American Express 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 American Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

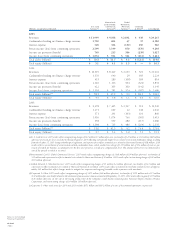

NOTE 21 Quarterly Financial Data (Unaudited)

(Millions, except per share amounts) 2005

(a)

2004

(a)

Quarters Ended 12/31

(b)

9/30

(c)

6/30

(d)

3/31 12/31

(e)

9/30

(f)

6/30 3/31

(g)

Revenues $ 6,437 $ 6,068 $ 6,090 $ 5,672 $ 5,903 $ 5,476 $ 5,467 $ 5,118

Pretax income from continuing operations 959 1,080 1,121 1,088 920 1,014 1,008 889

Income from continuing operations 751 865 860 745 669 702 706 609

(Loss)/income from discontinued operations,

net of tax (6) 165 153 201 227 177 170 256

Net income 745 1,030 1,013 946 896 879 876 794

Earnings Per Common Share — Basic:

Continuing operations 0.61 0.70 0.70 0.60 0.54 0.56 0.56 0.48

Discontinued operations (0.01) 0.14 0.12 0.16 0.18 0.14 0.13 0.20

Cumulative effect of accounting change ————— — — (0.06)

Net income 0.60 0.84 0.82 0.76 0.72 0.70 0.69 0.62

Earnings Per Common Share — Diluted:

Continuing operations 0.60 0.69 0.69 0.59 0.53 0.55 0.55 0.47

Discontinued operations (0.01) 0.13 0.12 0.16 0.18 0.14 0.13 0.19

Cumulative effect of accounting change ————— — — (0.05)

Net income 0.59 0.82 0.81 0.75 0.71 0.69 0.68 0.61

Cash dividends declared per common share 0.12 0.12 0.12 0.12 0.12 0.12 0.10 0.10

Common share price:

High 53.06

(h)

59.50 55.30 58.03 57.05 51.77 52.82 54.50

Low 46.59

(h)

52.30 49.51 50.01 50.86 47.70 47.32 47.43

(a)The spin-off of Ameriprise and certain dispositions (including the sale of TBS) were completed in 2005 and the results of these operations are presented

as discontinued operations.

(b)Fourth quarter 2005 results reflect $123 million ($80 million after-tax) increase in the provision for losses reflecting higher write-offs related to increased

bankruptcy filings, a state tax benefit of $60 million related to the finalization of state tax returns and reengineering charges of $65 million ($42 million

after-tax).

(c)Third quarter 2005 results reflect a tax benefit of $105 million from the resolution of a prior year tax item, reengineering charges of $86 million ($56

million after-tax) and a $49 million ($32 million after-tax) provision to reflect the estimated costs related to Hurricane Katrina.

(d)Second quarter 2005 results reflect $113 million ($73 million after-tax) benefit from the recovery of September 11

th

related insurance claims, a $87

million tax benefit resulting from an IRS audit of previous years’ tax returns and reengineering charges of $114 million ($74 million after-tax).

(e)Fourth quarter 2004 results reflect aggregate restructuring charges of $99 million ($64 million after-tax) for initiatives executed during 2004. In addition,

the Company recognized a $117 million ($76 million after-tax) net gain on the sale of the leasing product line of the Company’s small business financing

unit, American Express Business Finance Corporation.

(f)Third quarter 2004 results reflect a reconciliation of securitization-related cardmember loans, which resulted in a charge of $115 million (net of $32

million of reserves previously provided) for balances accumulated over the prior five year period as a result of a computational error. The amount of

the error was immaterial to any of the periods in which it occurred. In addition, third quarter 2004 results reflect a reduction in merchant-related reserves

of approximately $60 million that reflect changes made to mitigate loss exposure and ongoing favorable credit experience with merchants.

(g)First quarter 2004 results reflect $109 million non-cash pretax charge ($71 million after-tax) related to the January 1, 2004 adoption of SOP 03-1.

(h)The market price per share for the fourth quarter 2005 reflects the spin-off of Ameriprise as of September 30, 2005. The opening share price on the

first trading day subsequent to the spin-off was $50.75. See Note 2 for additional information on results of discontinued operations.

Notes to Consolidated

Financial Statements

AXP / AR.2005

[99 ]