric Co. (“GE”). e Company paid GE $140,000

in cash for the sale, transfer and conveyance of certain assets and

assumed certain liabilities. As part of the acquisition, the Company

entered into a new 10-year agreement to market extended warranties

and service contracts on GE-branded major appliances in the U.S.

and included warranty distribution agreements with two existing

retail customers. In connection with the acquisition of this business,

the Company recorded $126,840 of amortizable intangible assets and

$13,160 of goodwill. We recorded a charge of $30,948 (after-tax) in

the fourth quarter of 2010 for the impairment of a portion of the

intangible asset. e impairment charge resulted from the receipt, on

November 30, 2010, from one of the retail customers of notifi cation of

non-renewal of a block of the acquired business eff ective June 1, 2011.

We do not expect the lapse of the contract to have a material impact

on Assurant Solutions’ profi tability in 2011.

On October 1, 2008, the Company completed the acquisition of

Signal Holdings LLC (“Signal”), a leading provider of wireless handset

protection programs and repair services. e Company paid $257,400

in cash for the acquisition, transfer and conveyance of certain assets and

assumed certain liabilities. Signal services extended service contracts

for 4.2 million wireless subscribers.

Underwriting and Risk Management

We write a signifi cant portion of our contracts on a retrospective

commission basis. is allows us to adjust commissions based on claims

experience. Under these commission arrangements, the compensation

of our clients is based upon the actual losses incurred compared to

premiums earned after a specifi ed net allowance to us. We believe that

these arrangements better align our clients’ interests with ours and help

us to better manage risk exposure.

Profi ts from our preneed life insurance programs are generally earned

from interest rate spreads—the diff erence between the death benefi t

growth rates on underlying policies and the investment returns generated

on the assets we hold related to those policies. To manage these spreads,

we regularly adjust pricing to refl ect changes in new money yields.

Assurant Specialty Property

For the Years Ended

December 31, 2010 December 31, 2009

Net earned premiums and other considerations by major product grouping:

Homeowners (lender-placed and voluntary) $ 1,342,791 $ 1,369,031

Manufactured housing (lender-placed and voluntary) 220,309 219,960

Other (1) 390,123 358,538

TOTAL $ 1,953,223 $ 1,947,529

Segment net income $ 424,287 $ 405,997

Loss ratio (2) 35.1 % 34.1 %

Expense ratio (3) 39.5 % 41.5 %

Combined ratio (4) 73.3 % 74.7 %

Equity (5) $ 1,134,432 $ 1,184,798

(1) This primarily includes lender-placed flood, miscellaneous specialty property and renters insurance products.

(2) The loss ratio is equal to policyholder benefits divided by net earned premiums and other considerations.

(3) The expense ratio is equal to selling, underwriting and general expenses divided by net earned premiums and other considerations and fees and other income. (Fees and other income

are not included in the above table)

(4) The combined ratio is equal to total benefits, losses and expenses divided by net earned premiums and other considerations and fees and other income. (Fees and other income are not

included in the above table)

(5) Equity excludes accumulated other comprehensive income.

Products and Services

Assurant Specialty Property’s business strategy is to pursue long-term

growth in lender-placed homeowners insurance and expand its strategy

into other emerging markets with similar characteristics, such as lender-

placed fl ood insurance, lender-placed automobile and renters insurance.

Assurant Specialty Property also writes other specialty products.

Lender-placed and voluntary homeowners insurance

e largest product line within Assurant Specialty Property is homeowners

insurance, consisting principally of fi re and dwelling hazard insurance

off ered through our lender-placed programs. e lender-placed program

provides collateral protection to our mortgage lending and servicing

clients in the event that a homeowner does not maintain insurance

on a mortgaged dwelling. e majority of our mortgage lending

and servicing clients outsource their insurance processing to us. We

also provide insurance to some of our clients on properties that have

been foreclosed and are being managed by our clients. is type of

insurance is called Real Estate Owned (“REO”) insurance. is market

experienced growth increases in recent years as a result of the housing

crisis, but is now stabilizing.

We use a proprietary insurance-tracking administration system linked

with the administrative systems of our clients to continuously monitor

the clients’ mortgage portfolios and verify the existence of insurance on

each mortgaged property. We earn fee income for these administration

services. In the event that mortgagees do not maintain adequate