American Express 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 American Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 financial review

american express company

The Company has historically relied on the debt capital

markets to satisfy a substantial amount of its funding needs,

as do many financial services companies. Notwithstanding the

difficult conditions in the financial markets during the past

year, the Company accessed a variety of capital markets sources

during the first three quarters of the year. The Company’s

issuances of debt securities and securitizations, similar to most

issuances across the capital markets, included spreads above

benchmark rates that were significantly greater than those on

similar issuances completed during the prior several years.

The Company’s strategy is to issue debt and deposits

with a wide range of maturities to reduce and spread out the

refinancing requirements in future periods. However, the

Company’s ability to obtain financing in the debt capital market

for unsecured term debt and asset securitizations is subject to a

renewal of investor demand. The Company continues to assess

its needs and investor demand, which will likely change the

mix of its existing sources as well as seek to add new sources

to its funding mix. The Company’s funding plan is subject to

various risks and uncertainties, such as disruption of financial

markets, market capacity and demand for securities offered by

the Company, regulatory changes, ability to sell receivables and

the performance of receivables previously sold in securitization

transactions. Many of these risks and uncertainties are beyond

the Company’s control.

funding programs and activities

The Company meets its funding needs through a variety of

sources, including debt instruments such as commercial paper,

senior unsecured debentures and asset securitizations, long-

term committed bank borrowing facilities in certain non-U.S.

markets, and deposits placed with the Company’s U.S. banks by

individuals and institutions.

The following discussion includes information on both a

GAAP and managed basis. The managed basis presentation

includes debt issued in connection with the Company’s lending

securitization activities, which are off-balance sheet. For a

discussion of managed basis and management’s rationale for

such presentation, refer to the U.S. Card Services discussion

below. The Company had the following consolidated debt,

on both a GAAP and managed basis, and customer deposits

outstanding at December 31:

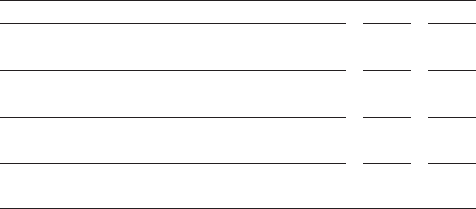

(Billions) 2008 2007

Short-term borrowings $ 9.0 $ 17.8

Long-term debt 60.0 55.3

Total debt (GAAP basis) 69.0 73.1

Off-balance sheet securitizations 29.0 22.7

Total debt (managed basis) 98.0 95.8

Customer deposits 15.5 15.4

Total debt (managed) and

customer deposits $113.5 $111.2

The Company’s current funding strategy for 2009 will be to

raise funds to maintain sufficient cash, and readily-marketable

securities that are easily convertible to cash in order to meet

short-term borrowings outstanding, seasonal and other working

capital needs for the next 12 months, including maturing

obligations, changes in receivables and other asset balances, as

well as operating requirements. The Company has $14.9 billion of

unsecured long-term debt and $4.8 billion of asset securitizations

that will mature during 2009. Cash provided by or required for

changes in business volumes will depend in large part on billings

volume and payment patterns from cardmembers. Refer to the

discussion above regarding how the credit market environment

could affect the mix of debt issuances.

The Company’s equity capital and funding strategies

are designed to maintain high and stable debt ratings from

the major credit rating agencies, Moody’s Investor Services

(Moody’s), Standard & Poor’s (S&P), Fitch Ratings, and

Dominion Bond Rating Services (DBRS). Recently, three of

the four credit rating agencies that rate the Company provided

updates on the Company’s ratings as follows:

• Moody’s lowered the Long-term Senior ratings of the

Company from A1 to A2, American Express Travel Related

Services Company, Inc. (TRS) and several rated subsidiaries

from Aa3 to A1 and revised its outlook of the Company and

its subsidiaries from stable to negative. This change, which

brings the ratings for the Company’s funding subsidiaries

to the same level as other rating agencies, reflects concerns

regarding weakness in the broader economy and specific

concerns regarding “negative asset quality trends and

lending exposures.” Moody’s affirmed all of its short-term

ratings. On October 23, 2008, Moody’s affirmed its ratings

on all outstanding classes of rated asset-backed securities

issued by the Company’s lending and charge trusts.

On February 25, 2009, Moody’s placed on review for

possible downgrade the long-term and short-term ratings

of the Company (A2/Prime-1). At the same time, the long-

term debt ratings of TRS and its rated operating subsidiaries

(senior at A1) were also placed on review for possible

downgrade. The Prime-1 short-term ratings for TRS and its

rated operating subsidiaries were affirmed.

• S&P lowered the long-term ratings of the Company, TRS and

several rated subsidiaries from A+ to A. The outlook on the

ratings is negative. S&P’s affirmed its short-term ratings.

• DBRS announced that it had revised its outlook on the

Long-term Senior ratings of the Company and its related

subsidiaries (A (high)) from stable to negative.

Historically, credit ratings have had a significant impact on the

borrowing capacity and costs of the Company. A downgrade

in the Company’s long-term debt rating would result in higher

interest expense on the Company’s unsecured debt, as well as

higher fees related to borrowings under its unused lines of credit.

35