American Express 2008 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2008 American Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 financial review

american express company

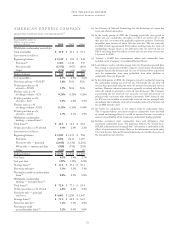

fair value measurement (continued)

Description Assumptions/Approach Used Effect if Actual Results Differ

from Assumptions

Derivative Instruments

The fair values of the Company’s derivative

instruments are estimated by using pricing

models that do not contain a high level of

subjectivity as the valuation techniques used

do not require significant judgment and

inputs to those models are readily observable

from actively quoted markets. The valuation

models used by the Company are consistently

applied and reflect the contractual terms

of the derivatives, including the period of

maturity, and market-based parameters such

as interest rates, foreign exchange rates,

equity indices or prices, and volatility.

In certain instances credit valuation

adjustments are necessary when the market

parameters (for example, a benchmark curve)

used to value the derivative instruments

are not indicative of the credit quality of

the Company or its counterparties. The

Company considers the counterparty credit

risk by applying an observable forecasted

default rate to the current exposure.

The Company manages derivative

instrument counterparty credit risk by

considering the current exposure, which is

the replacement cost of contracts on the

measurement date, as well as estimating the

maximum potential value of the contracts

over the next twelve months, considering

such factors as the volatility of the underlying

or reference index. To mitigate derivative

instrument credit risk, counterparties are

required to be pre-approved and rated

as investment grade. Counterparty risk

exposures are monitored by the Company’s

Institutional Risk Management Committee

(IRMC). The IRMC formally reviews large

institutional exposures to ensure compliance

with the Company’s Enterprise-wide Risk

Management Committee guidelines and

procedures and determines the risk mitigation

actions, when necessary. The Company’s

derivative instruments are classified in Level 2

of the fair value hierarchy. See further in

Note 14 to the Company’s Consolidated

Financial Statements.

20