Amgen 2001 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2001 Amgen annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

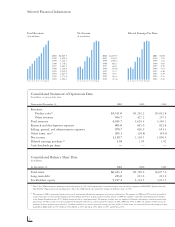

Amgen holds substantial cash and short-

term marketable securities on its balance

sheet and also maintains a bank line of

credit and other capital market relation-

ships to ensure financial flexibility and

adequate liquidity. At year-end 2001, the

current portion of the company’s assets

totaled $3,858.6 million. In March 2002,

Amgen received approximately $2.8 billion

from the issuance of 30-year zero coupon

senior notes that are convertible into shares

of the company’s common stock. These notes

have a yield to maturity of 1.125% and an

initial conversion price of $80.61. Amgen

used $650 million of the proceeds from the

sale of the notes to repurchase approxi-

mately 11.3 million shares of its common

stock. The remainder of the proceeds will

be used for general corporate purposes.

Amgen’s overall balance sheet strength

and substantial cash-generating capabilities

provide important sources of financing,

not only for internal research and develop-

ment activities and ongoing expansion of

company operations, but also for potential

product candidate in-licensing opportuni-

ties and strategic acquisitions, such as

the proposed Immunex transaction. As

markets for the company’s potential new

therapeutics become increasingly competi-

tive, Amgen’s strong financial position is

a distinct competitive advantage.

Creating Stockholder Value Amgen

remains committed to creating long-term

value for its stockholders, balancing near-

term earnings growth with the need to

continually re-invest substantial portions

of its cashflow in new research and product

development opportunities.

Since the company’s initial public offering

in 1983, shares of Amgen common stock

have appreciated at a compound annual

growth rate of 30%. An investment of $100

in Amgen on December 31, 1986 would

have been worth approximately $12,000

at year-end 2001. Amgen’s stock repurchase

program primarily reduces the dilutive

effect from the employee stock option and

the stock purchase plans. Our stock repur-

chase program also represents one measure

of our confidence in the long-term value of

Amgen’s stock. In 2001, Amgen repur-

chased 12.7 million shares of its common

stock at an average price of $58 per share,

at a total cost of $737.5 million. Since

1992, Amgen has bought back 327.4 mil-

lion shares at an average price of approxi-

mately $17 per share. The closing price of

Amgen stock on December 31, 2001 was

$56 per share.

8

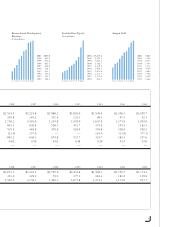

Cost 12/31/01*

Theoretical

Value

Share Repurchase Since 1992

($ in billions)

$5.5

$18.5

*Based on the

closing price of

Amgen stock on

December 31, 2001

12/31/86

$100 Invested in Amgen

vs. S&P 500 Index

1986 $100 $100

2001 $688 $12,245

S&P

500 Amgen

S&P 500

Amgen

12/31/01