Allegheny Power 2014 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2014 Allegheny Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

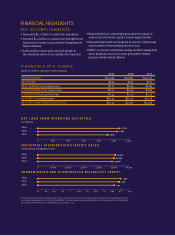

FINANCIAL HIGHLIGHTS

KEY ACCOMPLISHMENTS

• Generated $2.7 billion in cash from operations

• Invested $1.4 billion to expand and strengthen our

transmission system as part of our Energizing the

Future initiative

• Achieved five consecutive years of growth in

the industrial sector of our distribution business

• Repositioned our competitive generation business to

reduce risk and better capture market opportunities

• Moved forward with our program to install 2 million new

smart meters in Pennsylvania by mid-2019

• Efforts to ensure competitive energy markets adequately

value baseload coal and nuclear generation helped

produce initial market reforms

FINANCIALS AT A GLANCE

(dollars in millions, except per share amounts)

2014 2013 2012

TOTAL REVENUES $15,049 $14,892 $15,255

NET INCOME $299 $392 $771

BASIC EARNINGS per common share $0.71 $0.94 $1.85

DILUTED EARNINGS per common share $0.71 $0.94 $1.84

DIVIDENDS PAID per common share $1.44 $2.20 $2.20

BOOK VALUE per common share $29.49 $30.32 $31.29

NET CASH FROM OPERATING ACTIVITIES $2,713 $2,662 $2,320

NET CASH FROM OPERATING ACTIVITIES

(in millions)

2014

2013

2012

2,662

2,320

2,713

0 2,000 2,500 3,000500 1,000 1,500

* FirstEnergy’s index is comprised of two indices that are commonly used in the electric utility industry: Transmission Outage Frequency (TOF)

and System Average Interruption Duration Index (SAIDI). Our index measures frequency and duration of service interruptions: the better the

performance, the higher the score. The highest score possible is 2.75.

TRANSMISSION AND DISTRIBUTION RELIABILITY INDEX*

2014

2013

2012 2.31

INDUSTRIAL DISTRIBUTION ELECTRIC SALES

(in thousands of megawatt-hours)

2014

2013

2012

50,243

49,378

51,213

2.47

2.56

0 40,000 50,000 60,00010,000 30,00020,000

0 2 2.5 2.750.5 1 1.5.25 .75 1.25 1.75 2.25