Archer Daniels Midland 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Archer Daniels Midland annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To the Shareholders and Employees of ADM,

By almost any measure, 2007 was an excellent

year for ADM. We delivered our third consecutive

year of record earnings and achieved our seventh

consecutive year of double digit improvements in

safety. We extended our record of uninterrupted

dividends to 75 years, and exceeded our targets

for costs and returns—two important measures of

shareholder value.

As good as our numbers are—and in a year

marked by unprecedented volatility in commodity

markets, they are quite good—the numbers alone

do not tell the full story of our accomplishments.

For, as we were achieving record results, we were

also strengthening our organizational capacity for

change and building out the long-term value of

our company.

Delivering Results

In 2007, we demonstrated our ability to deliver growth and

returns. Net earnings for the year increased 65% over last

year’s record performance, to a record $2.2 billion dollars,

or $3.30 per share. Special items were significant in the

year-over-year increase, reflecting actions to strategically

align our portfolio. Sales revenues surpassed $44 billion, rising 20% primarily on the strength of commodity pricing and on

additional sales volumes.

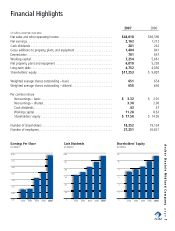

We finished the year with a Return on Net Assets of 15.7%, solidly over our 13% objective, and we held costs to below our

Cost per Metric Ton of Production objective of less than $110, achieving a rate of $108.89 for the year.

In a first for ADM, we issued $1.15 billion of convertible debt. This issuance provided cost-effective funds for a significant

buy-back of 15.4 million shares of ADM stock. And we increased our cash dividend payouts, in absolute dollars and in cents

per share.

With thanks, we offer full credit for this excellent performance to the people of ADM. While continuing to respect

and—indeed—relish the traditional strengths of the company, they embraced a new focus, new people and a new set

of expectations and disciplines, all the while maintaining an unwavering commitment to delivering quality and value for

ADM’s customers and shareholders. Their tireless efforts, across the globe, are reflected in the record results they achieved

in all of the major segments of our business.

Growing Opportunity

Last year, as we examined the global landscape to identify future possibilities for our company, we recognized two major

world trends that suggested unprecedented, sustained opportunity: the growing demand for food to feed a growing and more

prosperous world population, and the quest for alternative fuel sources to supply expanding energy needs. We embraced

that opportunity, identifying a longer-term, strategic destination for our company: to be the global leader in BioEnergy while

expanding our premiere position in the agricultural processing chain. With this destination firmly in mind, we identified key

p a g e 2 Archer Daniels Midland Company

Patricia A. Woertz,

Chairman, Chief Executive Officer and President