American Express 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 American Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overall, it is management’s priority to increase

shareholder value over the moderate to long-term by

achieving the following long-term financial targets, on

average and over time:

®Earnings per share growth of 12 to 15 percent;

®Revenue growth of at least 8 percent; and

®Return on shareholders’ equity of 28 to 30 percent (18

to 20 percent prior to the Ameriprise spin-off).

During 2005, the Company met or exceeded its earnings

per share, revenue and return on equity targets, illustrat-

ing the benefits of the strong business momentum

achieved through the business-building investments

made over the past few years. After the completion of

the Ameriprise spin-off in 2005, the Company raised its

return on equity target from 18 to 20 percent to 28 to

30 percent. Reported return on shareholders’ equity for

2005 was 25 percent which exceeded our target prior

to the spin-off and which is calculated on a trailing

12-month basis using reported net income over average

total shareholders’ equity including discontinued opera-

tions (prior to disposal).

Pro forma return on shareholders’ equity, determined

using income from continuing operations over the

average of the month-end shareholders’ equity at

September 30, 2005 through December 31, 2005, was

31 percent. Management believes pro forma return on

shareholders’ equity is a better comparison to the 28–30

percent target post spin-off as the earnings and capital

from discontinued operations reflected in the calcula-

tion of reported return on shareholders’ equity are not

included in the 28–30 percent target.

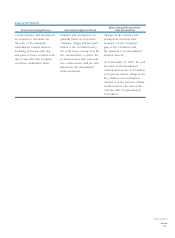

A summary of the Company’s recent financial perfor-

mance follows:

Years Ended December 31,

(Millions, except per share

amounts and ratio data) 2005 2004 Percent

Increase

Revenues $ 24,267 $ 21,964 10%

Expenses $ 20,019 $ 18,133 10

Income from

continuing

operations $ 3,221 $ 2,686 20

Net income $ 3,734 $ 3,445 8

Earnings per common

share from

continuing

operations —

diluted $ 2.56 $ 2.09 22

Earnings per common

share — diluted $ 2.97 $ 2.68 11

Return on average

shareholders’

equity

(a)

25.4% 22.0% —

(a)Calculated based on $3.7 billion of net income and $14.7 billion of

average shareholders’ equity for the trailing twelve months ending

December 31, 2005. Pro forma return on average shareholders’ equity

was 31.5 percent for 2005 and was calculated based on $3.2 billion of

income from continuing operations and $10.2 billion of average month-

end shareholders’ equity for the quarter ending December 31, 2005.

See Consolidated Results of Operations below for

discussion of the Company’s results.

The Company follows U.S. generally accepted account-

ing principles (GAAP). In addition to information pro-

vided on a GAAP basis, the Company discloses certain

data on a “managed basis.” This information, which

should be read only as a supplement to GAAP informa-

tion, assumes, in the Consolidated Selected Statistical

Information and U.S. Card Services segment, there have

been no cardmember lending securitization transac-

tions, and certain tax-exempt investment income had

been earned on a taxable basis. In addition, the Inter-

national Card & Global Commercial Services segment

reflects a reclassification of certain foreign exchange ser-

vices as revenues on a managed basis. These managed

basis adjustments, and management’s rationale for such

presentation, are discussed further in U.S. Card Services

and International Card & Global Commercial Services

sections below under “Differences between GAAP and

Managed Basis Presentation.”

Certain reclassifications of prior period amounts have

been made to conform to the current presentation

throughout this Annual Report. Certain of the state-

ments in this Annual Report are forward-looking

statements within the meaning of the Private Securities

Litigation Reform Act of 1995. See Forward-Looking

Statements at the end of this discussion.

Financial Review

AXP / AR.2005

[26 ]