American Home Shield 2002 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2002 American Home Shield annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

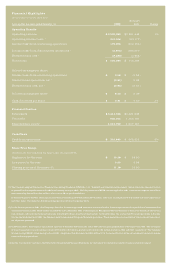

Financial Highlights

(In thousands, except per share data)

(Restated 4)

As of and for the years ended December 31 2002 2001 Change

Operating Results

Operating revenue $ 3,589,089 $3,561,445 1%

Operating income (loss) (1) 341,336 (23,177)

Income (loss) from continuing operations 170,098 (164,464)

Income (loss) from discontinued operations (2) (3,875) 284,270

Extraordinary loss (3) (9,229) (3,422)

Net income $ 156,994 $ 116,384

Diluted earnings per share:

Income (loss) from continuing operations $ 0.56 $ (0.55)

Discontinued operations, net (2) (0.01) 0.95

Extraordinary loss, net (3) (0.03) (0.01)

Diluted earnings per share $ 0.52 $0.39

Cash dividends per share $ 0.41 $0.40 3%

Financial Position

Total assets $ 3,414,938 $3,621,245

Total debt 835,475 1,155,193

Shareholders’ equity 1,218,700 1,207,187

Cash Flows

Cash from operations $ 381,049 $ 362,933 5%

Share Price Range

(Traded on the New York Stock Exchange under the symbol SVM)

High price for the year $ 15.50 $ 14.20

Low price for the year 8.89 9.84

Closing price as of December 31, 11.10 13.80

(1) The Company adopted Statement of Financial Accounting Standards (SFAS) No. 142, “Goodwill and Other Intangible Assets”, which eliminates the amortization

of goodwill and intangible assets with indefinite lives beginning in 2002. Had the provisions of SFAS 142 been applied to 2001, amortization expense would have

been reduced by $60 million ($42 million, after-tax), or $0.14 per diluted share.

In the fourth quarter of 2001, the Company recorded a pretax charge of $345 million ($279 million, after-tax), related primarily to goodwill and asset impairments

and other items. The impact on diluted earnings per share of this charge was $0.94.

(2) In the fourth quarter of 2001, the Company’s Board of Directors approved a series of actions related to the strategic review of its portfolio of businesses that

commenced earlier in 2001. These actions included the sale in November 2001 of the Company’s Management Services business as well as the decision to exit certain

non-strategic and under-performing businesses including TruGreen LandCare Construction, Certified Systems, Inc. and certain Terminix operations in Europe.

During the third quarter of 2002, the Company sold its remaining European Terminix operations. These operations are classified as “Discontinued Operations”

for all periods presented.

(3) In 2002 and 2001, the Company repurchased a portion of its public debt securities and in 2001 the Company prepaid some of its longer-term debt. The net impact

of these transactions was extraordinary losses of $9 million ($15 million pretax) and $3 million ($6 million pretax) in 2002 and 2001, respectively. The Company

intends to adopt SFAS 145 beginning in fiscal 2003. Adoption of this Statement in 2003 will result in the reclassification of the extraordinary losses into income

from continuing operations.

(4) See the “Restatement” section in the Notes to the Consolidated Financial Statements for the basis of the restatement and the financial statement impact.