Amgen 2001 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2001 Amgen annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

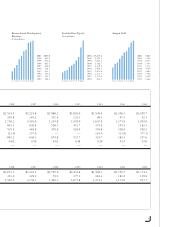

Earnings Performance In a year marked

by preparations for several new product

introductions, Amgen continued to success-

fully balance the need to invest in the

future with the desire to deliver quality

financial results.

Continued growth in demand for the

company’s expanding line of therapeutics

increased total product sales by 10% last

year. Net income, excluding non-recurring

items, was 36% of sales, among the indus-

try’s strongest net margins. Adjusted

earnings per share, adjusted to exclude non-

recurring items in both years, were $1.18

versus $1.05 in 2000, a 12% increase. In

2001, Amgen invested significant resources

required to launch two new products and

to prepare for the launch of a third.

Amgen expects growth in product sales

to expand at an even faster rate through

2005 as new Amgen products gather mar-

ket momentum and the company pursues

applications for new products and new

product indications in health care markets

around the world. Potential new revenue

and earnings streams from these activities

could also help to diversify Amgen’s

sources of income.

Successful completion of Amgen’s proposed

acquisition of Immunex, which would

bring with it an additional blockbuster

therapeutic targeting inflammation, also

has the potential to increase company sales

and earnings (adjusted to exclude merger-

related items) over the next few years.

Amgen’s substantial annual cashflow

from product sales and resulting strong

balance sheet has allowed the company to

reinvest profits into ongoing research and

development programs, the lifeblood of

a successful human therapeutics enterprise.

Research and development spending in

2001 was 25% of total product sales,

among the highest levels in the biotech-

nology and pharmaceuticals industries.

This is the seventh consecutive year

Amgen’s research and development

spending has exceeded 24%.

Financial Foundation Cashflow from

operations, generated largely by Amgen’s

product sales, totaled nearly $1.5 billion in

2001. The size and quality of the company’s

cashflow has allowed Amgen to finance

nearly all of its operations since the success-

ful market debuts of EPOGEN

®

and

NEUPOGEN

®

. Historically, Amgen has

reinvested in the company’s core business,

in capital expenditures, in collaborations

and new initiatives, and in selective

share repurchases.

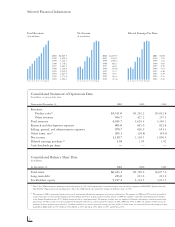

Financial Performance

91 93 95 97 99 01

Total Revenues

($ in millions)

2001 $4,016

1999 3,340

1997 2,401

1995 1,940

1993 1,374

1991 682

Total revenues have

increased at a compound

annual growth rate of

19.4% over the past

ten years.

7

91 93 95 97 99 01

Research and Development Expenses

($ in millions)

2001 $865.0

1999 822.8

1997 630.8

1995 451.7

1993 255.3

1991 120.9

Research and

development expenses

have increased at a

compound annual

growth rate of 21.7%

over the past ten years.